Technical analysis of cross-rates. (Anton Hanzenko)

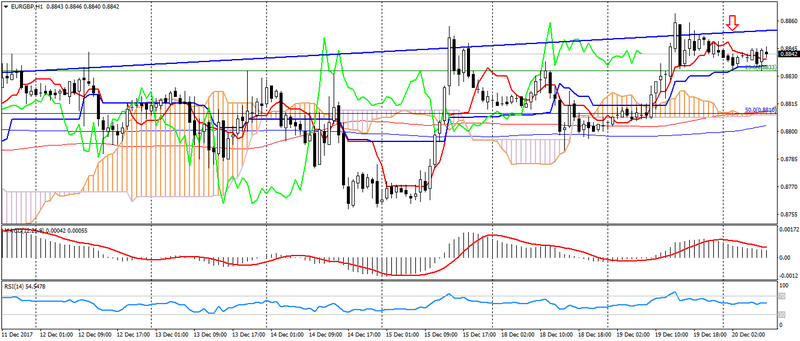

EUR GBP (current price: 0.8840)

- Support levels: 0.8730 (minimum of the last months), 0.8650, 0.8530.

- Resistance levels: 0.9020, 0.9170, 0.9300 (the maximum of the current year).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 0.8860, 0.8880, 0.8900.

- Alternative recommendation: buy entry is started from 0.8820, 0.8800 (MA 200), 0.8780.

The euro pound remains in the sideways trend, showing a slight increase, limited to resistance.

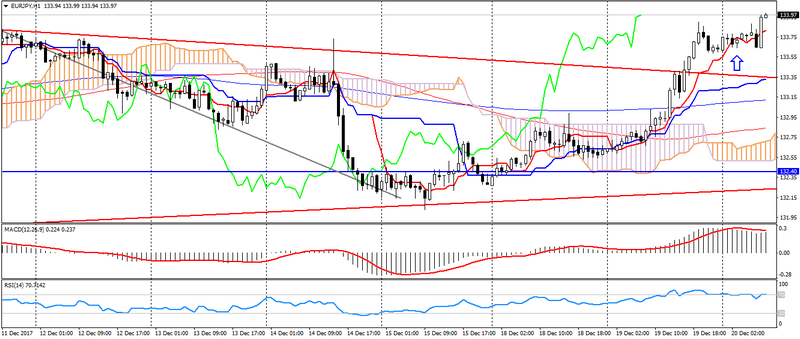

EUR JPY (current price: 133.90)

- Support levels: 131.40 (minimum of the last months), 130.50, 129.80 (Fib. 23.6 from the low of the current year).

- Resistance levels: 133.30, 134.40 (the maximum of the current year), 135.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 134.20 (MA 200), 134.40, 134.60.

- Alternative recommendation: buy entry is started from 133.60, 133.40, 133.20.

The euro yen is trading with a strengthening due to the weakness of the yen.

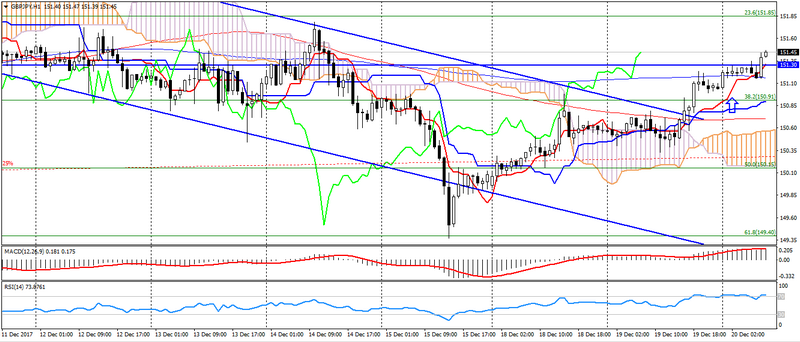

GBP JPY (current price: 151.40)

- Support levels: 147.00 (minimum of last months), 144.20 (Fibo, 50.0 from the low of April), 141.50.

- Resistance levels: 151.30, 152.80 (the maximum of the current year), 155.40.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 151.60, 151.80, 152.00.

- Alternative recommendation: buy entry is started from 151.00 (MA 200), 150.80, 150.60.

The pair of pound yen is trading in an uptrend, which is caused by the general weakness of the Japanese currency, pending the meeting of the Bank of Japan.

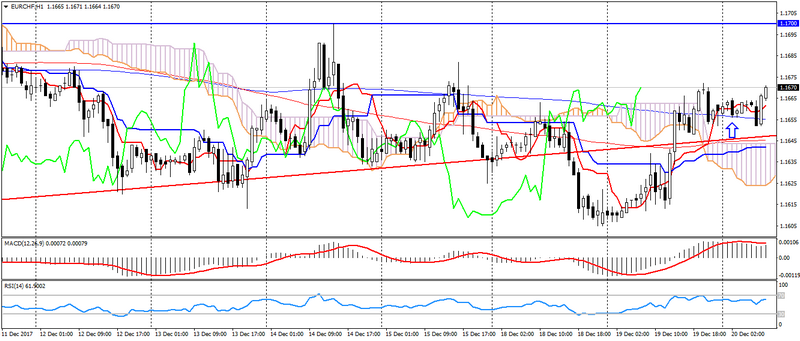

EUR CHF (current price: 1.1670)

- Support levels: 1.1500, 1.1450 (Fibo, 23.6 from the low of the current year), 1.1350.

- Resistance levels: 1.1700 (the maximum of the current year), 1.1750, 1.1800.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1.1680, 1.1700, 1.1720.

- Alternative recommendation: buy entry is started from 1.1650, 1.1630, 1.1600.

The euro franc returned higher than the significant support, thus pointing to the safety of the uptrend.