Тechnical analysis of currency pairs (Anton Hanzenko)

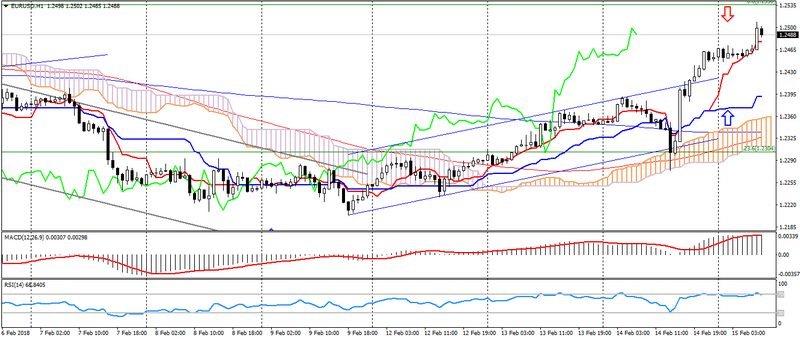

EUR USD (current price: 1.2490)

- Support levels: 1.2100 (September 2017 maximum), 1.1900, 1.1700.

- Resistance levels: 1.2600, 1.2750 (March 2013 minimum), 1.2270 (November 2014 minimum).

- Computer analysis: MACD (12,26,9) (signal-upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the overbought zone. IchimokuKinkoHyo (9,26,52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1.2500, 1.2520, 1.2550.

- Alternative recommendation: buy entry is started from 1.2450, 1.2420, 1.2400.

A pair euro dollar is traded with the strengthening after the sale of the American. But, despite the persistence of pessimistic sentiments for the dollar, further strengthening of the pair remains difficult due to reaching a pair of multi-year highs and oversold of the American.

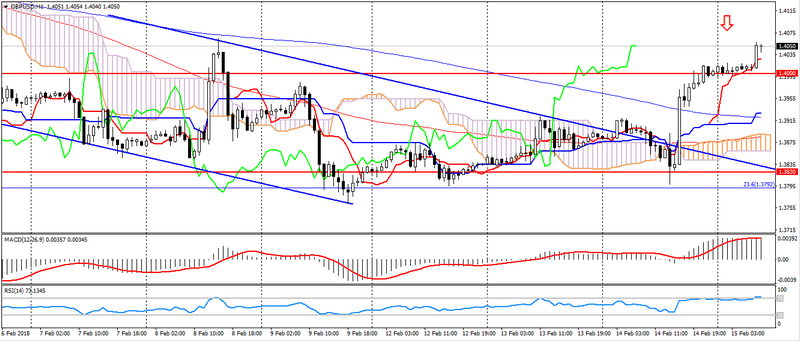

GBP USD (current price: 1.4050)

- Support levels: 1.4000 (April 2016 minimum), 1.3820, 1.3650 (September 2017 maximum).

- Resistance levels: 1.4350, 1.4500, 1.4750 (May May 2016 maximum).

- Computer analysis: MACD (12,26,9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the overbought zone. IchimokuKinkoHyo (9,26,52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1.4070, 1.4100, 1.4130.

- Alternative recommendation: buy entry is started from 1.4020, 1.4000, 1.3970.

The British pound also strengthened on the weakness of the American, but is limited to last week’s highs and overbought, as indicated by the Forex indicators.

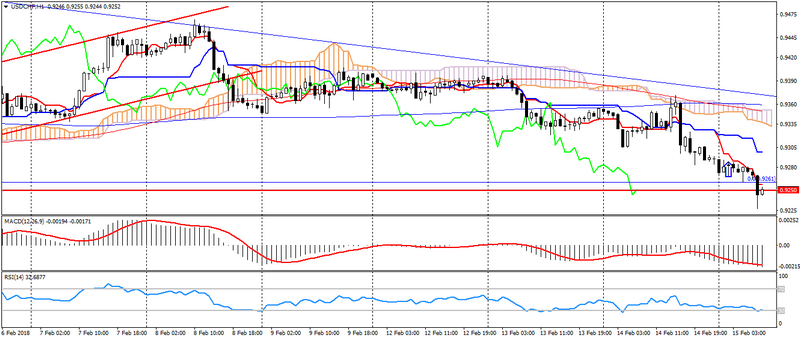

USD CHF (current price: 0.9250)

- Support levels: 0.9250 (August 2015 minimum), 0.9150, 0.9050 (May 2015 minimum).

- Resistance levels:, 0.9550, 0.9800, 1.0030 (November 2017 maximum).

- Computer analysis: MACD (12,26,9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) in the oversold zone. IchimokuKinkoHyo (9,26,52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 0.9280, 0.9310, 0.9340.

- Alternative recommendation: buy entry is started from 0.9220, 0.9200, 0.9180.

The Swiss franc strengthened earlier in the day on the weakness of the dollar, but further decline in the pair is limited.

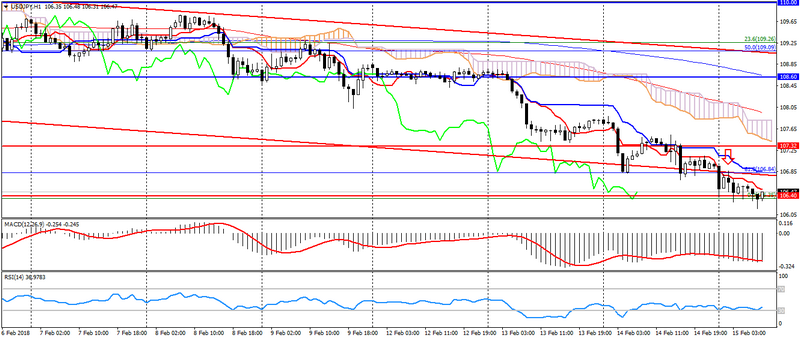

USD JPY (current price: 106.40)

- Support levels: 107.30 (2017 minimum), 106.40, 105.50.

- Resistance levels: 108.60, 110.00, 110.80.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal- downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 106.70, 107.00, 107.30.

- Alternative recommendation: buy entry is started from 106.40, 106.00, 105.50.

The Japanese yen keeps growing on positive data on Japan and American sales, remaining in the oversold zone.

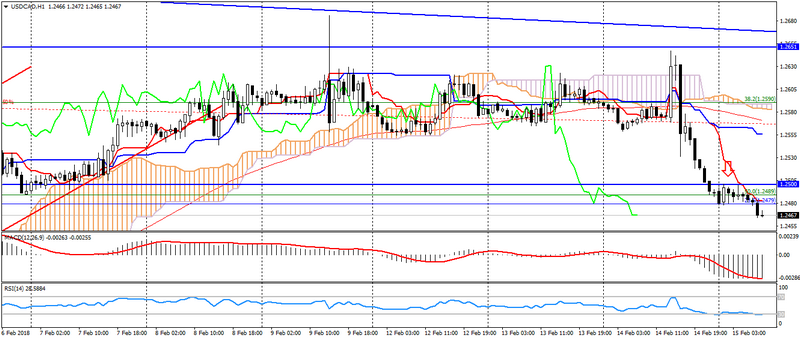

USD CAD (current price: 1.2470)

- Support levels: 1.2340.1.2200, 1.2060 (2017 minimum).

- Resistance levels: 1.2500, 1.2650, 1.2770 (August 2017 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the oversold zone. IchimokuKinkoHyo (9,26,52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1.2500, 1.2520, 1.2550.

- Alternative recommendation: buy entry is started from 1.24550, 1.2430, 1.2400.

The Canadian dollar accelerated growth on the decline of the US dollar, thereby resuming a downtrend in the pair.

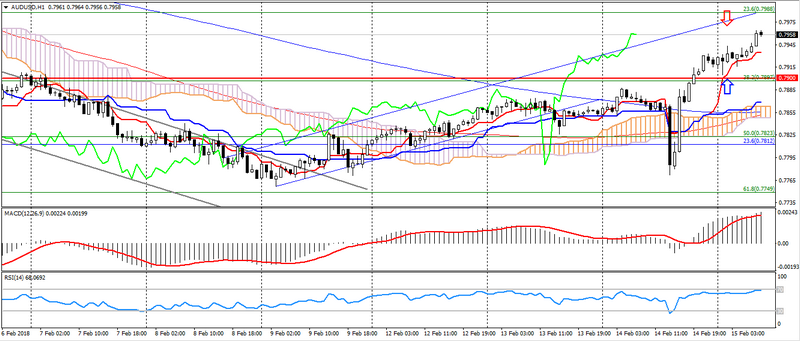

AUD USD (current price: 0.7960)

- Support levels: 0.7900, 0.7700 (March 2017 maximum), 0.7500.

- Resistance levels: 0.8120 (2017 maximum), 0.8200, 0.8290 (2014 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the overbought zone. IchimokuKinkoHyo (9,26,52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 0.7900, 0.7920, 0.7940.

- Alternative recommendation: buy entry is started from 0.7850, 0.7830, 0.7800.

The Australian also strengthened earlier in the day, on the resumption of the uptrend, but is limited to the zone of 0.7980-0.8000.

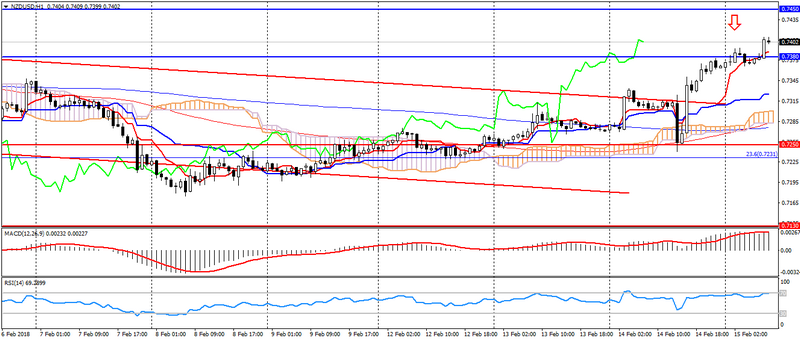

NZD USD (current price: 0.7400)

- Support levels: 0.7250, 0.7130 (August 2017 minimum), 0.7000.

- Resistance levels: 0.7380, 0.7450, 0.7550 (2017 maximum).

- Computer analysis: MACD (12, 26, 9) (signal-upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the overbought zone. IchimokuKinkoHyo (9,26,52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 0.7430, 0.7450, 0.7480.

- Alternative recommendation: buy entry is started from 0.7380, 0.7350, 0.7330.

The New Zealand dollar has renewed a maximum of a month, limited to global extremes.

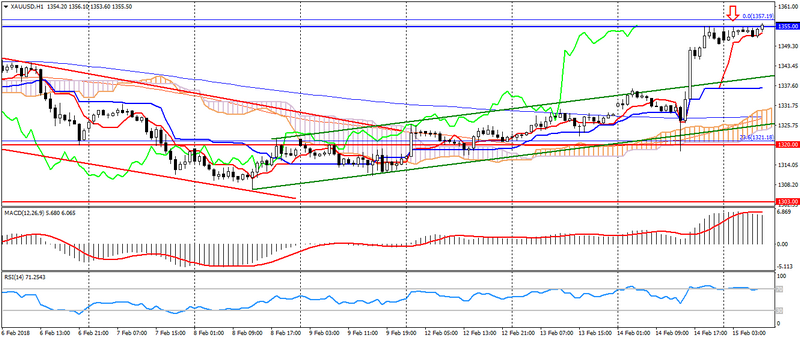

XAU USD (current price: 1355.00)

- Support levels: 1320.00, 1303.00, 1280.00.

- Resistance levels: 1355.00 (May May 2016 maximum), 1374.00, 1290.00 (March 2016 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line has left the histogram bar. RSI (14) is in the overbought zone. IchimokuKinkoHyo (9,26,52) (signal- upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1358.00, 1361.00, 1365.00.

- Alternative recommendation: buy entry is started from 1347.00, 1342.00, 1337.00.

Gold also accelerated growth on the weakness of the American, but is limited to the highs of January.