Тechnical analysis of currency pairs (Anton Hanzenko)

Forex indicators used in Technical analysis: MACD, RSI, Ichimoku Kinko Hyo, Equal-channel, Fibonacci lines, Price Levels.

Earn with the help of the trade service on the news Erste News!

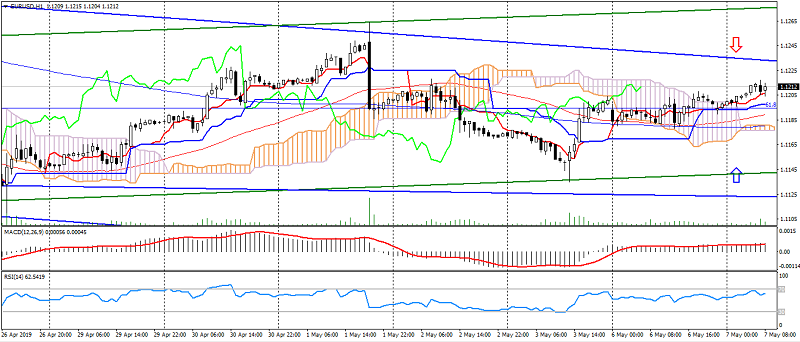

EUR USD (current price: 1.1210)

- Support levels: 1.1350, 1.1200, 1.1100.

- Resistance levels: 1.1450, 1.1550, 1.1650.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above Kijun-sen, the price is above the cloud.

- The main recommendation: sale entry is from 1.1220, 1.1250, 1.1280.

- Alternative recommendation: buy entry is from 1.1180, 1.1150, 1.1120.

A pair of euro dollar is traded with a strengthening of the weakness of the dollar, limited to recent highs.

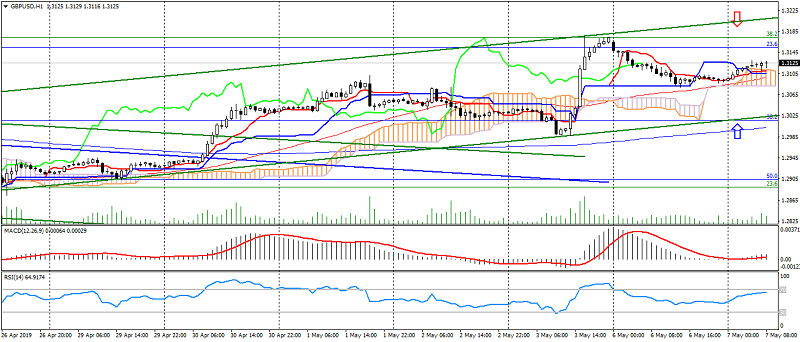

GBP USD (current price: 1.3120)

- Support levels: 1.2500, 1.2300, 1.2100.

- Resistance levels: 1.3300, 1.3600, 1.4000.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line near Kijun-sen line, the price is above the cloud.

- The main recommendation: sale entry is from 1.3150, 1.3180, 1.3220.

- Alternative recommendation: buy entry is from 1.3080, 1.3040, 1.3010.

The British pound maintains restraint, limited to a downward correction, continuing to trade in the upward two-week channel.

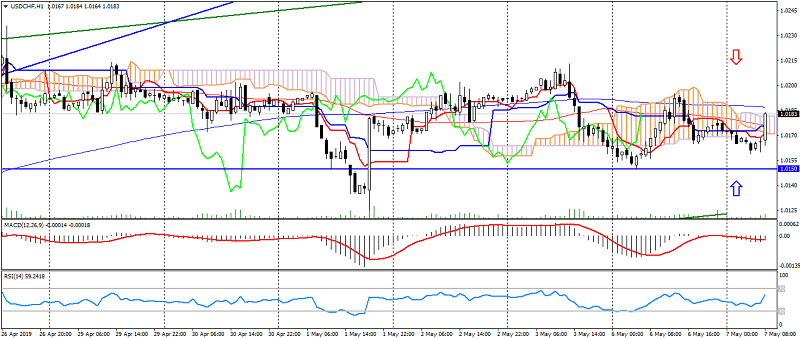

USD CHF (current price: 1.0170)

- Support levels: 0.9850, 0.9750, 0.9650.

- Resistance levels: 1.0000, 1.0060, 1.0150.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line is below the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 1.0180, 1.0200, 1.0230.

- Alternative recommendation: buy entry is from 1.0150, 1.0130, 1.0100.

The US dollar Swiss franc is trading in the side channel, limited to risk.

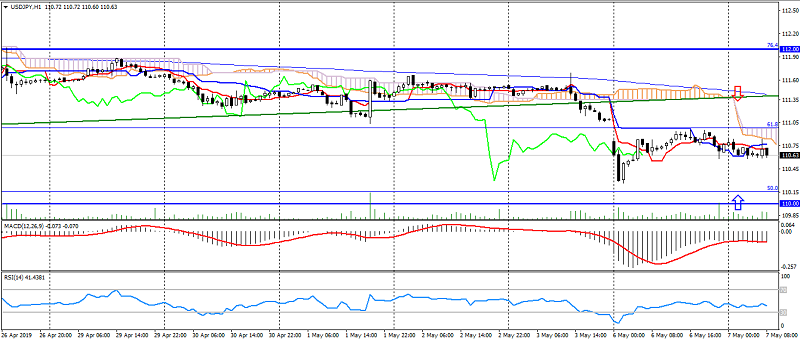

USD JPY (current price: 110.60)

- Support levels: 104.50, 103.00, 100.50.

- Resistance levels: 110.00, 112.00, 115.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line near Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 111.00, 111.30, 111.50.

- Alternative recommendation: buy entry is from 110.50, 110.30, 110.00.

The pair US dollar Japanese yen maintains a restrainingly downward trend in risks.

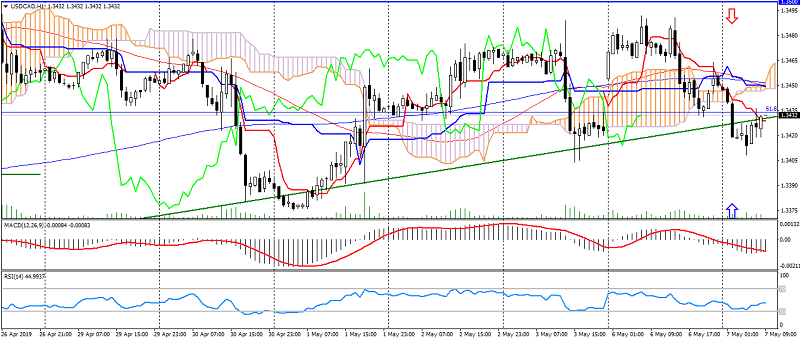

USD CAD (current price: 1.3430)

- Support levels: 1.3100, 1.3000, 1.2900.

- Resistance levels: 1.3300, 1.3500, 1.3700.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.3450, 1.3480, 1.3550.

- Alternative recommendation: buy entry is from 1.3400, 1.3380, 1.3350.

A pair of US dollars Canadian dollar has slowed growth, updating the low on the weakness of the American dollar.

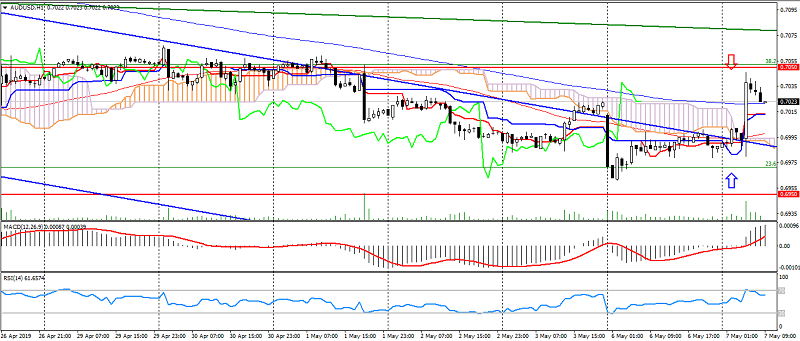

AUD USD (current price: 0.7020)

- Support levels: 0.7050, 0.6950, 0.6850.

- Resistance levels: 0.7200, 0.7300, 0.7400.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line near Kijun-sen line, the price is above the cloud.

- The main recommendation: sale entry is from 0.7050, 0.7080, 0.7100.

- Alternative recommendation: buy entry is from 0.7000, 0.6980, 0.6950.

The Australian dollar is trading lower on the correction after the growth, which was caused by RBA’s optimistic expectations.

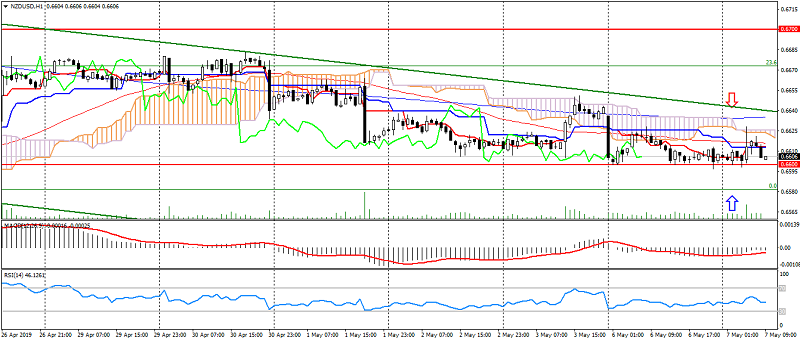

NZD USD (current price: 0.6600)

- Support levels : 0.6700, 0.6600, 0.6500.

- Resistance levels: 0.6880, 0.6950, 0.7050.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line came out of the histogram body. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line near Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.6630, 0.6650, 0.6680.

- Alternative recommendation: buy entry is from 0.6600, 0.6580, 0.6560.

The New Zealand dollar remains under the pressure of a downtrend, continuing to trade in a descending triangle.

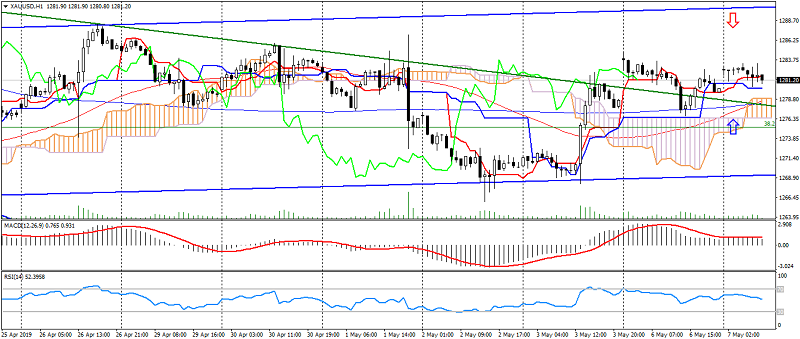

XAU USD (current price: 1281.00)

- Support levels: 1300.00, 1335.00, 1360.00.

- Resistance levels: 1265.00, 1240.00, 1220.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above the Kijun-sen line, the price is above the cloud.

- The main recommendation: sale entry is from 1285.00, 1290.00, 1295.00.

- Alternative recommendation: buy entry is from 1280.00, 1275.00, 1270.00.

Gold will maintain an upward trend in the growth of risk, limited to the general downward trend and market restraint.