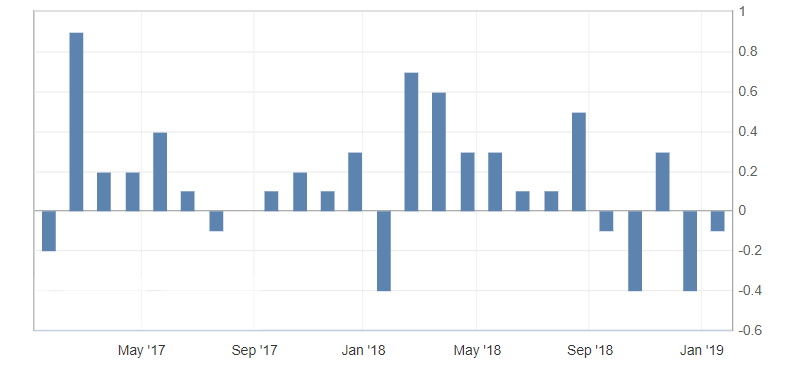

Inflation data in Canada

- Core consumer price index (CPI) (m/m) (December), fact -0.2%, previous value -0.2%.

- Core consumer price index (CPI) (y/y) (December), fact 1.7%, previous value 1.5%.

- Consumer price index (CPI) (m/m) (December), fact -0.1%, forecast -0.4%.

- Foreign investment in Canadian securities (November), fact 9.45B, previous value 3.97B.

An inflation report in Canada turned out to be very positive despite the large mass of restrained data, thanks to data on the consumer price index (CPI) (m/m). Thus, the consumer price index on a monthly basis slowed down less significantly than expected. It caused the growth of optimism for the Canadian dollar.

Fig. 1. Canada’s consumer price index (CPI) (m/m) chart

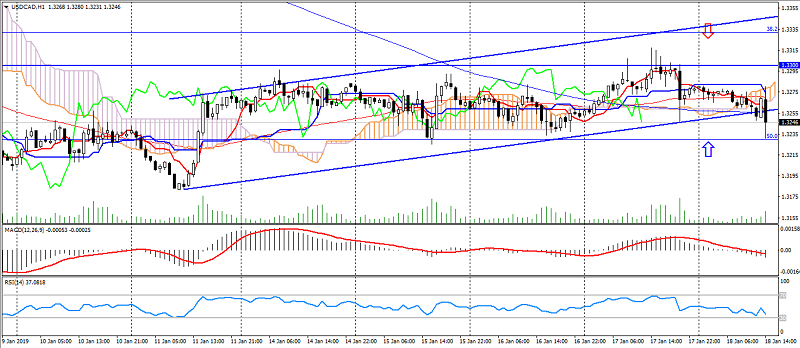

The USD/CAD pair has accelerated growth on positive inflation data in Canada, previously ignoring the positive trend in raw materials. It is also worth noting that the decline in this pair is limited to support levels: 1.3230 and 1.3200. Also published fundamental factors are very restrained for the continued growth of the Canadian dollar, not to mention the preservation of the upward dynamics of this pair.

Fig. 2 USD/CAD chart. Current price – 1.3150

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Long-term investment in currency pairs! The EUR/JPY pair!

- Geopolitical risks for the beginning of 2019! (Part 3)

- Long-term investment in currency pairs! The GBP/USD pair!

Current Investment ideas: