Technical analysis of cross-rates. (Anton Hanzenko)

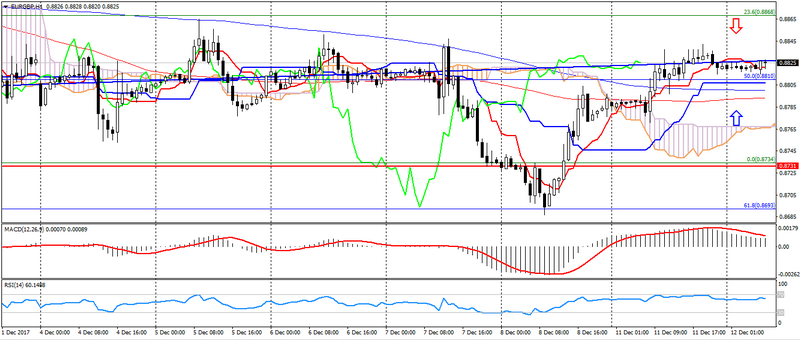

EUR GBP (current price: 0.8820)

- Support levels: 0.8730 (minimum of the last months), 0.8650, 0.8530.

- Resistance levels: 0.9020, 0.9170, 0.9300 (the maximum of the current year).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 0.8410, 0.8870, 0.8890.

- Alternative recommendation: buy entry is started from 0.8800, 0.8770, 0.8730.

The euro pound remains in a sideways trend, maintaining the potential for growth on the weakness of the pound, but at the same time limiting itself to a downward trend.

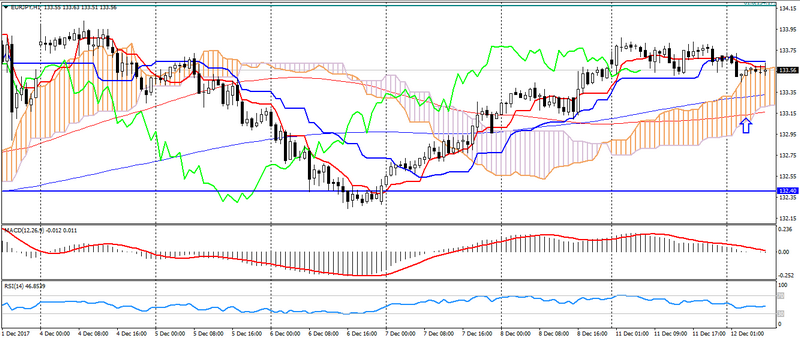

EUR JPY (current price: 133.60)

- Support levels: 131.40 (minimum of the last months), 130.50, 129.80 (Fib. 23.6 from the low of the current year).

- Resistance levels: 133.30, 134.40 (the maximum of the current year), 135.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – descending movement, flat): the Tenkan-sen line is below the line Kijun-sen, the price is in the cloud.

- The main recommendation: sale entry is started from 133.70, 134.00, 134.40.

- Alternative recommendation: buy entry is started from 133.30 (MA 200), 133.00, 132.70.

The euro yen slightly weakened on correction after a three-day growth, but at the same time keeps a restrained upward general trend.

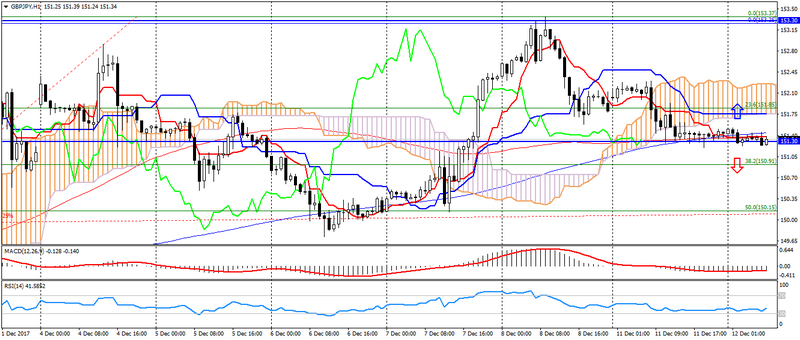

GBP JPY (current price: 151.30)

- Support levels: 147.00 (minimum of last months), 144.20 (Fibo, 50.0 from the low of April), 141.50.

- Resistance levels: 151.30, 152.80 (the maximum of the current year), 155.40.

- Computer analysis: MACD (12, 26, 9) (signal – downward motion): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 151.70, 152.30, 153.00.

- Alternative recommendation: buy entry is started from 150.90, 150.60, 150.30.

The pound yen remains under pressure due to the persistence of concerns over Brexit.

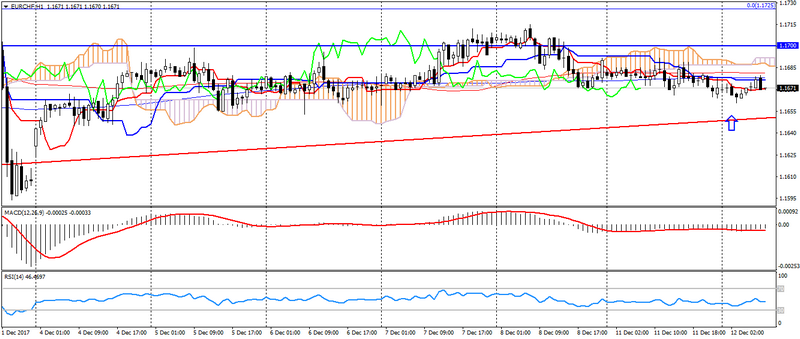

EUR CHF (current price: 1.1670)

- Support levels: 1.1500, 1.1450 (Fibo, 23.6 from the low of the current year), 1.1350.

- Resistance levels: 1.1700 (the maximum of the current year), 1.1750, 1.1800.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1.1680, 1.1700, 1.1720.

- Alternative recommendation: buy entry is started from 1.1660, 1.1640, 1.1620.

A pair euro franc remains in flat, limiting itself to an uptrend.