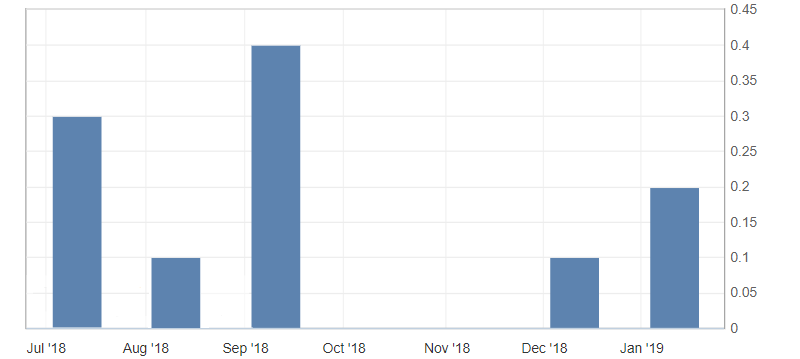

U.K. data

- GDP (m/m), fact 0.2%, forecast 0.1%.

- Industrial Production (m/m) (November), fact -0.4%, forecast 0.3%.

- Manufacturing Production (m/m) (November), fact -0.3%, forecast 0.4%.

- Change in monthly GDP 3m/3m, fact 0.3%, forecast 0.3%.

- Trade balance (November), fact -12.02B, fact -11.40B.

- Trade balance excluding EU countries (November), fact -3.92B, forecast -3.70B.

The UK data was more negative due to lower production volumes and a trade balance. The data on GDP became a positive note for the report, which unexpectedly rose after a very significant and prolonged decline, which indicated the potential for the recovery of the UK economy. General picture of the UK economy remains restrained negative due to a decrease in production and trade volumes. This is directly related to the risks of tough Brexit.

Fig. 1. U.K. GDP chart

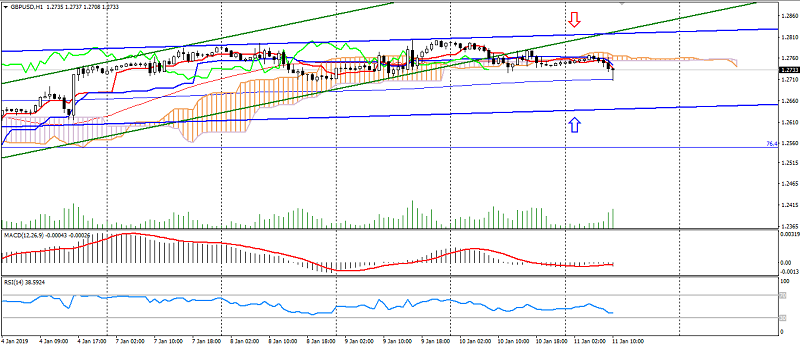

The British pound has accelerated the decline on these statistics, remaining under the pressure of risks for Brexit. The GBP/USD pair continues to trade in the side channel under the pressure of risks, limited to support levels: 1.2690 and 1.2660, resistance: 1.2760 and 1.2810.

Fig. 2. GBP/USD chart. Current price – 1.2730

Read also: “Swiss franc (CHF) – a feature of trading cross-rates ”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Long-term investment in currency pairs! The GBP/USD pair!

- Geopolitical risks for the beginning of 2019! (Part 2)

- Geopolitical risks for the beginning of 2019!

Current Investment ideas: