Технічний аналіз валютних пар (Антон Ганзенко)

Індикатори Forex використовуються в Технічному аналізі: MACD, RSI, Ichimoku Kinko Hyo, рівновіддалений канал, Лінії Фібоначчі, Цінові Рівні.

Заробляйте за допомогою сервісу торгівлі на новинах Erste News!

EUR USD (поточна ціна: 1.1460)

- Рівні підтримки: 1.1350, 1.1200, 1.1100.

- Рівні опору: 1.1450, 1.1550, 1.1650.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – спадний рух): індикатор вище 0, сигнальна лінія вийшла з тіла гістограми. RSI (14) в зоні перекупленості. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – висхідний рух): лінія Tenkan-sen вище лінії Kijun-sen, ціна вище хмари.

- Основна рекомендація: вхід на продаж від 1.1480, 1.1500, 1.1520.

- Альтернативна рекомендація: вхід на покупку від 1.1450, 1.1410, 1.1380.

Пара євро долар зберігає висхідну динаміку на зниженні долара, обмежуючись низхідніою дивергенцією і перекупленістю.

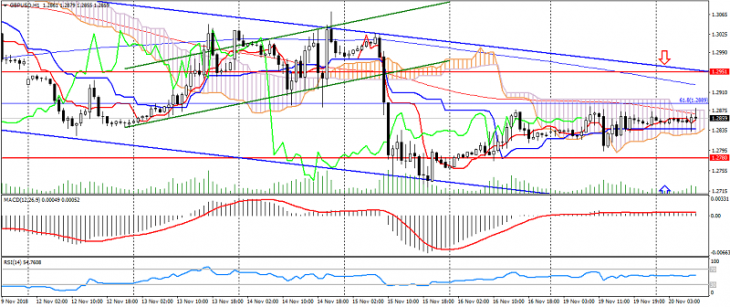

GBP USD (поточна ціна: 1.2860)

- Рівні підтримки: 1.2950, 1.2780, 1.2600 (мінімум червня 2017).

- Рівні опору: 1,3150, 1.3250, 1.3350.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – флет): індикатор біля 0.RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – флет): лінія Tenkan-sen вище лінії Kijun-sen, ціна в хмарі.

- Основна рекомендація: вхід на продаж від 1.2900, 1.2950, 1.2990.

- Альтернативна рекомендація: вхід на покупку від 1.2780, 1.2750, 1.2720.

Британський фунт обмежений бічним каналом і ризиками по Brexit.

USD CHF (поточна ціна: 0.9920)

- Рівні підтримки: 0.9700, 0.9600, 0.9550.

- Рівні опору: 0.9850, 0.9900, 1.0000.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – висхідний рух): індикатор нижче 0, сигнальна лінія вийшла з тіла гістограми. RSI (14) в зоні перепроданості. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – спадний рух): лінія Tenkan-sen нижче лінії Kijun-sen, ціною нижче хмари.

- Основна рекомендація: вхід на продаж від 0.99650, 0.9990, 1.0030.

- Альтернативна рекомендація: вхід на покупку від 0.9900, 0.9880, 0.9850.

Долар США швейцарський франк торгується з пониженням на зростанні ризиків.

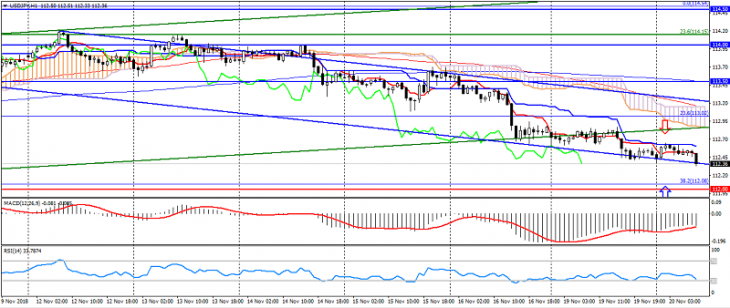

USD JPY (поточна ціна: 112.30)

- Рівні підтримки: 112.00, 111.50, 111.00.

- Рівні опору: 113.50, 114.00, 114.50.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – висхідний рух): індикатор нижче 0, сигнальна лінія вийшла з тіла гістограми. RSI (14) в зоні перепроданості. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – спадний рух): лінія Tenkan-sen нижче лінії Kijun-sen, ціна нижче хмари.

- Основна рекомендація: вхід на продаж від 112.70, 112.90 113.20.

- Альтернативна рекомендація: вхід на покупку від 112.20, 112.00, 111.80.

Пара долар США японська ієна торгується в спадному каналі, прискоривши зниження на зростанні ризиків.

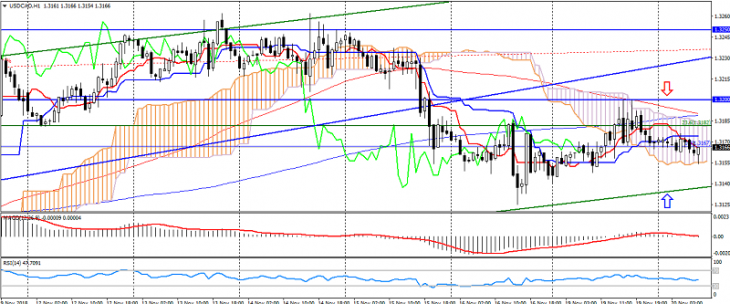

USD CAD (поточна ціна: 1.3160)

- Рівні підтримки: 1.3100, 1.3050, 1.3000.

- Рівні опору: 1.3200, 1.3250, 1.3300.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – флет): індикатор біля 0. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – флет): лінія Tenkan-sen біля лінії Kijun-sen, ціна в хмарі.

- Основна рекомендація: вхід на продаж від 1.3180, 1.3200, 1.3230.

- Альтернативна рекомендація: вхід на покупку від 1.3140, 1.3120, 1.3100.

Пара долар США канадський долар торгується різноспрямовано, зберігаючи бічний тренд.

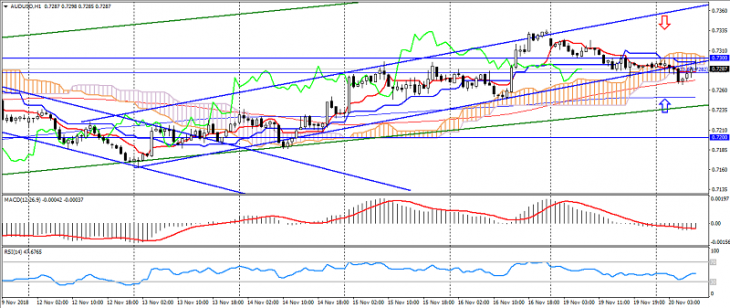

AUD USD (поточна ціна: 0.7290)

- Рівні підтримки: 0.7100, 0.7040, 0.6950.

- Рівні опору: 0.7100, 0.7300, 0.7400.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – спадний рух): індикатор нижче 0, сигнальна лінія в тілі гістограми. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – спадний рух): лінія Tenkan-sen нижче лінії Kijun-sen, ціна нижче хмари.

- Основна рекомендація: вхід на продаж від 0.7340, 0.7360, 0.7380.

- Альтернативна рекомендація: вхід на покупку від 0.7300, 0.7280, 0.7250.

Австралієць уповільнив зростання на корекції після зміцнення.

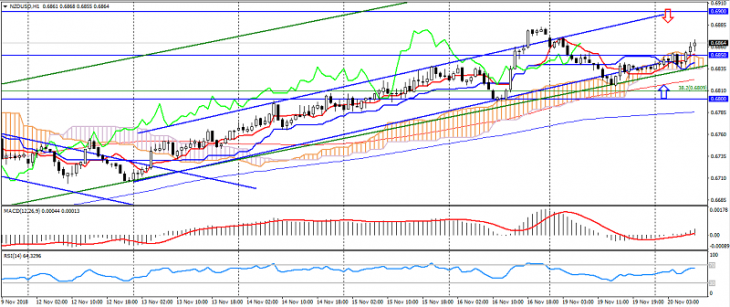

NZD USD (поточна ціна: 0.6860)

- Рівні підтримки 0.6800, 0.6850, 0.6900.

- Рівні опору: 0.6600, 0.6650, 0.6450.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – висхідний рух): індикатор вище 0, сигнальна лінія в тілі гістограми. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – висхідний рух): лінія Tenkan-sen вище лінії Kijun-sen, ціною вище хмари.

- Основна рекомендація: вхід на продаж від 0.6880, 0.6900, 0.6930.

- Альтернативна рекомендація: вхід на покупку від 0.6850, 0.6820, 0.6800.

Новозеландський долар перейшов до корекції на збереженні висхідного тренду.

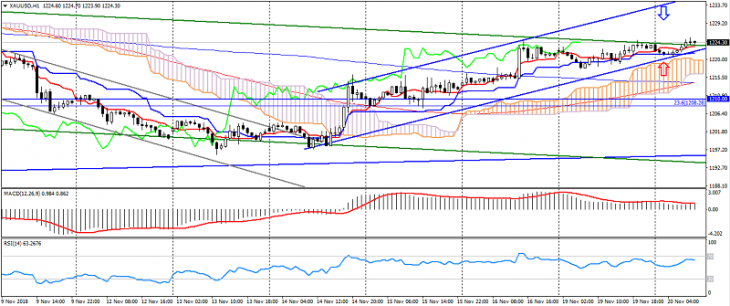

XAU USD (поточна ціна: 1224.00)

- Рівні підтримки: 1180.00, 1150.00, 1120.00.

- Рівні опору: 1210.00, 1250.00, 1240.00.

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – спадний рух): індикатор вище 0, сигнальна лінія вийшла з тіла гістограми. RSI (14) нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – висхідний рух): лінія Tenkan-sen вище лінії Kijun-sen, ціна вище хмари.

- Основна рекомендація: вхід на продаж від 1225.00, 1230.00, 1235.00.

- Альтернативна рекомендація: вхід на покупку від 1220.00, 1215.00, 1210.00.

Золото зберігає потенціал до зростання на зростанні ризиків, обмежуючись спадним трендом.