Тechnical analysis of currency pairs (Anton Hanzenko)

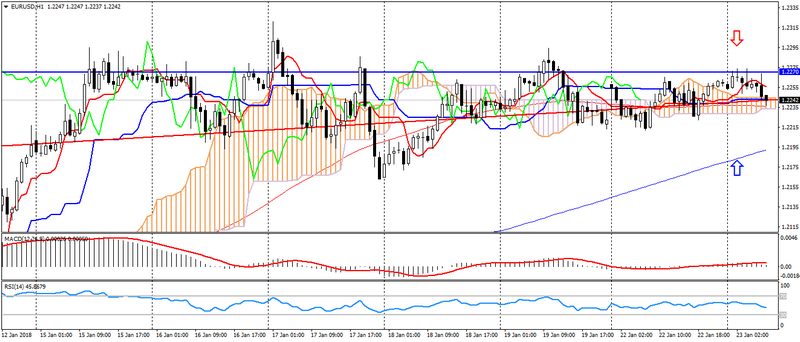

EUR USD (current price: 1.2240)

- Support levels: 1.1700 (August 2015 maximum), 1.1600 (2016 maximum), 1.1470.

- Levels of resistance: 1.2000, 1.2100, 1.2270 (November 2014 minimum).

- Computer analysis: MACD (12,26,9) (signal-flat): the indicator is near 0. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal – upward movement, flat): the Tenkan-sen line is above the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is started from 1.2250, 1.2270, 1.2300.

- Alternative recommendation: buy entry is started from 1.2200, 1.2170, 1.2150.

The euro is traded in flat, near the significant resistance 1.2270, retaining the potential for significant movement.

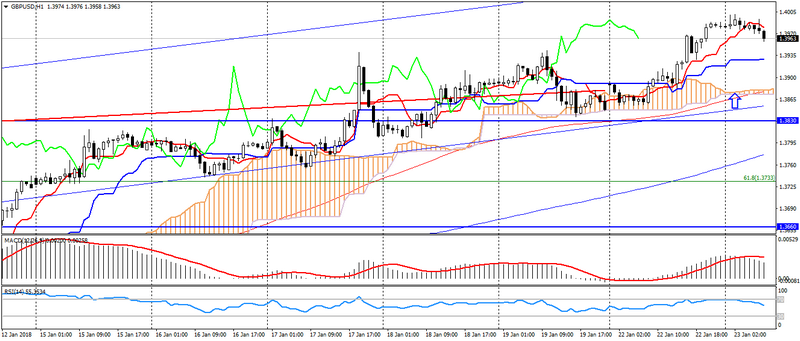

GBP USD (current price: 1.3960)

- Support levels: 1.3140, 1.2900, 1.2740 (August 2017 minimum).

- Resistance levels: 1.3500, 1.3660, 1.3830 (February 2016 minimum).

- Computer analysis: MACD (12,26,9) (signal – downward movement): the indicator is above 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal – upward movement): the Tenkan-sen line is above Kijun-sen, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1.3980, 1.3400, 1.4020.

- Alternative recommendation: buy entry is started from 1.3940, 1.3910, 1.3870.

The British pound remains under pressure of correction from the beginning of the day after growth, but at the same time it maintains a stable upward trend.

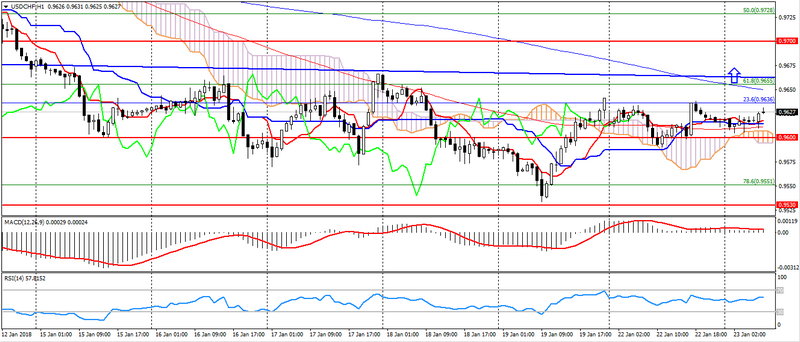

USD CHF (current price: 0.9630)

- Support levels: 0.9700, 0.9600, 0.9530.

- Resistance levels: 1.0000, 1.0050, 1.0100 (May maximum).

- Computer analysis: MACD (12,26,9) (signal-flat): the indicator is near 0. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal – upward movement): the Tenkan-sen line is above the line Kijun-sen, the price is higher than the clouds.

- The main recommendation: sale entry is started from 0.9640, 0.9660, 0.9680.

- Alternative recommendation: buy entry is started from 0.9600, 0.9580, 0.9550.

The Swiss franc maintains a sideways trend, keeping the potential for a decline because of the attempts to restore the US currency.

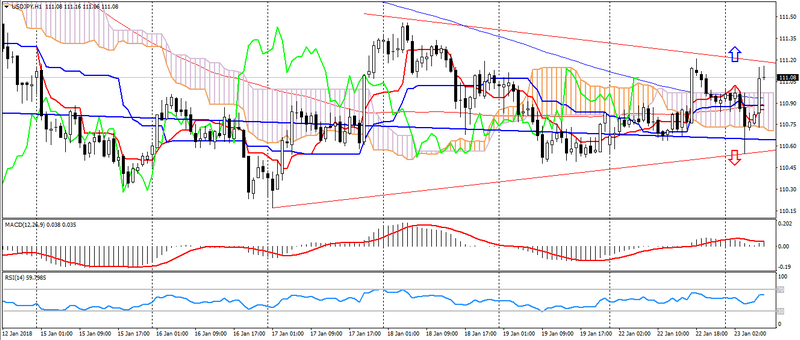

USD JPY (current price: 111.10)

- Support levels: 108.90, 108.10 (April 2017 minimum), 107.30 (2017 minimum).

- Resistance levels: 113.70, 114.50 (July 2017 maximum), 115.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal-flat): the line Tenkan-sen is near the line Kijun-sen, the price is in the cloud.

- The main recommendation: sale entry is started from 111.20, 111.50, 111.70.

- Alternative recommendation: buy entry is started from 110.70, 110.40, 110.00.

The Japanese yen is traded in different directions, preserving lateral movement after the publication of the restrained protocol of the Bank of Japan. The downtrend for this pair persists, but is limited to oversold.

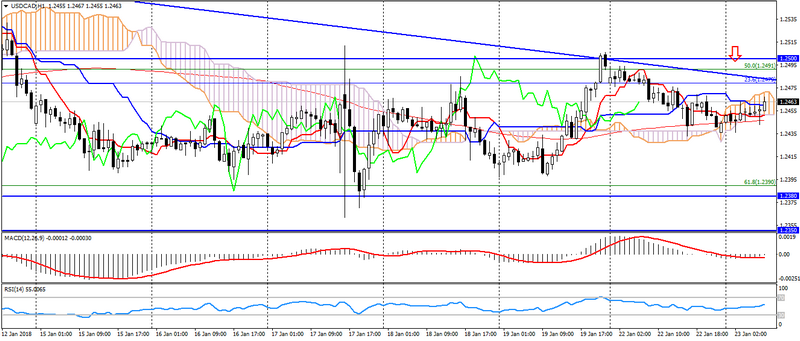

USD CAD (current price: 1.2460)

- Support levels: 1.2200, 1.2060 (2017 minimum), 1.1950 (2015 minimum).

- Resistance levels: 1.2780 (August 2017 maximum), 1.3000, 1.3160.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal – downward movement): the line Tenkan-sen is below the line Kijun-sen, the price is in the cloud.

- The main recommendation: sale entry is started from 1.2480, 1.2500, 1.2530.

- Alternative recommendation: buy entry is started from 1.2430, 1.2400, 1.2380.

The Canadian dollar weakened slightly at the beginning of the day due to the growth of the American, but overall downward dynamics persists.

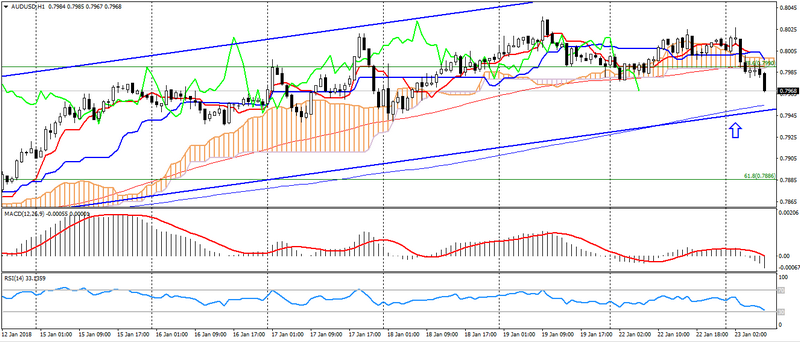

AUD USD (current price: 0.7970)

- Support levels: 0.7740, 0.7320 (2017 minimum), 0.7120.

- Resistance levels: 0.8120 (2017 maximum), 0.8200, 0.8290 (2014 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward motion): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal – downward movement): the line Tenkan-sen is below the line Kijun-sen, the price is in the clouds.

- The main recommendation: sale entry is started from 0.8000, 0.8020, 0.8050.

- Alternative recommendation: buy entry is started from 0.7960, 0.7940, 0.7910.

The Australian accelerated the decline earlier in the day, but the weakness of the Australian is limited to an uptrend.

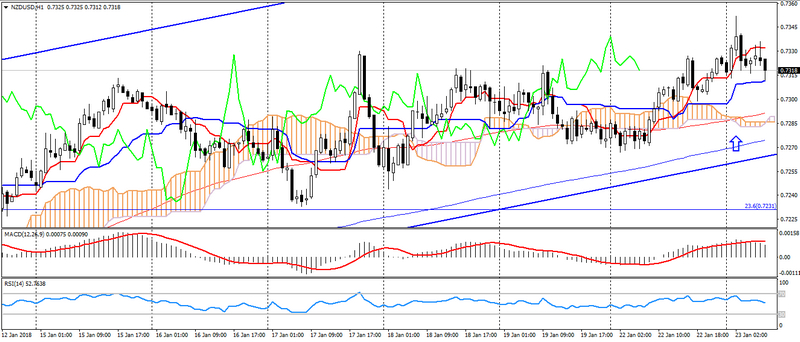

NZD USD (current price: 0.7310)

- Support levels: 0.7000, 0.6930, 0.6820 (the minimum of the current year).

- Resistance levels: 0.7380, 0.7450, 0.7550 (2017 maximum).

- Computer analysis: MACD (12, 26, 9) (signal- downward movement): the indicator is above 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 0.7330, 0.7350, 0.7370.

- Alternative recommendation: buy entry is started from 0.7300, 0.7280, 0.7250.

The New Zealand dollar also turned out to be under pressure, but it keeps upward dynamics.

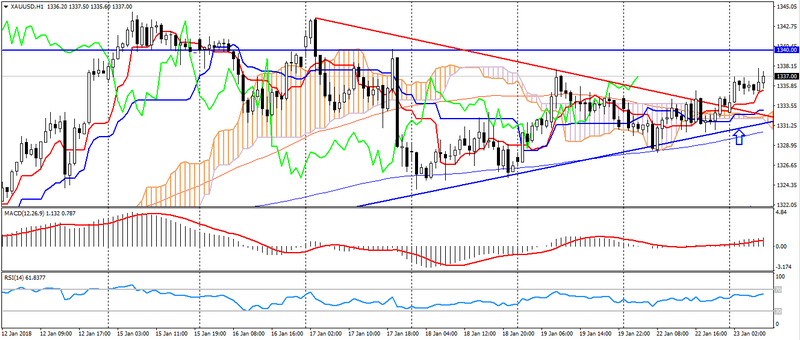

XAU USD (current price: 1337.00)

- Support levels: 1250.00, 1226.00, 1200.00.

- Resistance levels: 1340.00, 1355.00, 1374.00 (2016 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal-going traffic): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1338.00, 1340.00, 1343.00.

- Alternative recommendation: buy entry is started from 1333.00, 1330.00, 1328.00.

Gold maintains an upward trend, thereby confirming the dynamics to the strengthening.