The main market’s drivers

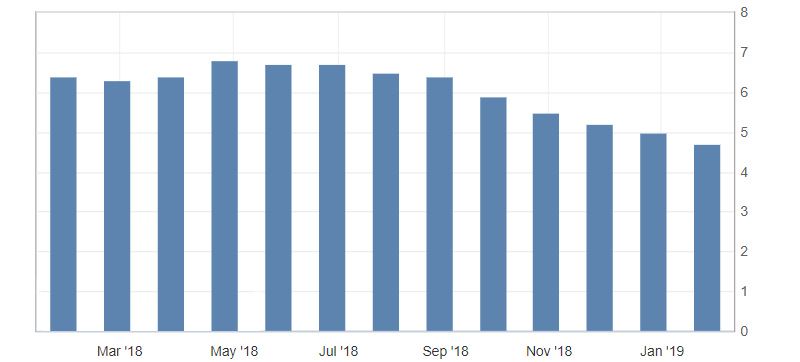

- S&P/CS Composite-20 house price index (USA) non seasonally adjusted (y/y), fact 4.7%, forecast 4.9%.

Data on the housing prices in the US fell to the lowest values of 2015, confirming keeping the downward trend of this indicator.

Fig. 1. S&P/CS Composite-20 house price index (USA) chart

In this case, general dynamics of the US dollar and the market remains restrained. The US dollar showed growth only against safe-haven currencies that remain under pressure across the market. The pressure on them was exerted by the growth of optimism in the stock markets. Along with the strengthening of stock indices, there is no trace of the strengthening of commodity currencies, which indicates that growth in optimism is limited. The US currency remains limited to lateral dynamics and oversold, maintaining the lateral dynamics from 95.80 to 95.60.

Fig. 2. The US dollar index chart. The current price is 96.70 (10-year government bonds yield is the blue line)

Read also: “Government Bonds as a Market Driver”

Andre Green

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Long-term investment in currency pairs! The USD/DKK pair!

- Another “Top 5” books on trading. It can’t be too much information!

- Long-term investment in currency pairs! The EUR/JPY pair!

Current Investment ideas: