Emerging markets and their prospects

Emerging markets have always been very interesting and dangerous for investors. So, on the one hand, forecasts and indicators of rapid economic growth attract investors to invest in the national currency with earning opportunities. On the other hand, the risks of devaluation (lowering the currency value) can become a terrible dream that has become a reality for any investor.

Today we will try to figure out how promising emerging markets are, according to the rate of economic growth compared with the US and the eurozone.

Among the most promising emerging market currencies are:

- Singapore dollar (SGD),

- Polish zloty (PLZ)

- and Mexican Peso (MXN).

Looking ahead, it is worth noting significant geopolitical and political risks when trading in emerging market currencies, which has recently been seen well on the Mexican peso.

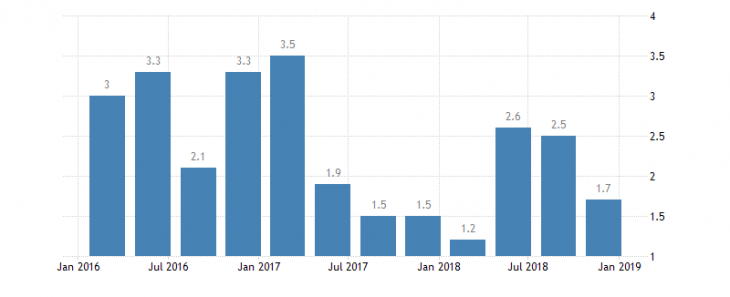

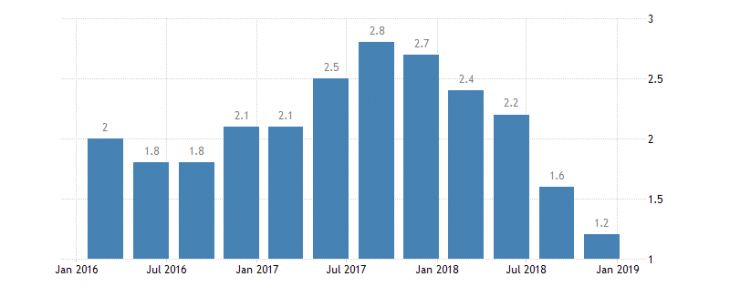

The following are examples of GDP growth rates

of the emerging markets:

Fig. 1. Poland’s GDP Growth Rate

Fig. 2. Singapore GDP Growth Rate

Fig. 3. Mexican GDP Growth Rate

At the same time, the growth rates of GDP in the United States and the eurozone differ from emerging markets in more stable dynamics. At the same time, the economic indicators of the USA and the eurozone have opposite motion vectors, indicating that investments in developing markets against the euro are more profitable.

Fig. 4. U.S. GDP Growth Rates

Fig. 5. Eurozone GDP Growth Rate

Comparing the dynamics of the US dollar index and currency pairs: USD/MXN, USD/PLN and USD/SGD, the following dynamics can be traced.

US dollar index (Japanese candlesticks), USD/MXN (blue line), USD/PLN (green line) and USD/SGD (orange line)

Comparing the dynamics of the euro index and currency pairs: EUR/MXN, EUR/PLN and EUR/SGD, the following dynamics can be traced.

Euro (Japanese candlesticks), EUR/MXN (blue line), EUR/PLN (green line) and EUR/SGD (orange line)

Comparing the dynamics of the dollar index and emerging market currencies with their GDP growth rates, it is worth noting the interesting dynamics of the general decline in the US currency, which fell at the peak of the growth of emerging markets. This indicates a direct correlation between these indicators and a very close movement of such currency pairs as: USD/PLN, USD/SGD with the US dollar index. The exception was the Mexican peso, which can be explained by the geopolitical situation.

Compared to the euro, these currencies behave less tethered to the euro, with the exception of the Singapore dollar. At the same time, the dynamics of the euro index to a greater extent depends on the growth rate of eurozone GDP.

Anton Hanzenko