Технический анализ валютных пар (Антон Ганзенко)

Индикаторы Forex использующиеся в Техническом анализе: MACD, RSI, Ichimoku Kinko Hyo, Равноудалённый канал, Линии Фибоначчи, Ценовые Уровни.

Зарабатывайте с помощью сервиса торговли на новостях Erste News!

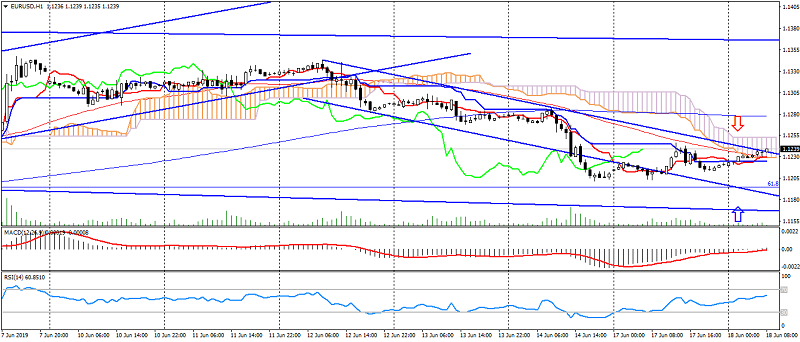

EUR USD (текущая цена: 1.1240)

- Уровни поддержки: 1.1350, 1.1200, 1.1100.

- Уровни сопротивления: 1.1450, 1.1550, 1.1650.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – флэт): линия Tenkan-sen возле Kijun-sen, цена в облаке.

- Основная рекомендация: вход на продажу от 1.1260, 1.1280, 1.1300.

- Альтернативная рекомендация: вход на покупку от 1.1200, 1.1180, 1.1150.

Пара евро доллар торгуется с попытками роста на коррекции американца, ограничиваясь нисходящей динамикой.

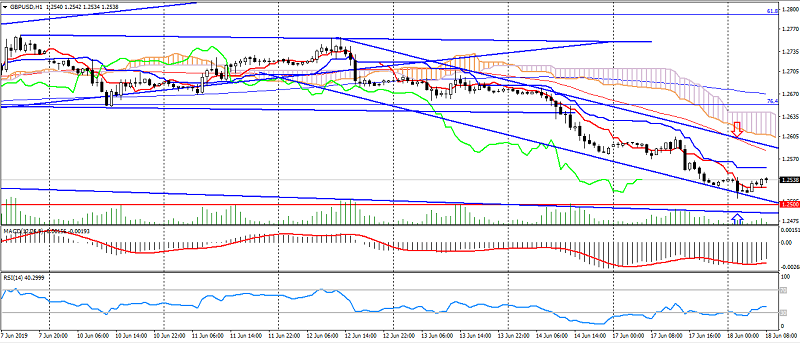

GBP USD (текущая цена: 1.2540)

- Уровни поддержки: 1.2500, 1.2300, 1.2100.

- Уровни сопротивления: 1,3300, 1.3600, 1.4000.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор ниже 0, сигнальная линия вышла с тела гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 1.2570, 1.2600, 1.2620.

- Альтернативная рекомендация: вход на покупку от 1.2500, 1.2470, 1.2450.

Британский фунт торгуется сдержанно, сохраняя нисходящую динамику и формируя бычью дивергенцию, что может указать на формирование разворота.

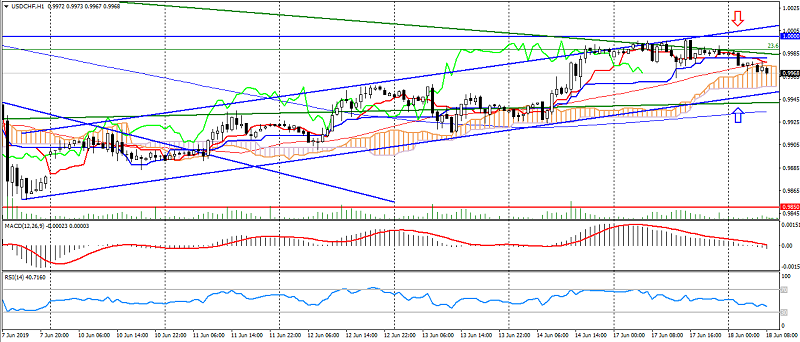

USD CHF (текущая цена: 0.9970)

- Уровни поддержки: 0.9850, 0.9750, 0.9650.

- Уровни сопротивления: 1.0000, 1.0060, 1.0150.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – флэт): линия Tenkan-sen возле линии Kijun-sen, цена в облаке.

- Основная рекомендация: вход на продажу от 0.9980, 1.0000, 1.0030.

- Альтернативная рекомендация: вход на покупку от 0.9950, 0.9930, 0.9900.

Доллар США швейцарский франк замедлил рост на отбитии от психологической отметки и формировании коррекции, сохранив восходящую динамику.

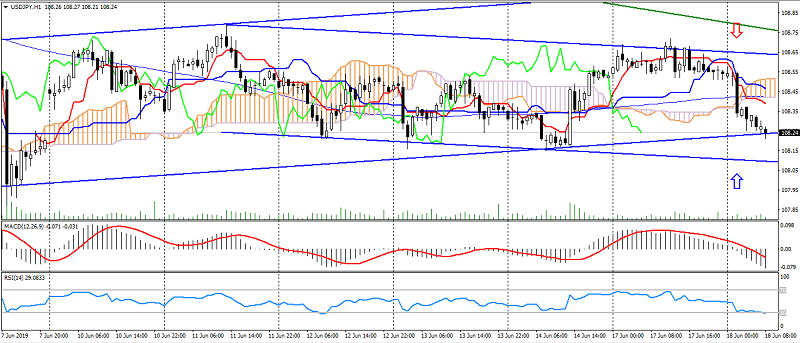

USD JPY (текущая цена: 108.20)

- Уровни поддержки: 104.50, 103.00, 100.50.

- Уровни сопротивления: 110.00, 112.00, 115.00.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI (14) в зоне перепроданности. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 108.30, 108.50, 108.70.

- Альтернативная рекомендация: вход на покупку от 108.00, 107.80, 107.50.

Пара доллар США японская иена ускорила снижение на рисках и возобновлении нисходящего тренда.

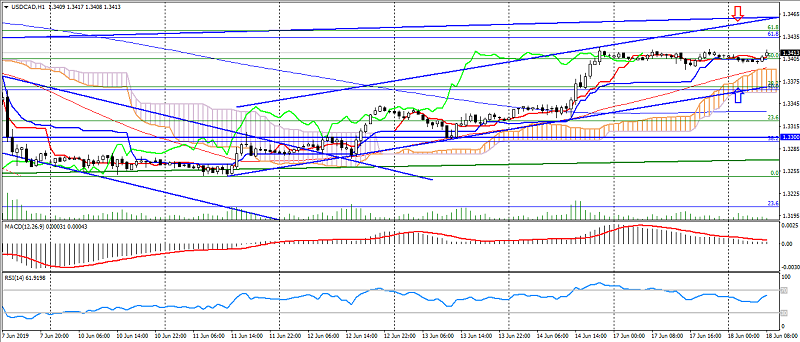

USD CAD (текущая цена: 1.3410)

- Уровни поддержки: 1.3100, 1.3000, 1.2900.

- Уровни сопротивления: 1.3300, 1.3500, 1.3700.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор выше 0, сигнальная линия вышла с тела гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение): линия Tenkan-sen возле линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 1.3430, 1.3460, 1.3480.

- Альтернативная рекомендация: вход на покупку от 1.3380, 1.3350, 1.3330.

Пара доллар США канадский доллар сохраняет восходящую динамику, ограничиваясь попытками коррекции.

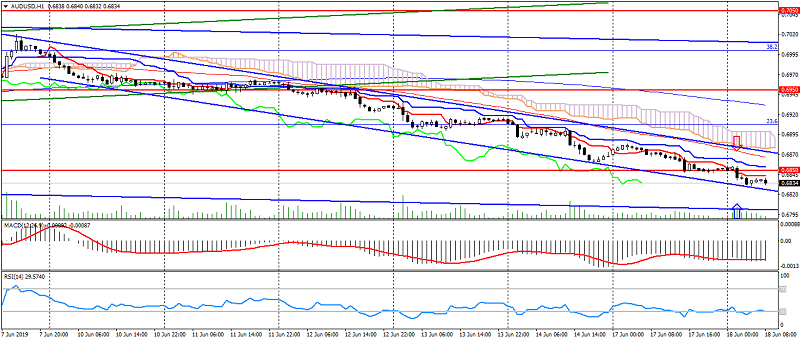

AUD USD (текущая цена: 0.6830)

- Уровни поддержки: 0.7050, 0.6950, 0.6850.

- Уровни сопротивления: 0.7200, 0.7300, 0.7400.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI (14) в зоне перепроданности. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen возле линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 0.6880, 0.6900, 0.6930.

- Альтернативная рекомендация: вход на покупку от 0.6820, 0.6800, 0.6780.

Австралиец с начала дня торгуется с понижением на сохранении рисков и публикации результатов заседания РБА.

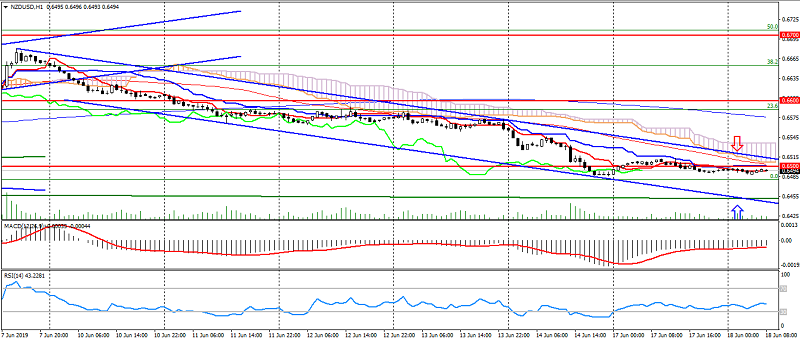

NZD USD (текущая цена: 0.6490)

- Уровни поддержки 0.6700, 0.6600, 0.6500.

- Уровни сопротивления: 0.6880, 0.6950, 0.7050.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор ниже 0, сигнальная линия вышла с тела гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 0.6520, 0.6550, 0.6580.

- Альтернативная рекомендация: вход на покупку от 0.6480, 0.6460, 0.6430.

Новозеландский доллар демонстрирует сдержанное снижение на обострении рисков, ограничиваясь общей перепроданностю.

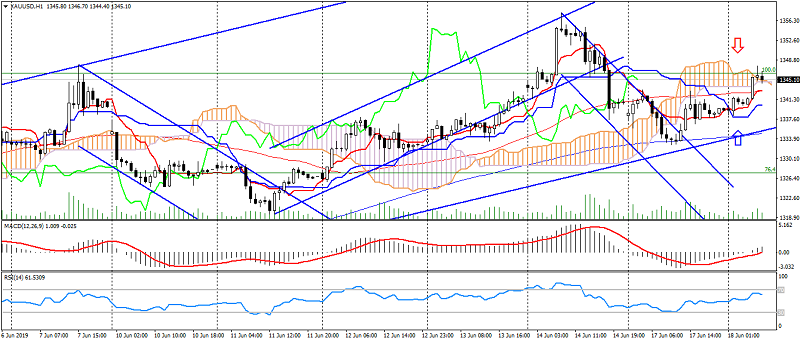

XAU USD (текущая цена: 1344.00)

- Уровни поддержки: 1300.00, 1335.00, 1360.00.

- Уровни сопротивления: 1265.00, 1240.00, 1220.00.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение): линия Tenkan-sen выше линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 1350.00, 1355.00, 1360.00.

- Альтернативная рекомендация: вход на покупку от 1340.00, 1335.00, 1330.00.

Золото возобновило рост на рисках, сохранив общую восходящую динамику.