Технический анализ валютных пар (Антон Ганзенко)

Индикаторы Forex использующиеся в Техническом анализе: MACD, RSI, Ichimoku Kinko Hyo, Равноудалённый канал, Линии Фибоначчи, Ценовые Уровни.

Зарабатывайте с помощью сервиса торговли на новостях Erste News!

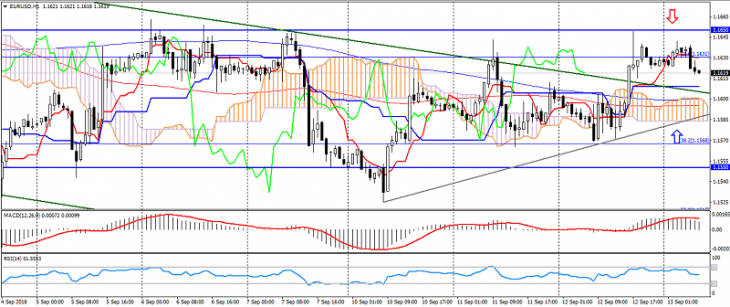

EUR USD (текущая цена: 1.1620)

- Уровни поддержки: 1.1450, 1.1350, 1.1200.

- Уровни сопротивления: 1.1550, 1.1650, 1.1740.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор выше 0, сигнальная линия вышла с тела гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen выше линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 1.1650, 1.1670, 1.1690.

- Альтернативная рекомендация: вход на покупку от 1.1600, 1.1580, 1.1550.

Пара евро доллар торгуется с понижением на коррекции после роста, ограничиваясь оптимистическими настроениями рынка.

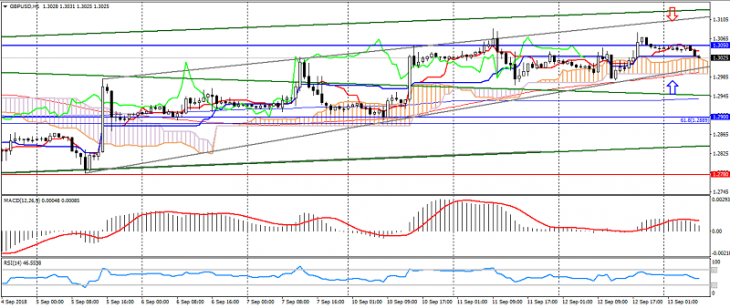

GBP USD (текущая цена: 1.3020)

- Уровни поддержки: 1.2780, 1.2600 (минимум июня 2017), 1.2370 (минимум апреля 2017).

- Уровни сопротивления: 1.2900, 1.3050, 1,3150.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор выше 0, сигнальная линия вышла с тела гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 1.3060, 1.3080, 1.3100.

- Альтернативная рекомендация: вход на покупку от 1.2980, 1.2950, 1.2920.

Британский фунт также оказался под давлением коррекции, но сохраняет восходящую динамику.

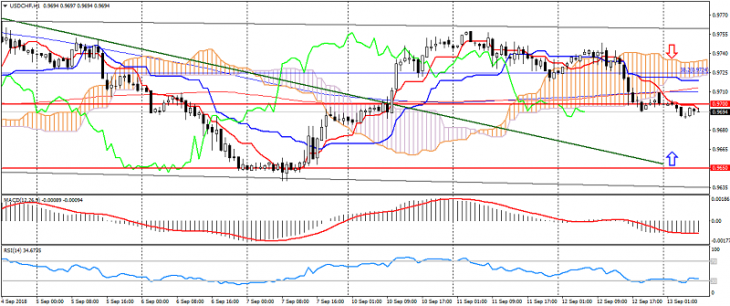

USD CHF (текущая цена: 0.9690)

- Уровни поддержки: 0.9700 (минимум июня), 0.9650, 0.9600.

- Уровни сопротивления: 0.9790, 0.9850, 0.9900.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор выше 0, сигнальная линия вышла с тела гистограммы. RSI (14) в зоне перепроданности. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 0.9700, 0.9720, 0.9750.

- Альтернативная рекомендация: вход на покупку от 0.9680, 0.9650, 0.9630.

Доллар США швейцарский франк торгуется с понижением, но ограничивается перепроданностью.

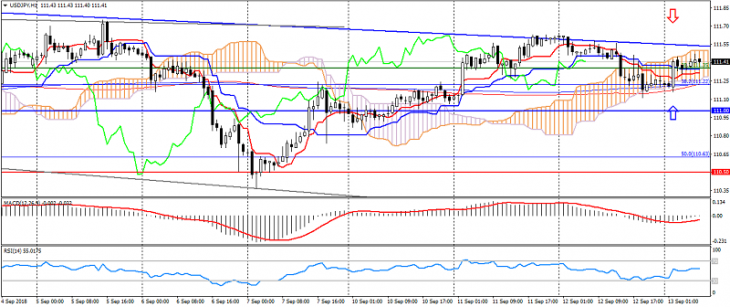

USD JPY (текущая цена: 111.40)

- Уровни поддержки: 110.50, 109.80, 109.00.

- Уровни сопротивления: 111.00, 112.00, 113.30 (максимум января).

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор ниже 0, сигнальная линия вышла с тела гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – флэт): линия Tenkan-sen ниже линии Kijun-sen, цена в облаке.

- Основная рекомендация: вход на продажу от 111.60, 111.80 112.00.

- Альтернативная рекомендация: вход на покупку от 111.20, 111.00, 110.70.

Пара доллар США японская иена торгуется со снижением на снижении рисков.

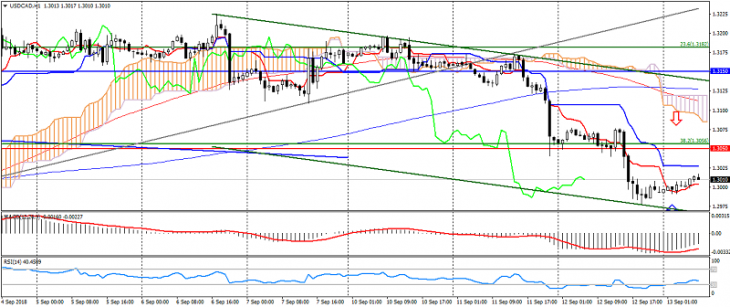

USD CAD (текущая цена: 1.3010)

- Уровни поддержки: 1.3050 (максимум мая), 1.2950, 1.2850.

- Уровни сопротивления: 1.3150, 1.3250, 1.3380.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор ниже 0, сигнальная линия вышла с тела гистограммы. RSI (14) в зоне перепроданности. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 1.3030, 1.3050, 1.3080.

- Альтернативная рекомендация: вход на покупку от 1.30500, 1.2980, 1.2950.

Пара доллар США канадский доллар остаётся под давлением на росте позитивных настроений, но также ограничивается перепроданностью.

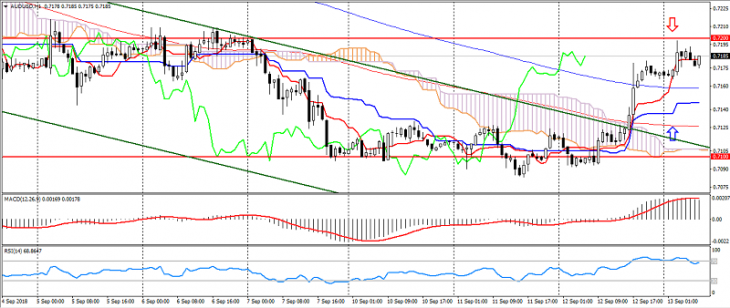

AUD USD (текущая цена: 0.7180)

- Уровни поддержки: 0.7200, 0.7100, 0.7040.

- Уровни сопротивления:0.7300, 0.7400, 0.7500.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор выше 0, сигнальная линия вышла с тела гистограммы. RSI (14) в зоне перекупленности. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение): линия Tenkan-sen выше линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 0.7200, 0.7220, 0.7250.

- Альтернативная рекомендация: вход на покупку от 0.7160, 0.7140, 0.7120.

Австралиец преломил нисходящий тренд на распродаже американца и позитивных данных по занятости в Австралии.

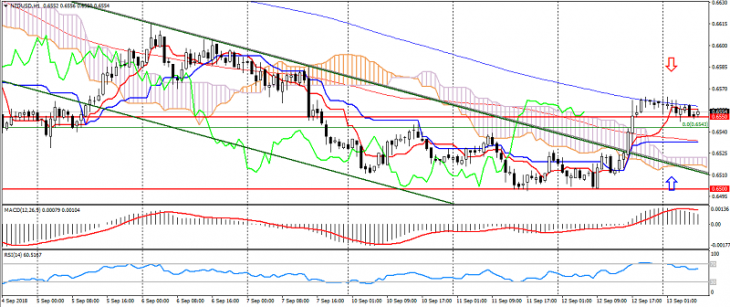

NZD USD (текущая цена: 0.6550)

- Уровни поддержки 0.6550, 0.6500, 0.6470.

- Уровни сопротивления: 0.6630, 0.6700, 0.6750.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор выше 0, сигнальная линия вышла с тела гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение): линия Tenkan-sen выше линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 0.6570, 0.6590, 0.6620.

- Альтернативная рекомендация: вход на покупку от 0.6540, 0.6520, 0.6500.

Новозеландский доллар также преломил нисходящий тренд на росте оптимизма.

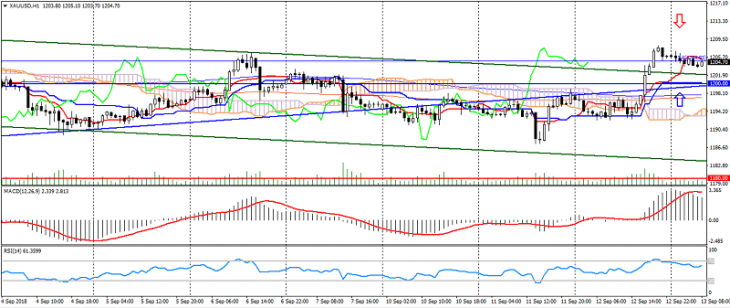

XAU USD (текущая цена: 1204.00)

- Уровни поддержки: 1180.00, 1170.00, 1155.00.

- Уровни сопротивления: 1200.00, 1220.00, 1240.00.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор выше 0, сигнальная линия вышла с тела гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение): линия Tenkan-sen выше линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 1210.00, 1215.00, 1220.00.

- Альтернативная рекомендация: вход на покупку от 1200.00, 1195.00, 1190.00.

Золото перешло к росту на слабости доллара.