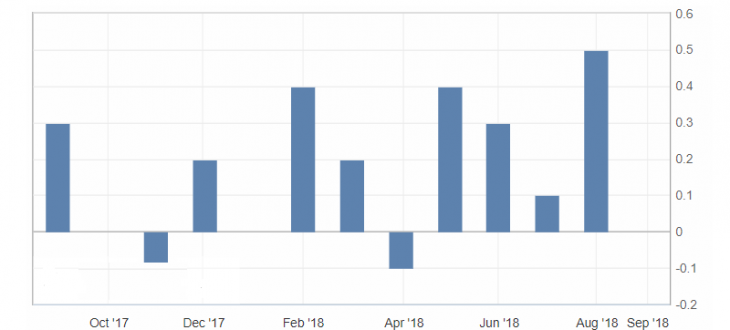

US data and Canada’s GDP

- Core price index of personal consumption expenditure (y / y) (July), US, fact 2.0%, forecast 2.0%.

- Core price index of personal consumption expenditure (m / m) (July), US, 0.2%, forecast 0.2%.

- Number of initial jobless claims in US, fact 213K, forecast 214K.

- Personal spending (m / m) (July), US, fact 0.4%, forecast 0.4%.

- GDP (m / m) (June) of Canada, fact 0.0%, forecast 0.1%.

- GDP (y / y) of Canada, fact 2.4%.

- GDP (QoQ) (Q2) of Canada, fact 0.7%.

- GDP annualized (Q2/Q2) of Canada, fact 2.9%, forecast 3.0%.

The Canadian dollar was under pressure on the unexpected slowdown in Canada’s GDP growth, which caused pressure on the Canadian dollar.

Fig. 1. Canada’s GDP chart

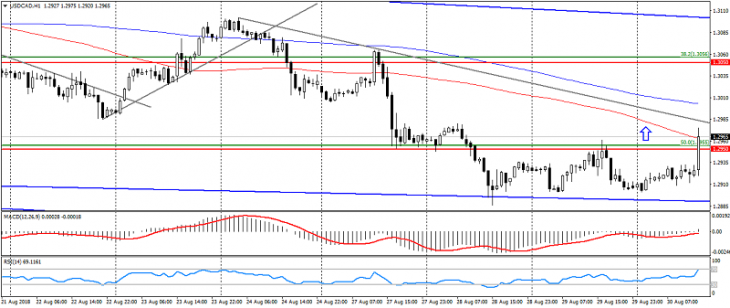

Against the background of a decline in the Canadian dollar, the US dollar received support. Also, the support of the US dollar was the reduction of initial applications for unemployment. As a result, the pair USD/CAD moved to growth on the formation of the “double bottom” figure, which opens the way to resistance levels of 1.3000 and 1.3030.

Fig. 2. USD/CAD chart. The current price is 1.2960.

Read also: “Market analysis: undervalued and overvalued shares”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Norwegian Krone. Features of trading Scandinavian currencies

- Stock indices of America: Canada, Mexico and Brazil

- Trade balance influence on the country’s economy

Current Investment ideas: