Технічний аналіз крос-курсів. (Антон Ганзенко)

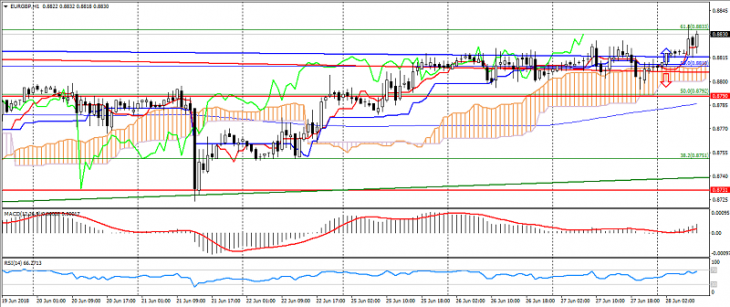

EUR GBP (поточна ціна: 0.8830)

- Рівні підтримки: 0.8790, 0.8730 (мінімум останніх місяців), 0.8700.

- Рівні опору: 0.8850, 0.8900, 0.8960 (максимум березня).

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – висхідний рух): індикатор вище 0, сигнальна лінія в тілі гістограми. RSI (14) в зоні перекупленності. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – висхідний рух): лінія Tenkan-sen вище лінії Kijun-sen, ціна вище хмари.

- Основна рекомендація: вхід на продаж від 0.8830, 0.8850, 0.8880.

- Альтернативна рекомендація: вхід на покупку від 0.8800, 0.8780, 0.8750.

Пара євро фунт прискорила зростання на негативному відкритті фондових майданчиків, що послужило драйвером до загального зміцнення євро.

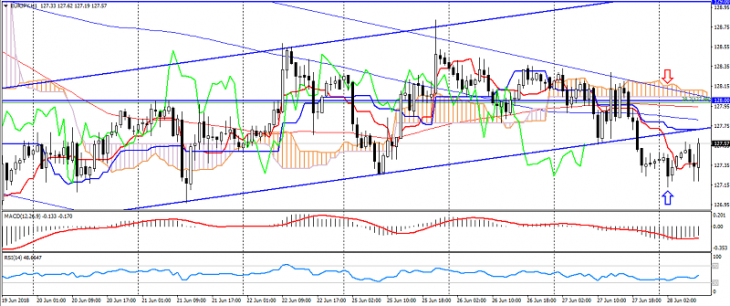

EUR JPY (поточна ціна: 127.60)

- Рівні підтримки: 126.80, 125.00 (мінімум травня), 123.50.

- Рівні опору: 128.00, 129.00, 130.00 (сильний психологічний рівень).

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – висхідний рух): індикатор нижче 0, сигнальна лінія вийшла з тіла гістограми. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – спадний рух): лінія Tenkan-sen нижче лінії Kijun-sen, ціна нижче хмари.

- Основна рекомендація: вхід на продаж від 127.80, 128.00, 128.30.

- Альтернативна рекомендація: вхід на покупку від 127.30, 127.00, 126.80.

Євро ієна торгується різноспрямовано на збереженні спадного тренду.

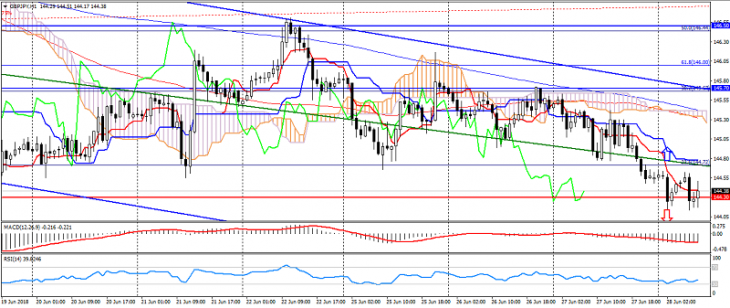

GBP JPY (поточна ціна: 144.40)

- Рівні підтримки: 144.30, 143.50, 143.00 (мінімум травня).

- Рівні опору: 145.70, 146.50, 147.00 (психологічний рівень).

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – спадний рух): індикатор нижче 0, сигнальна лінія в тілі гістограми. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – спадний рух): лінія Tenkan-sen нижче лінії Kijun-sen, ціна нижче хмари.

- Основна рекомендація: вхід на продаж від 144.80, 145.00, 145.30.

- Альтернативна рекомендація: вхід на покупку від 144.00, 143.70, 143.50.

Пара фунт ієна залишається під тиском ризиків і спадного тренду.

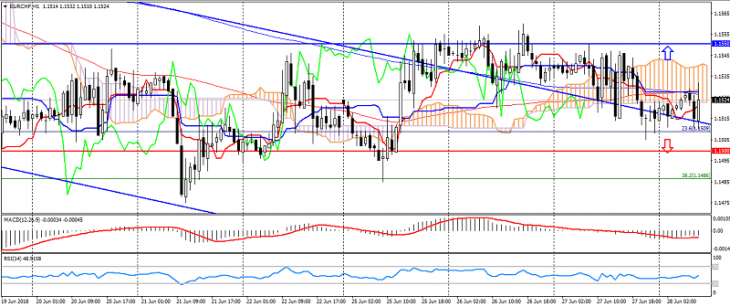

EUR CHF (поточна ціна: 1.1530)

- Рівні підтримки: 1.1500, 1.1450, 1.1360 (мінімум поточного року).

- Рівні опору: 1.1550, 1.1600, 1.1650 (максимум червня).

- Комп’ютерний аналіз: MACD (12, 26, 9) (сигнал – флет): індикатор біля 0. RSI (14) в нейтральній зоні. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – флет): лінія Tenkan-sen біля лінії Kijun-sen, ціна в хмарі.

- Основна рекомендація: вхід на продаж від 1.1550, 1.1570, 1.1600.

- Альтернативна рекомендація: вхід на покупку від 1.1520, 1.1500, 1.1480.

Пара євро франк повернулася до спадного тренду, незважаючи на його уповільнення.

Індикатори Forex, що використовуються в Технічному аналізі: MACD, RSI, Ichimoku Kinko Hyo, рівновіддалений канал, Лінії Фібоначчі, Цінові Рівні.