EUR/USD today: the pair is pending NFP

On Thursday, the pair EUR/USD appreciably strengthened, which was caused by ECB representative comments on the need to wind down the stimulus program in the euro area. As a result, the euro strengthened across the entire spectrum of the market. Also, the strengthening of this pair is caused by the general negative sentiments for the American, which intensified before the report on employment in the US (NFP).

Events for today:

- 15:30 – the US employment report: the average hourly wage in the US (m/m), the change in the number of non-farm workers in the US, the proportion of the economically active population in the US, the change in the number of people in the private non-farm sector of the United States and the unemployment rate in USA.

- 17:00 – the volume of industrial orders in the US (m/m).

- 20:00 – announcement of the number of drilling rigs in the US from Baker Hughes.

The main event of the day will be the publication of a report on employment in the US, which will largely depend on the likelihood of higher rates in the US at the March meeting of the Fed.

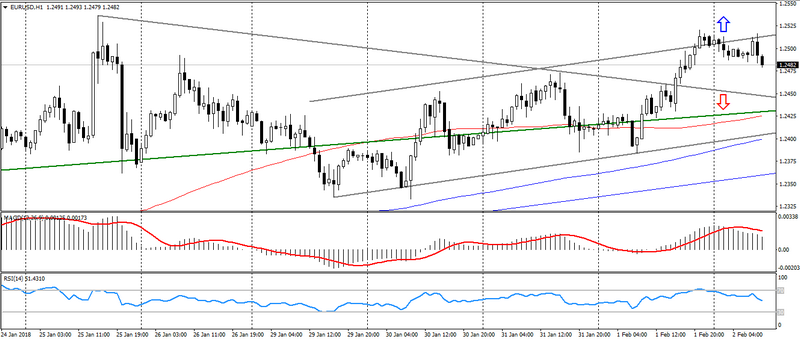

In the conditions of yesterday’s growth, the EUR/USD remains largely in overbought, which may cause correction, but will be limited to forthcoming employment data. A significant level of resistance is the psychology 1.2500, from which correction is possible.

The market today will be focused on data on employment in the US. Therefore, before the release of the NFP report, fluctuations in the range from 1.2460-50 to 1.2500-20 are possible. At the same time, the main support levels are: 1.2430-50, 1.2400 and 1.2350. The breakthrough of it will indicate the possibility of formation of a deep correction for the pair. Resistance is located at the levels: 1.2500, 1.2550 and 1.2600. The fixing of the price above the given marks will indicate the preservation of the general upward trend.

Fig. EUR/USD. The current price is 1.2480.

Hanzenko Anton