Технический анализ кросс-курсов. (Антон Ганзенко)

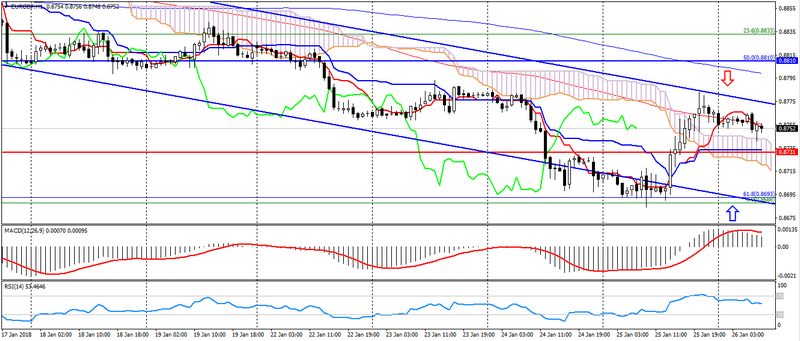

EUR GBP (текущая цена: 0.8750)

- Уровни поддержки: 0.8730 (минимум последних месяцев), 0.8650, 0.8530.

- Уровни сопротивления: 0.8810, 0.8900, 0.9050 (максимум ноября 2016 года).

- Компьютерный анализ: MACD (12, 26, 9) (сигнал –нисходящее движение): индикатор выше 0, сигнальная линия вышла с тела гистограммы.RSI(14) в нейтральной зоне.IchimokuKinkoHyo (9,26,52) (сигнал –восходящее движение): линия Tenkan-sen выше линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 0.8780,0.8800, 0.8820.

- Альтернативная рекомендация: вход на покупку от 0.8730, 0.8700, 0.8680.

Пара евро фунт замедлила нисходящую динамику, при этом сохраняя потенциал к снижению.

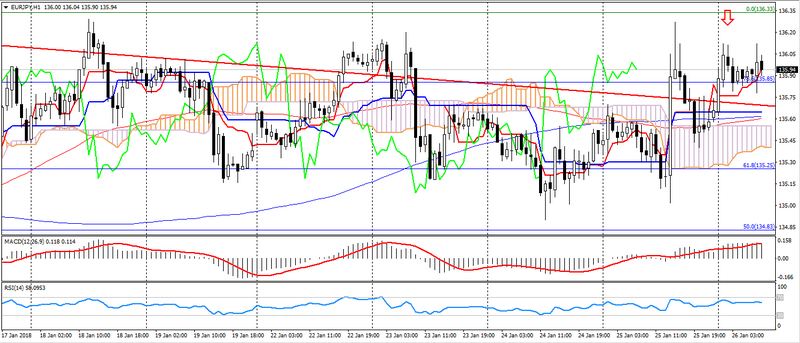

EUR JPY (текущая цена: 135.90)

- Уровни поддержки: 134.40 (максимум сентября 2017 года) 131.40, 127.40.

- Уровни сопротивления: 136.80 (максимум октября 2015 года), 139.00 (максимум августа 2015 года), 140.90.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI(14) в нейтральной зоне. IchimokuKinkoHyo (9,26,52) (сигнал – восходящее движение): линия Tenkan-sen выше линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 136.20, 136.40, 136.60.

- Альтернативная рекомендация: вход на покупку от 135.70, 135.50, 135.30.

Евро иена остаётся в боковом тренде, демонстрируя попытки роста, ограничиваясь перекупленностью.

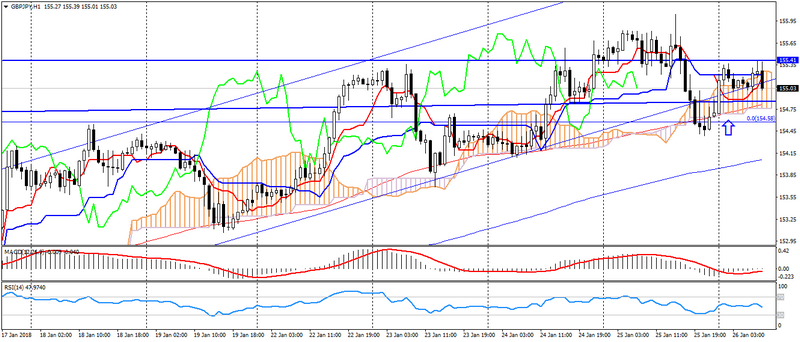

GBP JPY (текущая цена: 154.20)

- Уровни поддержки: 152.80 (максимум сентября 2017 года), 150.00, 147.00.

- Уровни сопротивления: 155.40, 158.00, 160.30.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – флэт): индикатор возле 0.RSI(14) в нейтральной зоне. IchimokuKinkoHyo (9,26,52) (сигнал – флэт): линия Tenkan-sen выше линии Kijun-sen, цена в облаке.

- Основная рекомендация: вход на продажу от 155.40, 155.80, 156.00.

- Альтернативная рекомендация: вход на покупку от 154.80, 154.40, 154.00.

Пара фунт иена продолжает торговаться с укреплением, сохраняя восходящий тренд, но демонстрирует некоторое замедление, что может указывать на возможность коррекции.

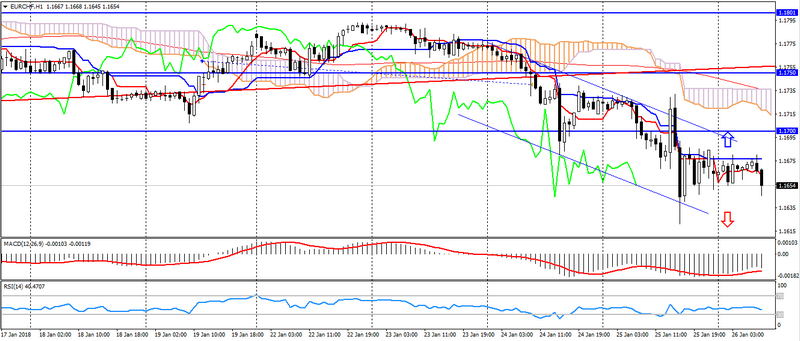

EUR CHF (текущая цена: 1.1650)

- Уровни поддержки: 1.1600 (минимум декабря 2017 года), 1.1550 (минимум ноября 2017 года), 1.1500.

- Уровни сопротивления: 1.1700(максимум текущего года), 1.1750, 1.1800.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор ниже 0, сигнальная линия вышла стела гистограммы. RSI(14) в нейтральной зоне.IchimokuKinkoHyo (9,26,52) (сигнал – нисходящее движение, флэт): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 1.1680, 1.1700, 1.1730.

- Альтернативная рекомендация: вход на покупку от 1.1630, 1.1600, 1.1580.

Пара евро франк оказалась под давлением на росте рисков, но замедлила двухдневный нисходящий тренд.