Cross-rates Trading Strategies. Anton Hanzenko.

Given some specificity of the cross-rate movement, while trading on a particular cross, it is possible to identify trading strategies that are more efficient for a particular cross-rate. Despite the specific features of crosses, it is worth noting that the cross-rates are well suited to technical analysis of the figures: “double top and bottom”, “head and shoulders”, a variety of triangles, trade channels and others.

More detailed information about the figures can be found in the previous articles:

- The main figures for earnings in financial markets! Part 1.

- MAIN FIGURES FOR EARNINGS IN THE FINANCIAL MARKETS! PART 2.

- Some formations for earnings in financial markets. Part 3.

Trading strategies for cross-rates

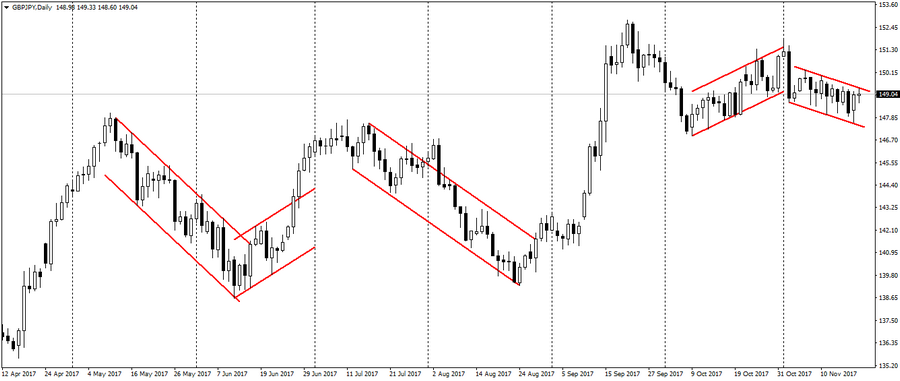

One of the most striking examples of trade with technical analysis is the cross-rate GBP/JPY, which differs from trading in the channel and even despite the fact that this cross has recently been highly volatile.

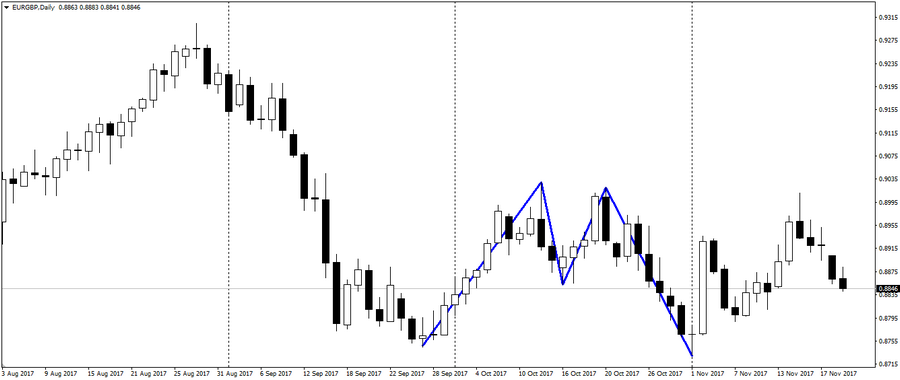

Also, the work off of the figures “double top, bottom”, “head and shoulders” and other figures of technical analysis is very common on the cross-rates.

Conditionally, all cross-rates can be divided into two groups: with high volatility and low volatility, which will correspond to those or other trading tactics.

Thus, for highly volatile crosses (EUR/JPY, GBP/JPY, CHF/JPY, AUD/JPY, CAD/JPY, NZD/JPY, GBP/CHF, EUR/CAD, AUD/CAD, EUR/AUD, AUD/NZD), tactics are mainly used to break through the important price levels in the direction of the main trend. These tactics include: trading at the breakdown of Fibonacci levels, breakdown of the intraday extremum and fixing prices above or below psychological levels.

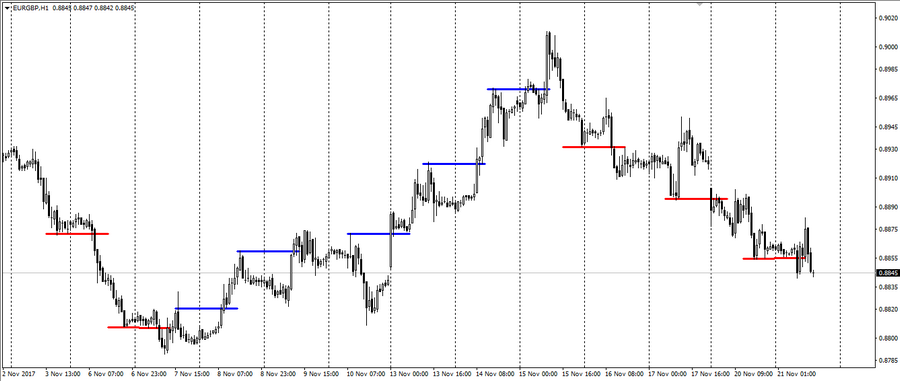

In turn, for the low volatility crosses (EUR/CHF and EUR/GBP) tactics of repelling will be more efficient. For example, trade in a channel or on a repel from important levels of support and resistance.

Also, it is worth remembering that these definitions are very abstract and can be changed in the process of trading and depending on the conditions prevailing in the market. They will relate more to the overall expectations for the pair, rather than to all deals. For example, the trade on the break through the intraday extreme on the low volatile cross EUR/GBP.

Specifically, this cross-rate, due to the political relations between the euro area and the UK, can go into the category of highly volatile. Due to a decrease in one direction of trade of the pairs EUR/USD and GBP/USD.

The main stable difference between volatile and low volatile crosses is intraday volatility, which should be taken into account when setting goals and stops.

Trading on cross-rates is a very interesting and profitable process, which differs slightly from trading on majors. More details about cross-rates trading and not only can be learned from the training courses offered by Ester Holdings Inc.

Hanzenko Anton