nternal conflicts of JPY. Analysis of the decision of the Bank of Japan and further prospects for the USD/JPY pair.

Have a good start of the trading week! And with you, the business angel of the international currency market ForEx Andrew Green. Why a business angel – because I advise you and I trade with you.

To begin our analysis of the USD/JPY pair it is worth to study the decision of the Bank of Japan on January 23 and the speech of the head of the Bank of Japan Haruhiko Kuroda in Davos.

Let’s start with the first: In general, the content did not carry anything new either for the market as a whole or for the Japanese currency itself. Once again, the target inflation rate of 2% was emphasized. The reference point for its achievement in 2019-2020 is indicated. The need to continue the policy of quantitative easing remains in force until the price dynamics, to a greater extent, is weak. Over time, there will be made adjustments to the process of buying ETF debt. Briefly, blah blah blah … It’s an old route.

And what’s more interesting is his interview in Davos, where he is more optimistic about reaching a key level, and somewhere between the lines one can read the desire to curtail the policy of mitigation.

The question is, where is the real Kuroda, where is its real position on this issue, and is there a clear understanding of what the Bank of Japan will do in the near future ?!

So, my dear, this is a real position – and this is the real Bank of Japan.)

Those who carefully study Japan’s economic policy: the structure of production, exports and other – tedious, but important information on this region and is a participant of the international market, know that Japan is maximally export oriented. The exchange rate of the national currency is close to the level of 100.00 – very painful for the income of most of the main producers and generators of Japan’s GDP. Therefore, no matter how close and stable the internal inflation is, the policy of quantitative deterrence-manipulation of the market will be applied by the Bank of Japan if necessary, without the slightest scruples of conscience and additional delays.

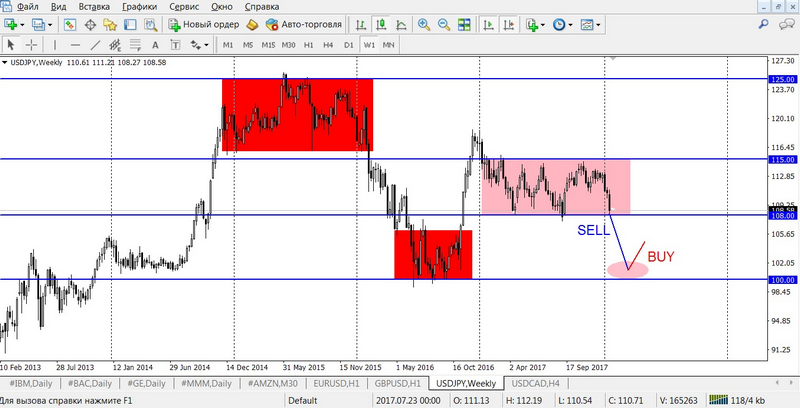

Let’s take a look at Figure # 1, which I already published in the previos articles, namely, the weekly timeframe for the pair USD/JPY.

We see tunnel penetrations, channels in which the Japanese yen wanders long enough, restrained on one side by the Bank of Japan, so that it does not become much stronger and does not go beyond the current target levels. But at the same time, with its strong sales, it receives strong support from outside investors, for whom it is a proven safety tool, so called Safe Haven.

If you do not know this term, or you just would like to understand this concept in more detail, and also to understand other existing instruments in the financial market, then we are happy to invite you to our individual training courses, the content of which you can find on the website , as well as to enroll for the training.

[maxbutton id = “2” url = “https://esterholdings.com/en/learning/paid-training/modul-basic/#modal-1” text = “Sign up for a course!” ]

The pair approaches the lower boundary of one of these channels, so we are preparing for trading.

And we, as professional traders, should not limit ourselves to only one option of the development of events, just with the example of this situation we will analyze the option of trading regardless of where it goes)

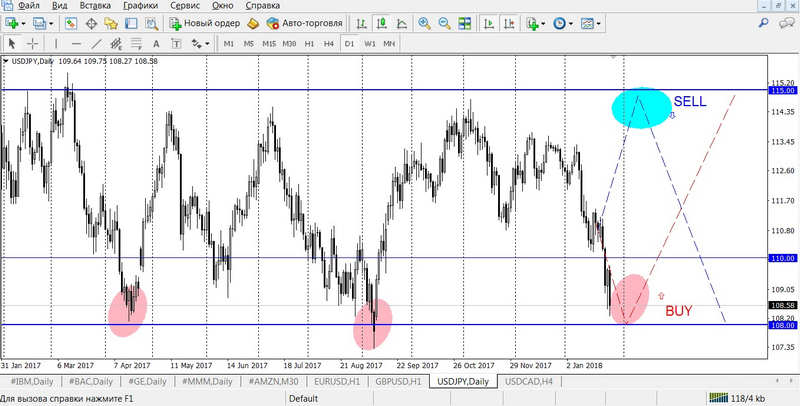

Let’s look at Figure # 2, here we have a daily timeframe.

There are two options for the development of events:

- The reversal from the annual minimums in 2017, in the 108.00 psychological range. Example of the transaction:

- conservative:

BUY limit 107.90 , SL 107.40 , TP 108.80,

aggressive:

BUY (from the opening of the market) , SL 107.40 , TP 109,60.

- Break of the lows and fixing below the level of 108.00. Here the situation for analysis is more complicated. It is necessary to take into account several additional circumstances – breakdown and fixation. If the breakdown is clear – this is when the price falls below 108.00, then the fixation should be explained. In fact, this is the dynamics after the breakdown, the rollback to the levels of broken support, in our case 108.00, and the formation of a new round of downward dynamics from this level. Therefore, the trading tactic in this case looks like this:

- breakdown and exit of the price near support levels of 107.20-30;

- correction from 107.20-30 to the levels of 107.90 and there is an entrance for sale.

If you do not fully understand the recommendation, write to the technical support of Ester Holdings support@esterholdings.com with a note for Andrew Green, and also sign up for a course about my tactics of permanent trade – ADRENALIN.

Exchange trade is a high income multiplied by the received pleasure from the process!

Andrew Green