The level is completed. Are we going to the next one? Weekly review for the pair USD/JPY.

Good day to fans of uncompromising trading. With you Andrew Green.

Our favourite one in the ForEx market, the pair USD/JPY, including the afterburner SafeHaven, took a step of faith and rushed to a new low from the already flattened flat 115-108.00. On the common shoots last week of investors in safe havens of risk-free assets, the Japanese yen broke through support at 108.00 and rushed into the mid-2016 flot. Of course, there are still about 3-6 figures to reach the range, but we know what this Japanese guy.

This week is more likely to add the right sentiment to the market, and the only thing that can hamper is the actions of the Bank of Japan, whose position is generally clear (supporting the interests of the export-oriented economy), but the levels that are key, just in the lower range close to 100 -103.00.

I do not think that we will see some kind of throw-in from the Board of the central bank of Japan this week.

In turn, you can learn more about the dynamics of the US dollar in the USD/JPY pair in the article with an overview of the USD index.

The news background of the week in Japan is almost near zero.

For a more specific study of trade prospects, we turn to technical analysis.

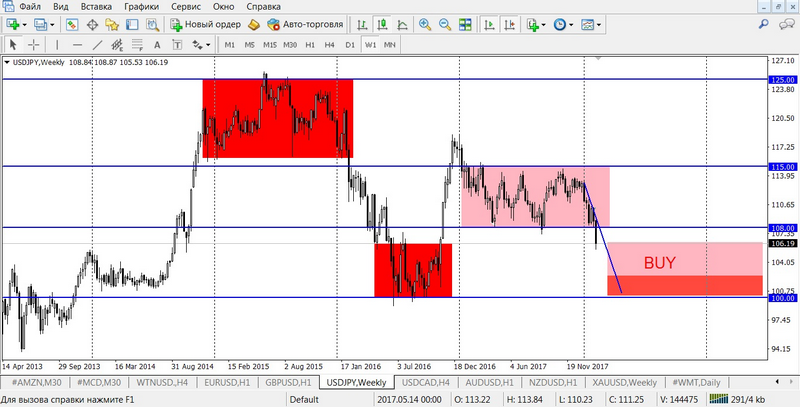

Let’s start with the analysis of long-term prospects and the timeframe of the week (Figure 1).

Here we see the potential for moving into a new range with support guidelines at 100.00. The width of the new flatbed corridor is about 500 points (100-105.00). The possibility of a downward movement of 600 points is, of course, very tempting, but my recommendation is, for the medium-term trade, to wait for the fixation in the flat and the input from the supports close to 100.00-101.00. The cut is below 99,00. Potential of each such transaction is from 200 points.

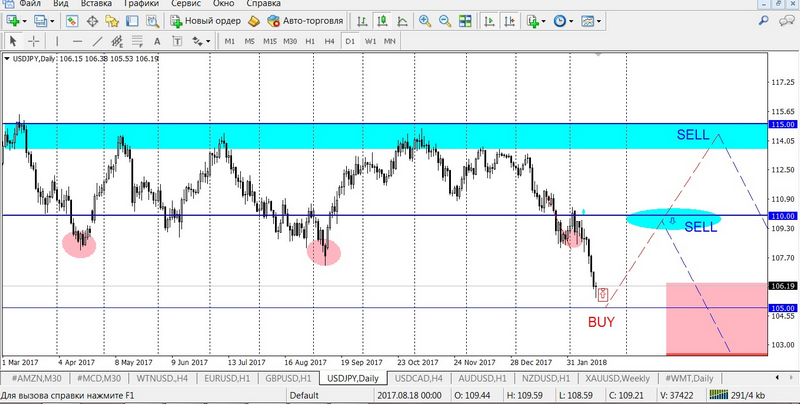

To trade for shorter periods, go to the daily timeframe and Figure 2.

Here we are interested in the psychological level at 105.00. Potentially, it can give a good correction with the movement for the resistance line at 108.00, before continuing the downtrend to 100.00. But be careful, the pair can give a strong breakdown from the first touch, as it did before, so consider buying as close as possible to support at 105.00 and short stop loss, no lower than 104.50. But the sales zone at 110-108.00 is very promising in light of the long-term prospects of the weekly timeframe, of which I wrote about earlier.

We go to the depth, and go to the mode of intraday trading and the hourly timeframe in Figure 3.

Very beautifully seen is the strengthening of the downward trend and the zone at 105.00, which I mentioned earlier. With regard to sales areas, then 108.00 for intraday trading is the closest convenient option.

Examples of transactions:

- BUY limit 105.10, SL 104.70, TP 105.70

- SELL limit 107.90, SL 108.50, TP 107.10

If you have any questions on the review, or have an opinion that you would like to make, write to the technical support address of Ester’s support@esterholdings.com with the mark “for Andrew Green”.

Trading on a pair of USD/JPY, do not fall into the trap of your own illusions, and clearly place the stop-loss, it is this pair that knows how to make jumps without kickbacks, and then stop loss is 40 points lower than 140.

Andrew Green