Crypto-currencies of the world: Ripple and its differences from Bitcoin. Alexander Sivtsov.

Today we will talk about the crypto currency, which most recent rally led to the growth of its market capitalization and allowed it to gain a foothold in the second position, immediately after Bitcoin. As you already understood, the name of this crypto currency is Ripple.

Ripple is a global system of mutual settlements, through which currency exchange operations are carried out. It allows almost instantaneous transfer of any currency to anywhere in the world. To date, one of the most basic systems of international bank transfers is SWIFT, but transactions using this system can take from one to several days. Also, as a person who has quite a lot of experience working with international money transfers, I want to note that even the actual processing of a SWIFT transfer can take quite a lot of time, which creates certain inconveniences for its users.

The history of Ripple

The development of the Ripple system began in 2004. At that time the payment protocol was called Ripplepay, which was developed by Ryan Fugger in Vancouver. The Ripplepay system was launched in 2005 to ensure the safe transfer of funds using the Internet. In May 2011, the development of an electronic payment system was started, the transactions in which would be confirmed at the expense of the consensus of network participants, and not by mining, as it is done in the Bitcoin network. In September 2012, the development team was the company OpenCoin inc., and in September 2013 it was renamed Ripple Labs inc.

The main differences between Ripple and Bitcoin

- The first difference is that Ripple is in fact not an alternative to Bitcoin, since it does not use the blockchain system.

- Bitcoin was created to obtain an independent settlement system between its users, as an alternative to traditional money and the banking system. Ripple was created precisely as an advanced method of settlements for the banking system, but the possibility of calculating between ordinary users of the network remains.

- Unlike Bitcoin, there is no mining. 100 billion coins were created immediately, each of which can be divided into a million parts. 65% of the coins founders of the Ripple Labs left themselves, and the rest was shared between users.

- The number of Bitcoin coins is constantly growing and is limited to 21 million, so the crypto currency is deflationary. Ripple also has a deflationary structure, but in this system, the number of coins is reduced by the burning off of a written off commission in the process of conducting transactions.

Ripple and the World Banking System

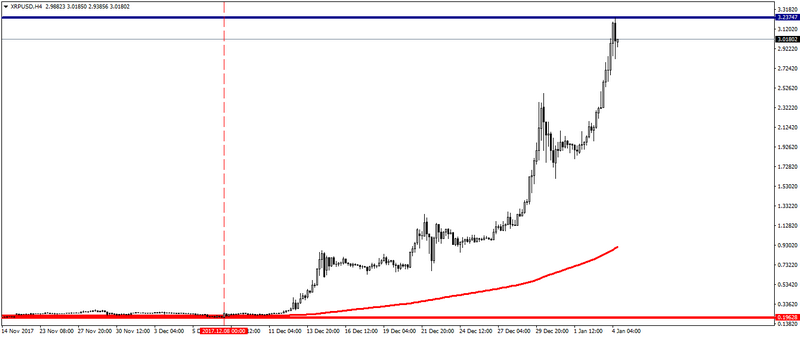

Ripple already enjoys great popularity among the world’s largest banks, as conducting transactions in the Ripple system allows the bank to save an average of about $ 3.7 per transaction, which is thousands and even millions per year. It should be noted that in the fall of 2016 several of the world’s largest banks, such as Bank of America, Uni Credit, Merill Lynch and others, created a consortium called Global Payments Steering Group, which uses Ripple in its work, and this is not the whole list, which is growing every day, thereby supporting the growth of the price of the crypto currency. Due to the expansion of the use of crypto currency by large banks of the world, the price of Ripple has increased about 16 times since the second half of December and reached the level of $ 3.23747 per coin, and the market capitalization exceeded $ 150.00 billion.

Conclusion

To sum up, it is worth noting that Ripple is not just an excellent crypto currency for various transactions, but the newest system of bank transfers, which can soon replace not just a number of similar crypto currencies, but whole companies that are engaged in money transfers around the world. Personally, I would like to note from myself that among all the crypto-currencies I have described, Ripple has the most worthy competition to the usual money for mutual settlements.

Alexander Sivtsov