U.S. data

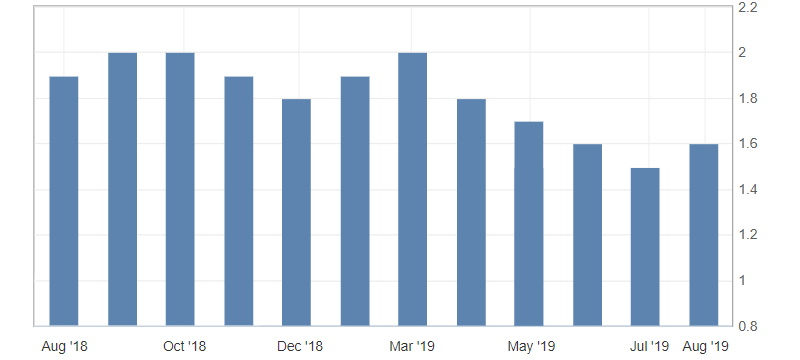

- Core price index for personal consumption expenditures (m/m) (June), fact 0.2%, forecast 0.2%.

- Core price index for personal consumption expenditures (y/y) (June), fact 1.6%, forecast 1.7%.

- Expenses of individuals (m/m) (June), the fact of 0.3%, the forecast of 0.3%.

Expenditure data in the US slowed down in June, showing a slower pace than predicted. This can be regarded as a sign of a slowdown in consumption and consumer inflation. General dynamics of this indicator became restrained ascending, which may serve as a signal for the resumption of growth.

Fig. 1. Core price index for personal consumption expenditures (y/y) in the USA

The US dollar reacted restrained to the published data, remaining under the pressure from the correction before the meeting results of the US Federal Reserve. The US dollar index is limited to the side channel from 98.20 to 98.00.

Fig. 2. The US dollar index chart. The current price is 98.10 (10-year US government bonds yield is the blue line)

Read also: “Analysis of speeches of key persons of the financial market“

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- What does British pound wait for with a new prime minister

- The risks of a trade war are back

- Expectations from the July Fed meeting

Current Investment ideas: