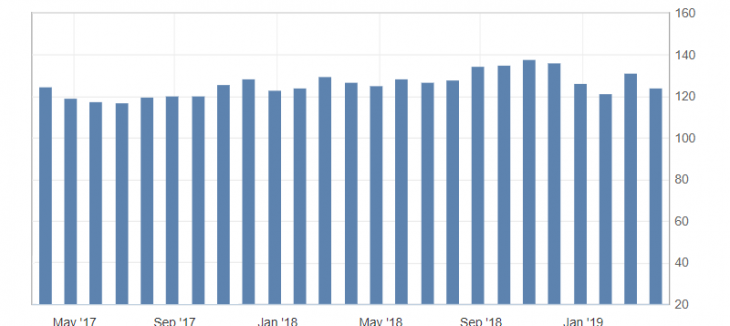

U.S. consumer confidence data

- Consumer Confidence Index CB (Mar), fact 124.1, forecast 132.0.

Consumer confidence in the US in March decreased, denying expectations for an increase. The actual value fell to the average for the year and actually had a negative impact on the US dollar. Published data indicate a decrease in consumer optimism and the possibility of slowing inflation.

Fig. 1. U.S. consumer confidence index chart

The overall dynamics of the US dollar index and the market as a whole remains limited by Friday extremes. Continuing optimism in the stock markets supports commodity currencies and partly the American dollar against safe-haven currencies. The US dollar index on weak US data is limited by the resistance level of 96.70-80. Rebound from this level will indicate the continuation of the lateral dynamics.

Fig. 2. The US dollar index. The current price is 96.70 (10-year government bonds yield is the blue line)

Ganzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Prospects for the euro based on the ECB policy

- Brexit vote results

- Prospects for Boeing shares after the planes crash

Current Investment ideas: