Сінгапурський долар. Особливості торгівлі.

Сінгапурський долар (SGD) – національна валюта Сінгапуру. Сінгапурський долар відноситься до валют з розвиненою ринковою економікою і входить в неофіційну групу «східно-азіатських тигрів», які демонструють найвищі темпи зростання економіки. До цієї групи входять Південна Корея, Тайвань, Сінгапур і Гонконг.

Дані про економіку Сінгапуру

Економіка Сінгапуру відноситься до розвинених ринкових економік. Основними статтями експорту даної країни є електроніка, фармацевтика, інформаційні технології і фінансові послуги.

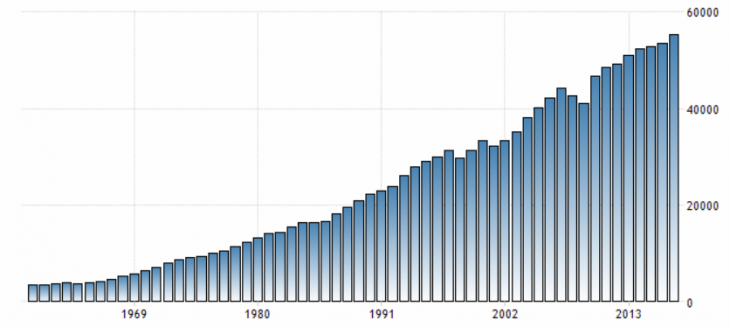

Сінгапур відрізняється неабияким зростанням ВВП на душу населення, який є одним з найвищих в світі.

Мал. 1. Графік зростання ВВП на душу населення Сінгапуру

Не в останню чергу даними показником Сінгапур зобов’язаний найнижчий корупції і відкритій економіці.

Оподаткування Сінгапуру дуже просте і привабливе для інвестицій, чого вартий тільки той факт, що в даній країні існує тільки 5 податків. А імпортними митами обкладається тільки 4 групи товарів.

Банківська справа Сінгапуру виступає одним з найбільш швидкозростаючих галузей, що обумовлено географічним розташуванням і робить його фінансовим центром Азії. Також даному статусу сприяє національна політика ЦБ Сінгапуру. Так, в країні існує близько 121 комерційних банків, серед яких тільки 7 місцевих, інші іноземні.

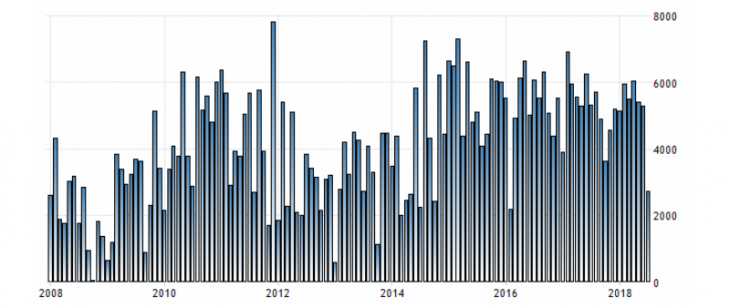

Сінгапур відноситься до світових експортерів, що робить його торговий баланс позитивним, враховуючи, що більшість країн з розвиненою ринковою економікою мають негативний торговий баланс.

Мал. 2. Графік торгового балансу Сінгапуру

Також варто відзначити, що Сінгапур важливий у форміванні цін на нафту в Азії. Нафтова галузь дає близько 5% ВВП. Не кажучи про те, що нафтовидобувні компанії Сінгапуру займають монополію в нафтовидобувній промисловості.

Сінгапурський долар – особливості торгівлі

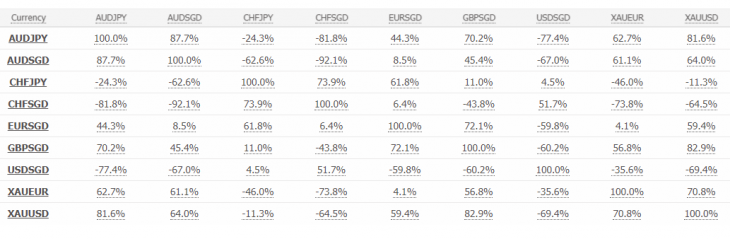

Через те, що сінгапурський долар має ринкову економіку та надмірно міцний банківський сектор його можна віднести до валют безпечної гавані, незважаючи на те, що він має багато спільних рис з сировинними економіками. Тому сінгапурський долар стоїть в одному ряду з японською ієною по стабільності ціноутворення.

На графіку вище наведений приклад руху пари USD/SGD (японські свічки), пара USD/JPY (синя лінія) і золото (червона лінія).

Мал. 3. Таблиця кореляції сінгапурського долара

Сінгапурський долар виступає валютою безпечної гавані, але з деякими особливостями, що робить його не менш привабливим активом, ніж японська ієна або золото на тлі зростання ризиків, а в деяких випадках навіть більш прибутковим.

Антон Ганзенко