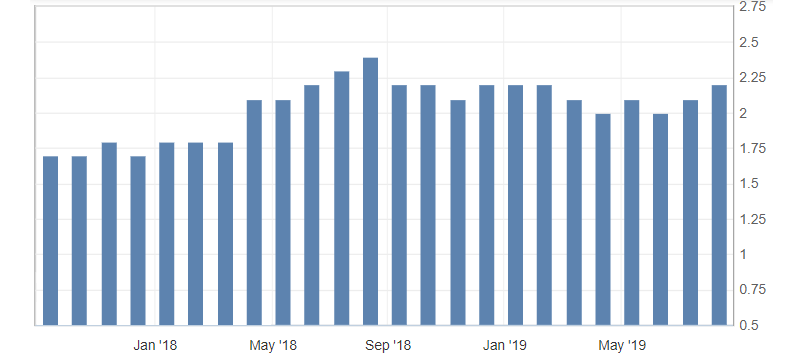

U.S. inflation data

- Core Consumer Price Index (CPI) (m/m) (July), fact 0.3%, forecast 0.2%.

- Core Consumer Price Index (CPI) (y/y) (July), fact 2.2%, forecast 2.1%.

- Consumer Price Index (CPI) (m/m) (July), fact 0.3%, forecast 0.3%.

The US Consumer Price Index (CPI) rose in July, despite moderate indicators that indicated continued growth and the possibility of a slowdown, indicating a resumption of growth in the US consumer inflation.

Fig. 1. Core Consumer Price Index (CPI) (y) in the USA

On positive inflation data in the US, the dollar index slowed down the decline, which remained for some time. Positive data slowed the decline in the American dollar, but did not serve as a reason for a reversal. As a result, levels 97.30-20 remain significant support. The main reason for the decline in the American dollar remains the risk of a slowdown in the US economy on the escalation of the trade war.

Fig. 2. The US dollar index chart. Current price – 97.40 (10-year US government bonds yield – blue line)

Read also: “Procter & Gamble gave to earn!

Analysis of the investment idea of June“

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Gold in the light of current events. How long is its growth

- A new round of trade war: duties, restrictions, prospects

- The results of the July Fed meeting for the market

Current Investment ideas: