The bright future of Bank of America (BAC)? Let’s trade on corporate reporting!

“The ultimate measure of a man is not where he stands in moments of comfort and convenience, but where he stands at times of challenge and controversy…”

M.L. King.

It was not a simple trading week. Not simple because of the several reasons:

- We are recovering after the holidays);

- The financial market exits from the “thin” market regime;

- The beginning of the period of annual corporate reporting.

Monday for us is still the time of preparation for a protracted winter marathon in the stock market, as in the US the day off is the day of the memory of Martin Luther King.

This week, I will be focused on the publication of the report of Bank of America Corporation (NYSE: BAC). Date of publication 17/01/2018.

After the crisis of 2008, like the entire financial sector of the US economy, this bank survived the moment: “we thought we had reached the bottom – but there was a knock …”. Having reached 55 USD per share in October 2006, at the peak of the crisis in July 2008, it drops to 18 dollars. Then, getting a breather rolls back up to 40, and one may think that everything is OK … But then a knock … Further its peak ends at a price of 2.53-3.00 USD in February-March 2009. But BAC does not give up, like any proud seaman – and, after a repeated retest of the level of 5 USD per share, in the winter of 2011-2012, confidently forms a reversal and waves to the floating bottom of the financial market with a price below 10 USD.

The most interesting part begins with the coming to power of Mr. Donald (Donald Trump). Since the summer of 2016, the shares of BAC have been steadily gaining momentum from 12 USD to 30 USD (250%). Their dynamics is: 25-30 USD for the period from September 2017 to the present day. Here you could end up saying WOW … But the most interesting is yet to come.

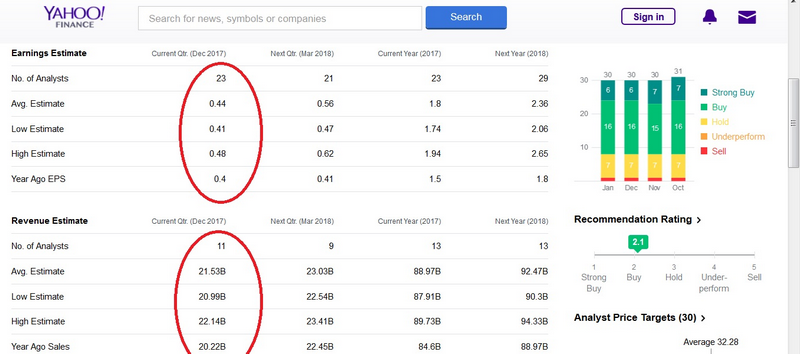

The forecasts of 23 Wall Street analysts point to an expected profit of $ 51.52 billion and earnings per share of $ 2.5. With such indicators one can safely count on 37 USD in a very short time.

Few fundamental assumptions for such optimism:

- The expected 3-fold increase in the discount rate this year;

- The US GDP growth;

- Revision by the Trump’s administration of restrictive rules for financial organizations to control risks.

The aggregate strong economic performance and deregulation of the financial market is a very fertile ground for the growing crop of Bank of America Corporation shareholders.

As a result, the main trading recommendation:

Strong Buy – with a hold of up to 37 USD

The price of detachment (Stop Loss) – 25 USD

Since such a recommendation is more strategic, let’s move on to our favorite charts and study the timeframe of H1.

One can clearly see the acceleration of the upward trend of the DAY channel, after the breakthrough and development of flat consolidation in the ranges 22-25,80. The stock price chart is testing the resistance lines of the equidistant trend channel DAY 2.

Ideally, for conservative trading, one should consider the following option:

Examples of transactions:

- conservative option:

BUY limit 29.20, SL 28.00, TP 32.30 - aggressive option:

BUY limit 30.20, SL 25.00, TP 37.00

BUY limit 27.20, SL 25.00, TP 29.50

I continue to use different tools for graphical analysis of financial instruments in my recommendations, therefore I recommend that for those who are not familiar with them or do not have enough knowledge, should take one of our individual training courses from Ester Holdings Inc.

For those who are interested in more accented training in the analysis of the stock market and its derivatives, write to the support@esterholdings.com e-mail with the mark “for Andrew Green”.

With you was your fan to poke a nose in the latest news and events on the financial market!

Andrew Green