BoE meeting results

- The total amount of the QE program of the Bank of England (Mar), fact 435B, forecast 435B.

- Interest rate decision (Mar), fact 0.75%, forecast 0.75%.

The March meeting of the Bank of England did not bring changes in the monetary policy of Great Britain. So, this meeting fully coincided with market expectations. It is worth noting that the Central Bank of Great Britain noted a decrease in the target inflation rate to 1.9%, which can be regarded very negatively. A limiting factor for the Bank of England is also the uncertainties surrounding Brexit and the possibility of extending its time limits.

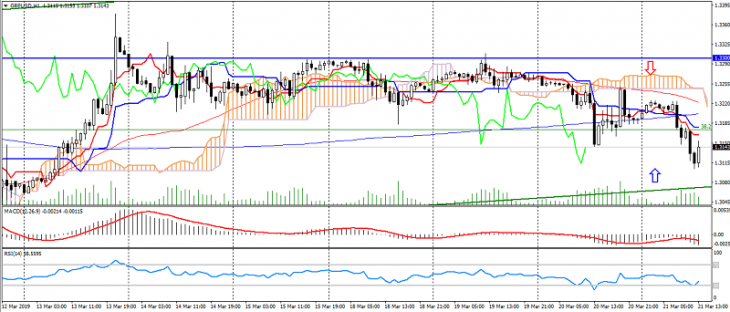

As a result, the published report of the Bank of England turned out to be very much expected, but at the same time caused a restrained strengthening of the British pound, which was caused by a less dovish tone of the Central Bank. Also it is worth noting a significant oversold pound against most competitors, which can be traced from the start of the day. Therefore, a modest strengthening in correction is expected from the GBP/USD pair. Resistance levels: 1.3180 and 1.3220, support: 1.3100 and 1.3050.

GBP/USD chart. Current price – 1.350

Read also: “VSA: bullish and bearish volumes; signs of strength and weakness in the market “

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Brexit vote results

- Prospects for Boeing shares after the planes crash

- The US Dollar Index (DXY) as an auxiliary indicator for trading in safe haven currencies

Current Investment ideas: