Тechnical analysis of currency pairs (Anton Hanzenko)

Forex indicators used in Technical analysis: MACD, RSI, Ichimoku Kinko Hyo, Equal-channel, Fibonacci lines, Price Levels.

Earn with the help of the trade service on the news Erste News!

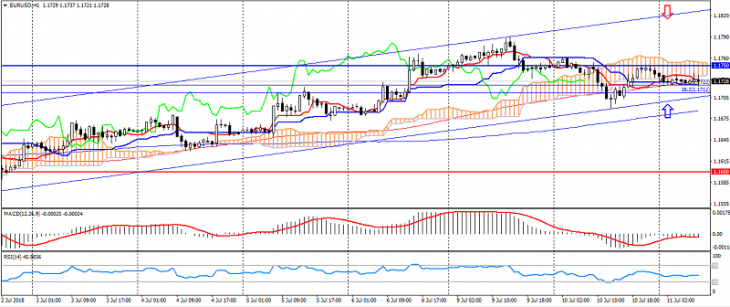

EUR USD (current price: 1.1730)

- Support levels: 1.1600 (significant psychology), 1.1500 (local minimum), 1.1450.

- Resistance levels: 1.1750, 1.1850 (June maximum), 1.2000 (May maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line near the Kijun-sen line, the price in the cloud.

- The main recommendation: sale entry is from 1.1770, 1.1790, 1.1820.

- Alternative recommendation: buy entry is from 1.1700, 1.1670, 1.1650.

The euro dollar remains in the correction phase, thereby expanding the upward channel.

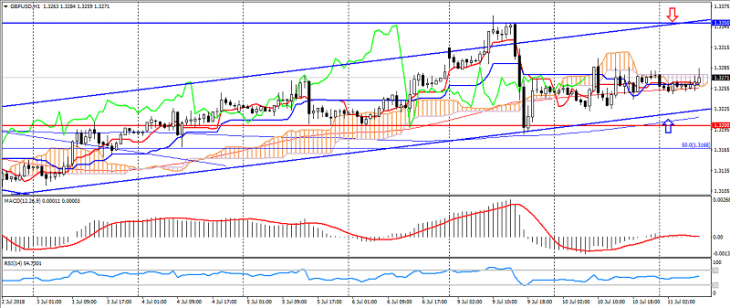

GBP USD (current price: 1.3270)

- Support levels: 1.3200 (the minimum of May), 1.3050, 1.3000 (strong psychology).

- Resistance levels: 1.3350 (June maximum), 1.3460, 1.3600 (May maximum).

- Computer analysis: MACD (12, 26, 9) (signal-flat): indicator near 0.RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line near the Kijun-sen line, the price in the cloud.

- The main recommendation: sale entry is from 1.3320, 1.3350, 1.32750.

- Alternative recommendation: buy entry is from 1.3230, 1.3200, 1.3170.

The British pound remains under pressure of political risks in the UK, while maintaining an upward dynamics.

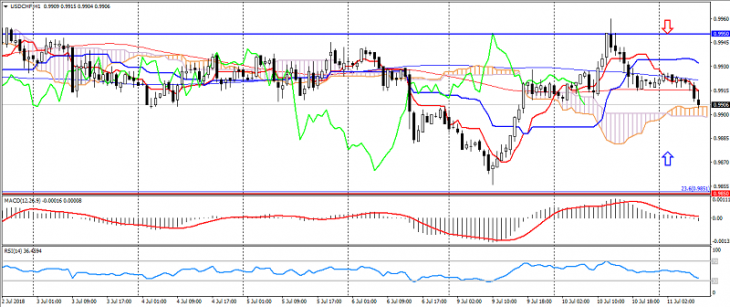

USD CHF (current price: 0.9900)

- Support levels: 0.9850 (local minimum), 0.9700 (June low), 0.9730.

- Resistance levels: 0.9950, 1.000 (significant psychology), 1.0050 (May maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is below the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 0.9930, 0.9950, 0.9970.

- Alternative recommendation: buy entry is from 0.9880, 0.9850, 0.9830.

The US dollar Swiss franc is trading with a strengthening on the growth of risks around the US trade confrontation.

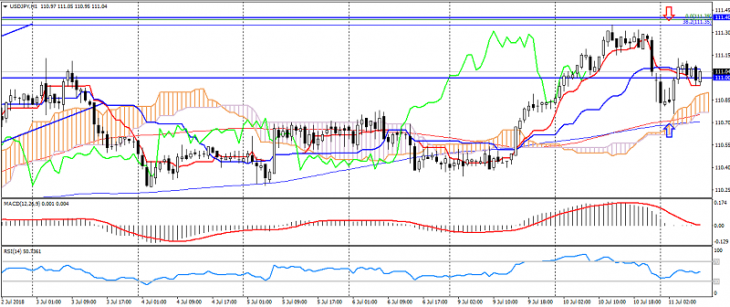

USD JPY (current price: 111.00)

- Support levels: 109.80, 109.00 (the minimum of May), 108.00.

- Resistance levels: 111.00, 110.40 (May maximum), 112.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is below the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 111.20, 111.40 111.60.

- Alternative recommendation: buy entry is from 110.80, 110.50, 110.20.

The USD / JPY pair is trading in different directions, on the uncertainty of the market.

USD CAD (current price: 1.3130)

- Support levels: 1.3050 (May maximum), 1.2950, 1.2860.

- Resistance levels: 1.3150, 1.3250, 1.3380.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 1.3150, 1.3170, 1.3200.

- Alternative recommendation: buy entry is from 1.3100, 1.3070, 1.3050.

The US dollar Canadian dollar pair is trading with a strengthening on the correction of positions on the Canadian dollar before the publication of the results of the meeting of the Bank of Canada.

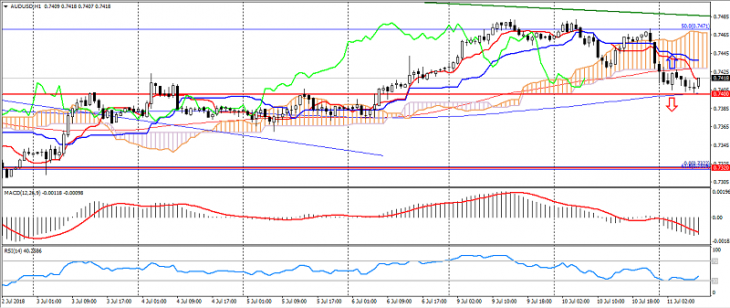

AUD USD (current price: 0.7420)

- Support levels: 0.7400, 0.7320, 0.7250.

- Resistance levels: 0.7500, 0.7550, 0.7600.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: the entrance is for sale from 0.7450, 0.7480, 0.7500.

- Alternative recommendation: buy-in from 0.7400, 0.7380, 0.7350.

The Australian dollar remains under pressure on the possibility of introducing new duties on China.

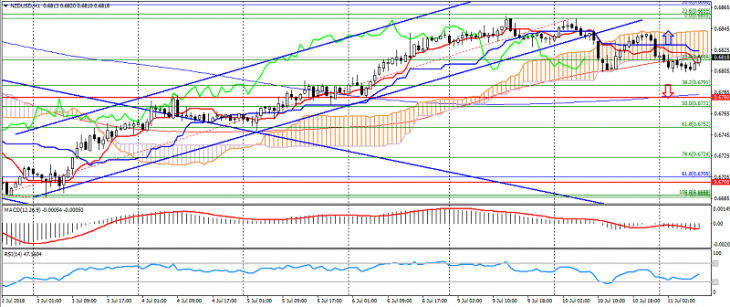

NZD USD (current price: 0.6820)

- Support levels: 0.6780, 0.6700 (significant psychology), 0.6650.

- Resistance levels: 0.6880, 0.6920, 0.6970.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.6850, 0.6880, 0.6900.

- Alternative recommendation: buy entry is from 0.6800, 0.6780, 0.6750.

The New Zealand dollar also weakened on the growth of risks in the region.

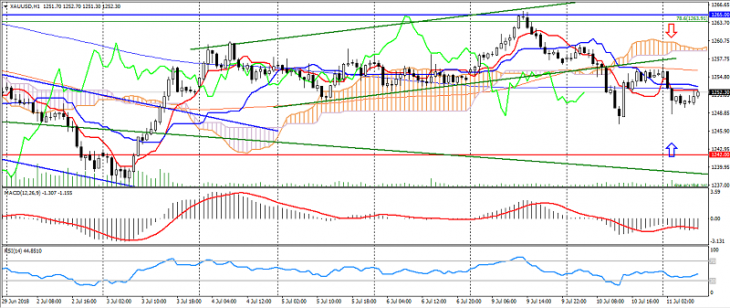

XAU USD (current price: 1252.00)

- Support levels: 1242.00, 1235.00 (minimum of December 2017), 1220.00.

- Resistance levels: 1265.00, 1275.00 (local maximum), 1285.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1257.00, 1260.00, 1265.00.

- Alternative recommendation: buy entry is from 1245.00, 1242.00, 1237.00.

Gold accelerated the decline, but is limited to yesterday’s low and can get support for increasing risks.