В фокусе: Разбор сделок по паре EUR/USD за неделю

Разбирая отчёт о сделках за период от 06.07 до 13.07, можно проследить за явной сменой тренда пары EUR/USD. Рассмотрим подробнее причины, повлиявшие на изменение тренда.

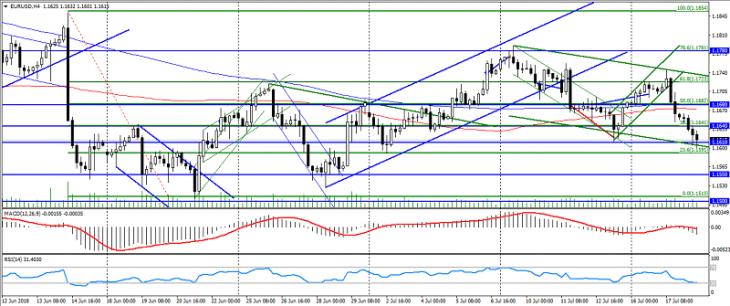

Рис. 1. График пары EUR/USD

Начиная разбор с июля, а точнее со 2 июля, данная пара торгуется исключительно в восходящем тренде, что было вызвано как сохранением пессимизма по доллару, так и слабым отчётом по занятости США. Фактическим уровнем разворота пары EUR/USD стал уровень 1.1780, который отвечает уровню коррекции Фибо. 78.6 от максимума 14 июня до минимума 21 июня. Данный обвал евро был вызван комментариям ЕЦБ относительно не готовности повышения ставок в еврозоне до лета 2019 года.

Рис. 2. График пары EUR/USD H4

Стоит отметить, что первая сделка за 6-9 июля закрыта в плюсе. После чего последовала коррекция.

Вторая сделка 10-11 июля закрыта в минус. Сделка была открыта на отбитии от нижней границы восходящего канала. И рассчитывалась на возобновлении восходящего тренда. В свою очередь, закрытие данной сделки по стопу поставило под сомнение сохранность восходящего тренда начала июля.

С другой стороны возврат под отметку 1.1680, уровень коррекции Фибо 50.0 от максимума 14 июня до минимума 21 июня, указывал на формирование нового нисходящего тренда, который также был преломлен в начале следующей недели.

В свою очередь, за последние две недели пара EUR/USD сформировала нисходящий канал, который вкладывается в рамки снижения конца июня и ограничивается уровнями поддержки: 1.1610 и 1.1640.

Рис. 3. График EUR/USD

Это наталкивает на мысли о коррекции против нисходящего тренда. Выше упомянутая поддержка: 1.1610 и 1.1640 выступает разворотной зоной. Но также стоит помнить о том, что торговля осуществится против тренда, а значит с заниженными целями, в силу возможно возобновления нисходящего тренда.

Уровням значимого сопротивления при такой модели выступает зона 1.1680-1.1700. Разворот в которой укажет на сохранение двухнедельного нисходящего тренда и откроет дорогу к уровням поддержки 1.1580 и 1.1550.

Факторами рисков, которые могут повлиять на динамику пары EUR/USD остаются риски, связанные с внешней политикой США, и данные относительно ужесточения монетарной политики в США. В результате возможен рост волатильности или преломление ожидаемой модели движения пары.

Подробнее о мнениях относительно данной пары и не только можно ознакомиться в Мнениях экспертов. Также следите за Блогом Трейдера.

Антон Ганзенко