Analysis of trading with Erste News

During the trading week from April 29 to May 3, Erste News was traded on the publication of Canadian GDP (April 30), the publication of the US employment report (01.05) and the manufacturing business index (PMI) from ISM (April) USA (01.05).

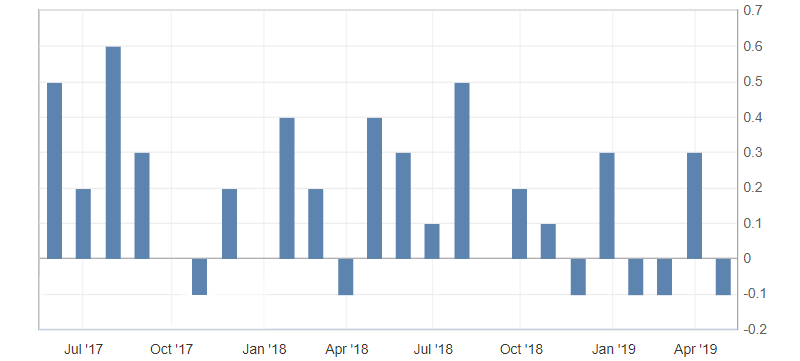

On April 30, CA GDP data came out, which unexpectedly pointed to a noticeable slowdown in Canadian economy growth to its lowest values in the last two years.

Fig. 1. Canadian GDP chart

As a result, the Canadian dollar returned to decline. But in fact, the overall dynamics of the Canadian dollar on this day continued to remain ascending against the background of a significant increase in oil prices. This actually limited the decline in the Canadian dollar.

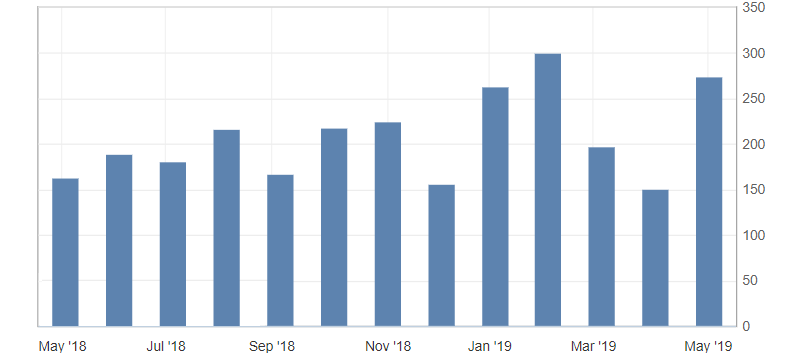

On May 1, two Erste News deals took place at once. On the publication of US ADP Nonfarm Employment Change and, later, US ISM Manufacturing PMI. As a result, the news had a polar effect on the USD/JPY currency.

US employment data exceeded all expectations and showed a significant increase in jobs.

Fig. 2. US ADP nonfarm payrolls chart

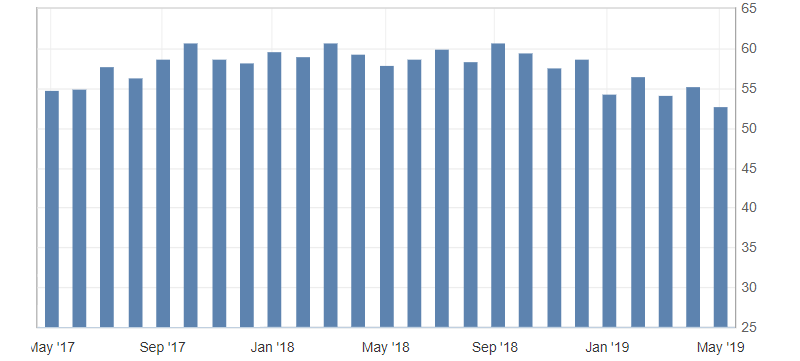

But the business PMI in the US manufacturing sector from US ISM, on the contrary, slowed down to its lowest level in the last two years, ultimately intensifying the sale of the American, which remained under general pressure on the expectation of lower rates.

Fig. 3. ISM USA index of business activity in the manufacturing sector (PMI) chart

It is also worth noting that this trading week was very saturated with trading news. This, in fact, was the limiting factor of Erste News trading. Since the week’s volatility was too high, as were the risks, this caused a high degree of system failure.

Hanzenko Anton