Результати засідання Банку Канади

- Рішення по процентній ставці Банку Канади: факт 1,75%, прогноз 1,75%.

За підсумками засідання Банку Канади ключова процентна ставка залишилася без змін, але канадський долар отримав помітну підтримку по всьому спектру ринку, що було викликано яструбиним тоном ЦБ Канади. Приводом до зростання оптимізму щодо Канади стали коментарі щодо позитивної динаміки економіки та споживчої інфляції в Канаді. Це може нести тимчасовий характер, зазначив ЦБ. ЦБ Канади також зазначив ризики торгової війни і заявив, що продовжить стежити за зміною ситуації в світі.

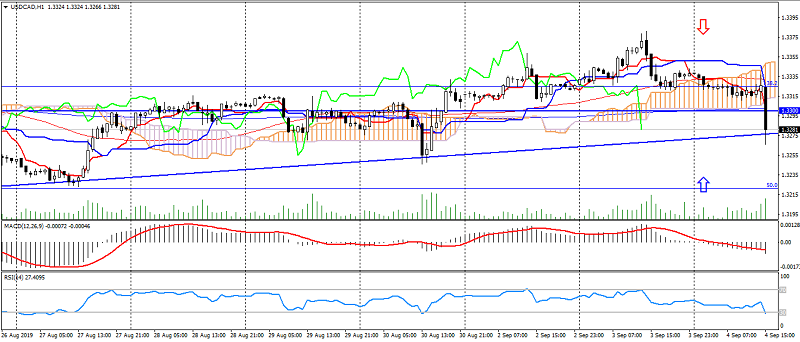

На тлі даних заяв Банку Канади пара USD/CAD прискорила зниження до рівнів 1.3260, посиливши уповільнення висхідної динаміки даної пари останніх місяців. В умовах слабкості долара США, збереження зростання оптимізму на ринку і зміцнення вартості нафти, даною парою можливий тест рівнів підтримки: 1.3250 і 1.3230.

Мал. Графік USD/CAD. Поточна ціна – 1.3290

Читайте також: «Політичні ризики навколо кандидатів

на крісло прем’єр-міністра в Великобританії загострюються»

Ганзенко Антон

Заробляйте за допомогою сервісу торгівлі на новинах Erste News!

Актуальні статті Блогу трейдера:

- Валюта – зброя в торговельній війні!

- На скільки перспективи USD/JPY можуть бути спадними

- Що означає виступ глави ФРС США Пауелла для долара США

Актуальні Інвестиційні ідеї: