Тechnical analysis of currency pairs (Anton Hanzenko)

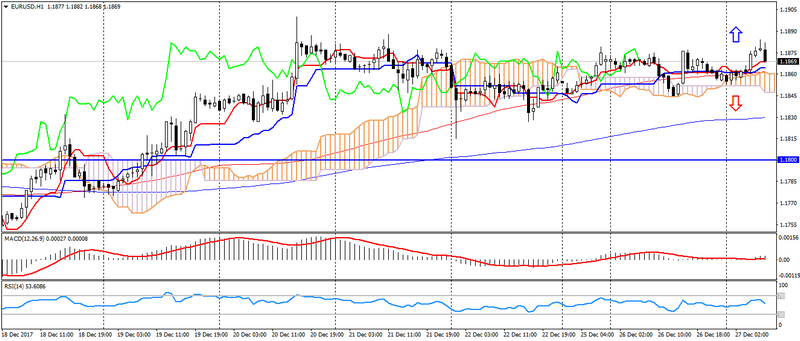

EUR USD (current price: 1.1870)

- Support levels: 1.1700 (August 2015 maximum), 1.1600 (2016 maximum), 1.1470.

- Levels of resistance: 1.2000, 1.2100, 1.2270 (November 2014 minimum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: entrance for sale from 1.1890, 1.1910, 1.1960.

- Alternative recommendation: buy-in from 1.1850 (MA 100), 1.1820 (MA 200), 1.1780.

The euro is trading with a strengthening on the weakness of the American, but at the same time the pair is limited to the existing lateral trend.

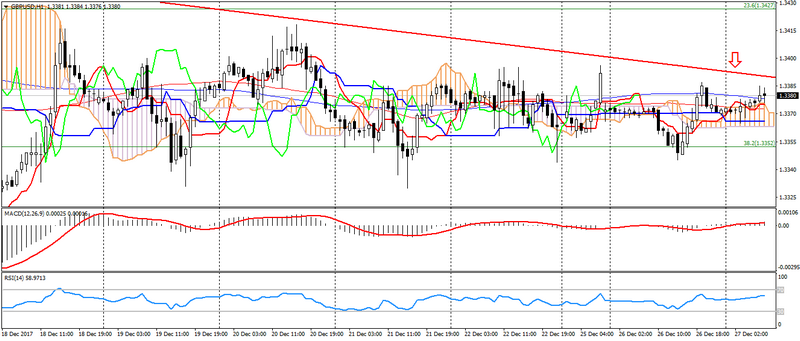

GBP USD (current price: 1.3380)

- Support levels: 1.3140, 1.2900, 1.2740 (the minimum of August 2017).

- Resistance levels: 1.3500, 1.3660, 1.3830 (February 2016 minimum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line near the Kijun-sen line, the price in the cloud.

- The main recommendation: entrance for sale from 1.3390, 1.3420, 1.3440.

- Alternative recommendation: buy-in from 1.3360, 1.3330, 1.3300.

The British pound continues to trade in a narrow flat, limited to weak activity.

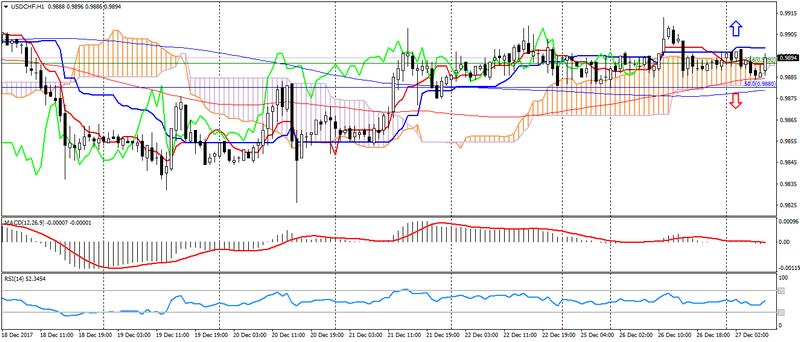

USD CHF (current price: 0.9890)

- Support levels: 0.9700, 0.9600, 0.9530.

- Resistance levels: 1.0000, 1.0050, 1.0100 (May maximum).

- Computer analysis: MACD (12, 26, 9) (signal-flat): the indicator is near 0. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line is below the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is started from 0.9900, 0.9930, 0.9950.

- Alternative recommendation: buy entry is started 0.9880 (MA 100), 0.9860, 0.9840.

The Swiss franc remains trading at the opening day.

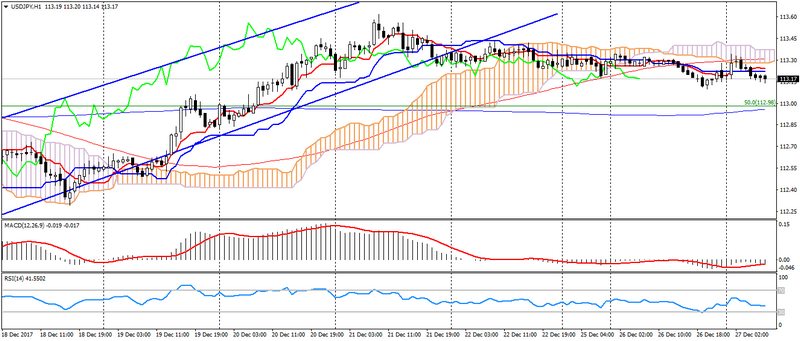

USD JPY (current price: 113.20)

- Support levels: 108.90, 108.10 ( April 2017 minimum), 107.30 (2017 minimum).

- Resistance levels: 113.70, 114.50 (July 2017 maximum), 115.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line is above the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 113.40, 113.60, 114.00.

- Alternative recommendation: buy entry is started from 113.00, 112.80 (MA 200), 112.50.

The Japanese yen remains in flat due to low activity.

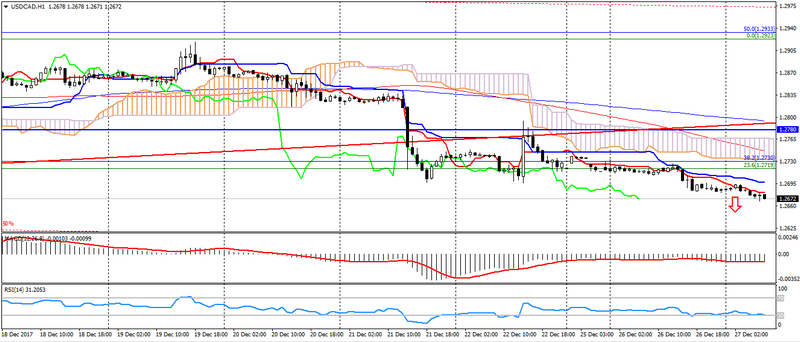

USD CAD (current price: 1.2670)

- Support levels: 1.2200, 1.2060 (2017 minimum), 1.1950 (2015 minimum).

- Resistance levels: 1.2780 (August 2017 maximum), 1.3000, 1.3160.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1.2700, 1.2730, 1.2750 (MA 100).

- Alternative recommendation: buy entry is started from 1.2660, 1.2640, 1.2620.

The Canadian dollar is trading with a strengthening based on the positive dynamics of raw materials.

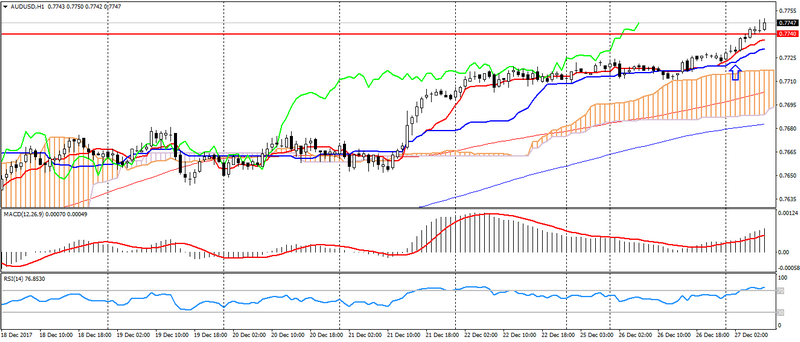

AUD USD (current price: 0.7750)

- Support levels: 0.7740, 0.7320 (2017 minimum), 0.7120.

- Resistance levels: 0.8120 (2017 maximum), 0.8200, 0.8290 (2014 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 0.7750, 0.7780, 0.7800.

- Alternative recommendation: buy entry is started from 0.7720, 0.7700, 0.7680.

The Australian remains in an upward trend, receiving support from the positive dynamics of raw materials.

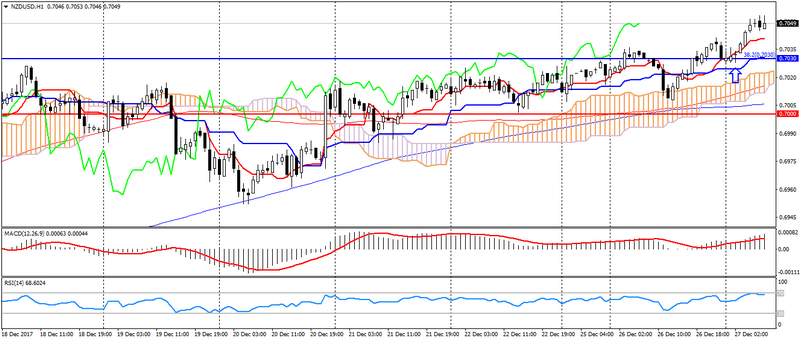

NZD USD (current price: 0.7050)

- Support levels: 0.7000, 0.6930, 0.6820 (the minimum of the current year).

- Resistance levels: 0.7380, 0.7450, 0.7550 (2017 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 0.7070, 0.7090, 0.7110.

- Alternative recommendation: buy entry is started from of 0.7030, 0.7000, 0.6980.

The New Zealand dollar is also trading with a strengthening based on the positive dynamics of raw materials.

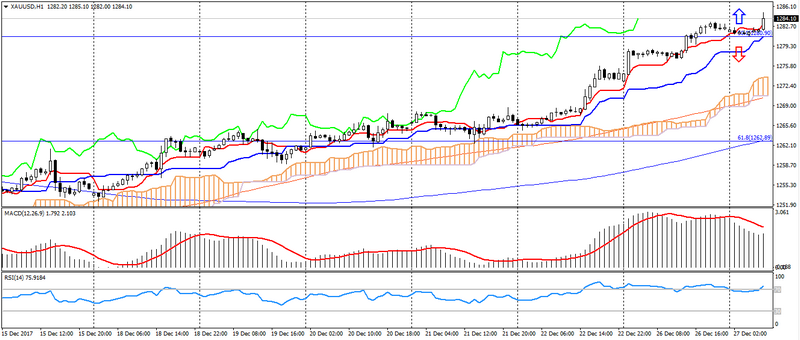

XAU USD (current price: 1284.00)

- Support levels: 1250.00, 1226.00, 1200.00.

- Resistance levels: 1340.00, 1355.00, 1374.00 (2016 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line has left the body of the histogram. RSI (14) is in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1285.00, 1288.00, 1290.00.

- Alternative recommendation: buy entry is started from 1281.00, 1275.00, 1273.00.

Gold maintains an upward trend, but is limited to a significant overbought and upcoming correction.