Технический анализ валютных пар (Антон Ганзенко)

Индикаторы Forex использующиеся в Техническом анализе: MACD, RSI, Ichimoku Kinko Hyo, Равноудалённый канал, Линии Фибоначчи, Ценовые Уровни.

Зарабатывайте с помощью сервиса торговли на новостях Erste News!

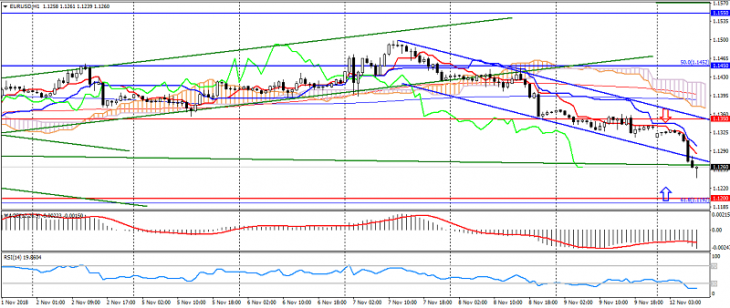

EUR USD (текущая цена: 1.1260)

- Уровни поддержки: 1.1350, 1.1200, 1.1100.

- Уровни сопротивления: 1.1450, 1.1550, 1.1650.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI (14) в зоне перепроданности. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 1.1290, 1.1320, 1.1350.

- Альтернативная рекомендация: вход на покупку от 1.1250, 1.1230, 1.1200.

Пара евро доллар остаётся под давлением американца, ограничиваясь перепроданностью.

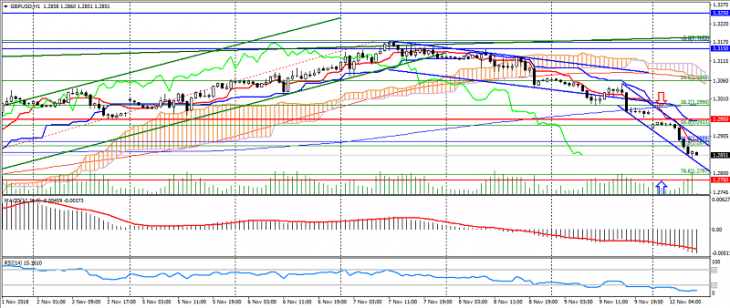

GBP USD (текущая цена: 1.2850)

- Уровни поддержки: 1.2950, 1.2780, 1.2600 (минимум июня 2017).

- Уровни сопротивления: 1,3150, 1.3250, 1.3350.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI (14) в зоне перепроданности. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 1.2900, 1.2930, 1.2950.

- Альтернативная рекомендация: вход на покупку от 1.2830, 1.2800, 1.2780.

Британский фунт также оказался под давлением доллара, ограничиваясь перепроданностью и уровнями поддержки.

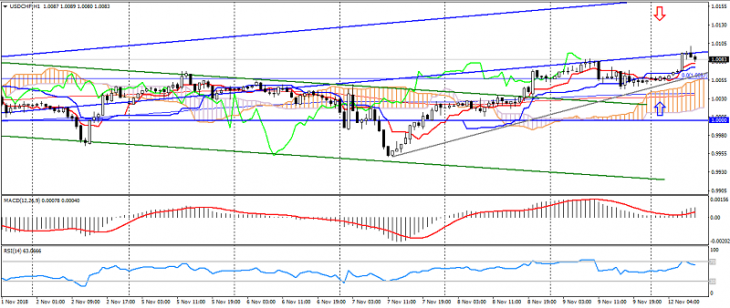

USD CHF (текущая цена: 1.0080)

- Уровни поддержки: 0.9700, 0.9600, 0.9550.

- Уровни сопротивления: 0.9850, 0.9900, 1.0000.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI (14) в зоне перекупленности. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение): линия Tenkan-sen выше линии Kijun-sen, цене выше облака.

- Основная рекомендация: вход на продажу от 1.0100, 1.0120, 1.0150.

- Альтернативная рекомендация: вход на покупку от 1.0050, 1.0030, 1.0000.

Доллар США швейцарский франк вернулся к восходящему тренду, но ограничивается перекупленностью и границами восходящего канала.

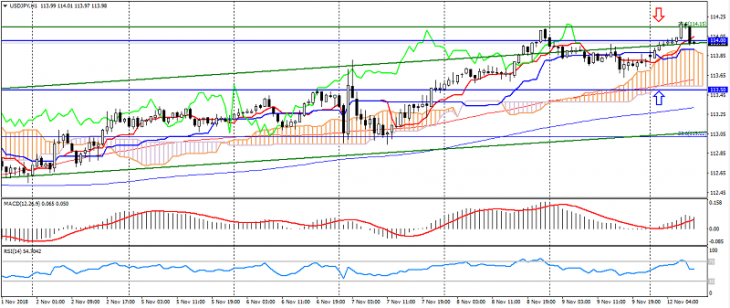

USD JPY (текущая цена: 114.00)

- Уровни поддержки: 112.00, 111.50, 111.00.

- Уровни сопротивления: 113.50, 114.00, 114.50.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение): линия Tenkan-sen выше линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 114.00, 114.20 114.50.

- Альтернативная рекомендация: вход на покупку от 113.50, 113.30, 113.00.

Пара доллар США японская иена торгуется в восходящем тренде, ограничиваясь верхней границей канала и возможными рисками.

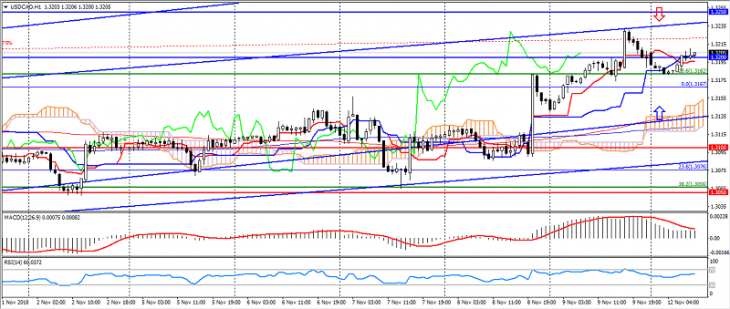

USD CAD (текущая цена: 1.3200)

- Уровни поддержки: 1.3100, 1.3050, 1.3000.

- Уровни сопротивления: 1.3200, 1.3250, 1.3300.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор выше 0, сигнальная линия вышла с тела гистограммы. RSI (14) в нейтральной зоне. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – восходящее движение): линия Tenkan-sen возле линии Kijun-sen, цена выше облака.

- Основная рекомендация: вход на продажу от 1.3230, 1.3250, 1.3270.

- Альтернативная рекомендация: вход на покупку от 1.3180, 1.3150, 1.3130.

Пара доллар США канадский доллар торгуется с укреплением, ограничиваясь перекупленностью, при этом остаётся в фазе коррекции.

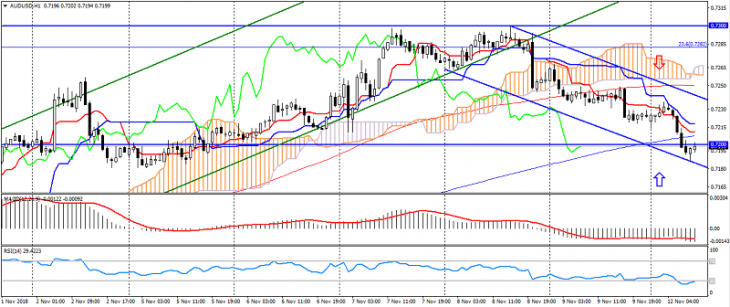

AUD USD (текущая цена: 0.7200)

- Уровни поддержки: 0.7100, 0.7040, 0.6950.

- Уровни сопротивления: 0.7100, 0.7300, 0.7400.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI (14) в зоне перепроданности. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 0.7220, 0.7250, 0.7270.

- Альтернативная рекомендация: вход на покупку от 0.7180, 0.7160, 0.7140.

Австралиец остаётся под давлением доллара и коррекции.

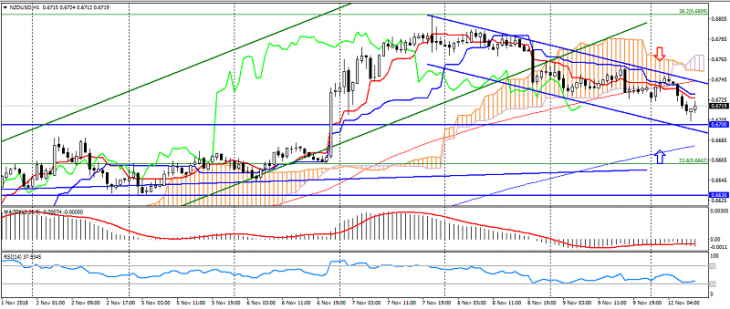

NZD USD (текущая цена: 0.6720)

- Уровни поддержки 0.6450, 0.6350, 0.6300.

- Уровни сопротивления: 0.6550, 0.6630, 0.6700.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI (14) в зоне перепроданности. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цене ниже облака.

- Основная рекомендация: вход на продажу от 0.6740, 0.6760, 0.6780.

- Альтернативная рекомендация: вход на покупку от 0.6700, 0.6680, 0.6650.

Новозеландский доллар также перешёл к снижению, усилив коррекцию после роста.

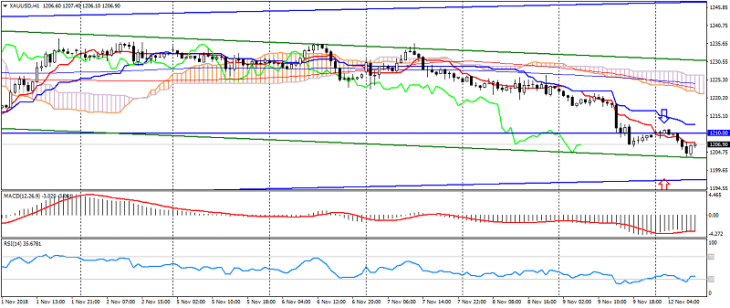

XAU USD (текущая цена: 1206.00)

- Уровни поддержки: 1180.00, 1150.00, 1120.00.

- Уровни сопротивления: 1210.00, 1250.00, 1240.00.

- Компьютерный анализ: MACD (12, 26, 9) (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI (14) в зоне перепроданности. Ichimoku Kinko Hyo (9, 26, 52) (сигнал – нисходящее движение): линия Tenkan-sen ниже линии Kijun-sen, цена ниже облака.

- Основная рекомендация: вход на продажу от 1215.00, 1220.00, 1225.00.

- Альтернативная рекомендация: вход на покупку от 1205.00, 1200.00, 1195.00.

Золото остаётся под давлением, ограничиваясь трёхмесячным восходящим трендом.