Технический анализ валютных пар (Антон Ганзенко)

Индикаторы Forex использующиеся в Техническом анализе: MACD, RSI, Ichimoku Kinko Hyo, Равноудалённый канал, Линии Фибоначчи, Ценовые Уровни.

Зарабатывайте с помощью сервиса торговли на новостях Erste News!

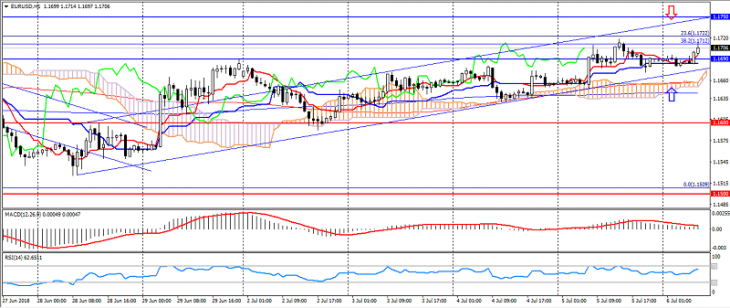

EUR USD (текущая цена: 1.1710)

- Уровни поддержки: 1.1600 (значимая психология), 1.1500 (локальный минимум), 1.1450.

- Уровни сопротивления: 1.1690, 1.1750, 1.1850 (максимум июня).

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение): линия Tenkan-sen выше линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 1.1730, 1.1750, 1.1780.

- Альтернативная рекомендация: вход на покупку от 1.1690, 1.1660, 1.1640.

Пара евро доллар сохраняет восходящую динамику на росте рисков относительно торгового противостояния США и Китая, но может ограничиваться предстоящими данными по занятости в США.

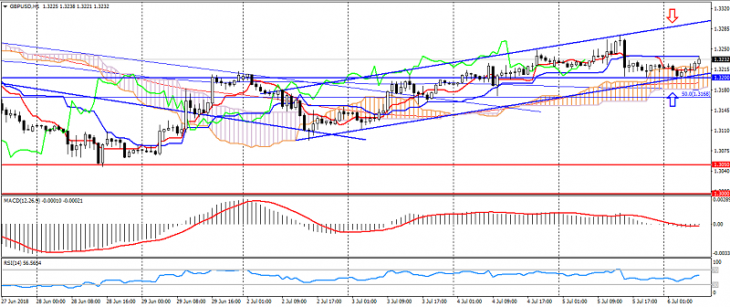

GBP USD (текущая цена: 1.3230)

- Уровни поддержки: 1.3050, 1.3000 (сильная психология), 1.2900.

- Уровни сопротивления: 1.3200, 1.3350 (максимум июня), 1.3460.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – флэт): индикатор возле 0. RSI (14) в зоне лёгкой перекупленности. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 1.3250, 1.3270, 1.3290.

- Альтернативная рекомендация: вход на покупку от 1.3200, 1.3170, 1.3150.

Британский фунт замедлил восходящую динамику на комментариях Банка Англии, при этом ограничивается сдержанно восходящим трендом.

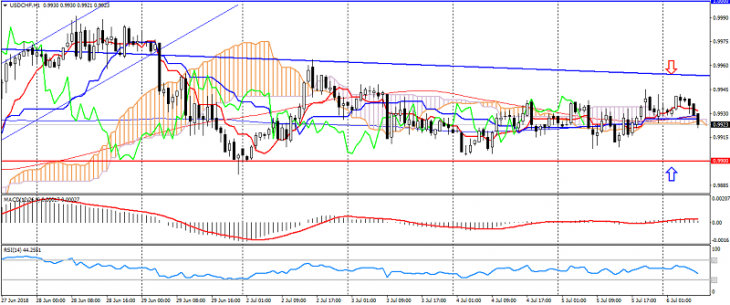

USD CHF (текущая цена: 0.9920)

- Уровни поддержки: 0.9900, 0.9850 (локальный минимум), 0.9700 (минимум июня).

- Уровни сопротивления:, 1.000 (значимая психология), 1.0050 (максимум мая), 1.0150.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – флэт): индикатор возле 0. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – флэт): линия Tenkan-sen возле линии Kijun-sen, цена в облаке.

- Основная рекомендация: вход на продажу от 0.9940, 0.9960, 0.9980.

- Альтернативная рекомендация: вход на покупку от 0.9900, 0.9880, 0.9870.

Доллар США швейцарский франк торгуется возле минимумов недели на сохранении бокового тренда.

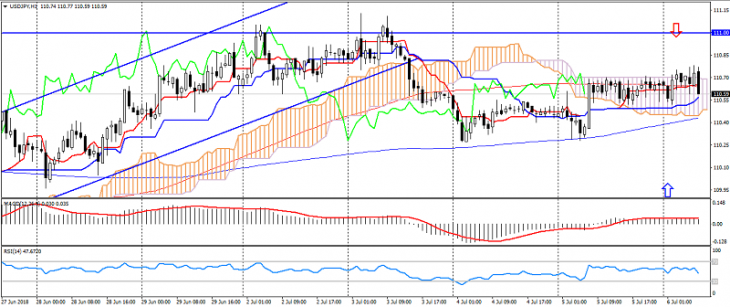

USD JPY (текущая цена: 110.60)

- Уровни поддержки: 109.80, 109.00 (минимум мая), 108.00.

- Уровни сопротивления: 111.00, 110.40 (максимум мая), 112.00.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – флэт): линия Tenkan-sen ниже линии Kijun-sen, цена в облаке.

- Основная рекомендация: вход на продажу от 110.80, 111.00 111.20.

- Альтернативная рекомендация: вход на покупку от 110.40, 110.20, 109.80.

Пара доллар США японская иена торгуется разнонаправленно на неоднозначности рынка и ожидании драйверов к движению.

USD CAD (текущая цена: 1.3120)

- Уровни поддержки: 1.3150, 1.3050 (максимум мая), 1.2950.

- Уровни сопротивления: 1.3250, 1.3380, 1.3450 (максимум июня).

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – флэт): индикатор возле 0. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – флэт): линия Tenkan-sen возле линии Kijun-sen, цена в облаке.

- Основная рекомендация: вход на продажу от 1.3170, 1.3200, 1.3250.

- Альтернативная рекомендация: вход на покупку от 1.3100, 1.3080, 1.3060.

Пара доллар США канадский доллар сохраняет боковую динамику, тем самым замедляя снижение.

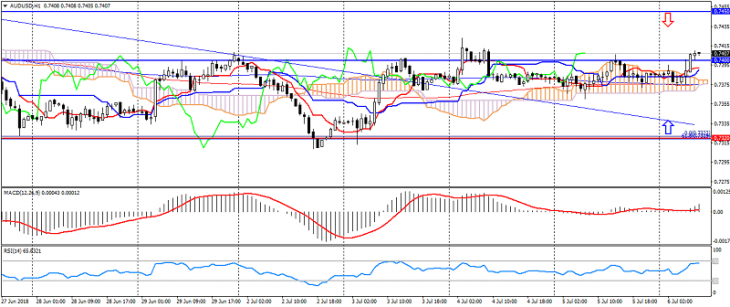

AUD USD (текущая цена: 0.7400)

- Уровни поддержки: 0.7350, 0.7250, 0.7200.

- Уровни сопротивления: 0.7400, 0.7450, 0.7500.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение): линия Tenkan-sen выше линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 0.7420, 0.7450, 0.7470.

- Альтернативная рекомендация: вход на покупку от 0.7380, 0.7350, 0.7320.

Австралиец ограничивается боковой динамикой на замедлении снижения на слабости доллара США.

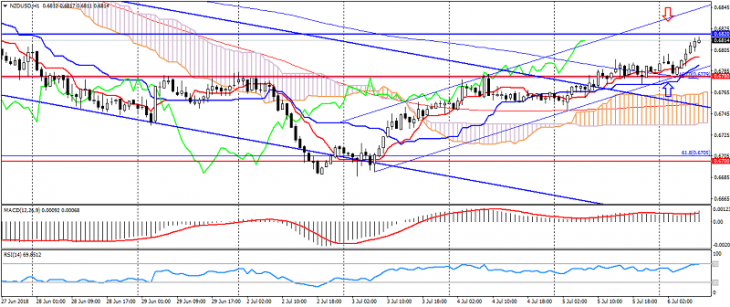

NZD USD (текущая цена: 0.6770)

- Уровни поддержки: 0.6820, 0.6700 (значимая психология), 0.6650.

- Уровни сопротивления: 0.6820, 0.6880, 0.6920.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI (14) в зоне перекупленности. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение): линия Tenkan-sen выше линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 0.6820, 0.6840, 0.6860.

- Альтернативная рекомендация: вход на покупку от 0.6780, 0.6750, 0.6730.

Новозеландский доллар ускорил рост на сохранении оптимизма.

XAU USD (текущая цена: 1255.00)

- Уровни поддержки: 1242.00, 1235.00 (минимум декабря 2017), 1220.00.

- Уровни сопротивления: 1265.00, 1275.00 (локальный максимум), 1285.00.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – флэт): индикатор возле 0. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – флэт): линия Tenkan-sen возле линии Kijun-sen, цена в облаке.

- Основная рекомендация: вход на продажу от 1259.00, 1262.00, 1265.00.

- Альтернативная рекомендация: вход на покупку от 12549.00, 1246.00, 1242.00.

Золото остаётся во флэте на ожидании драйверов к движению.