Тechnical analysis of currency pairs (Anton Hanzenko)

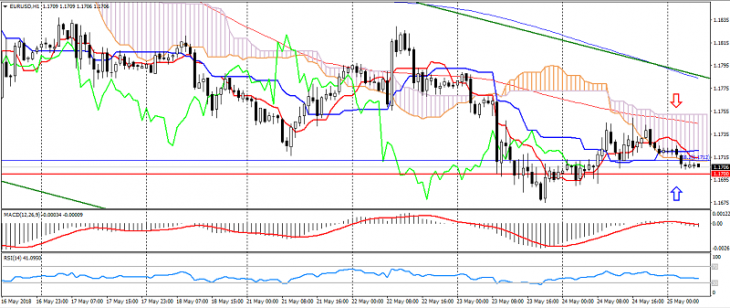

EUR USD (current price: 1.1710)

- Support levels: 1.2100 (September 2017 maximum), 1.1900, 1.1700.

- Resistance levels: 1.2600, 1.2750 (March 2013 minimum), 1.2270 (November 2014 minimum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.1740, 1.1760, 1.1790.

- Alternative recommendation: buy entry is from 1.1680, 1.1650, 1.1620.

The pair keeps a downtrend, confining itself to flat and support level 1.1700.

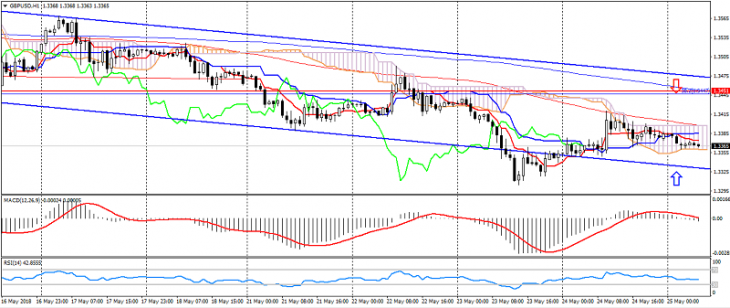

GBP USD (current price: 1.3360)

- Support levels: 1.3820, 1.3650 (September 2017 maximum), 1.3450.

- Resistance levels: 1.4050, 1.4350, 1.4500.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal-flat): the Tenkan-sen line is near the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 1.3420, 1.3450, 1.3470.

- Alternative recommendation: buy entry is from 1.3340, 1.3320, 1.3290.

The British pound is traded in a downtrend, limited to oversold.

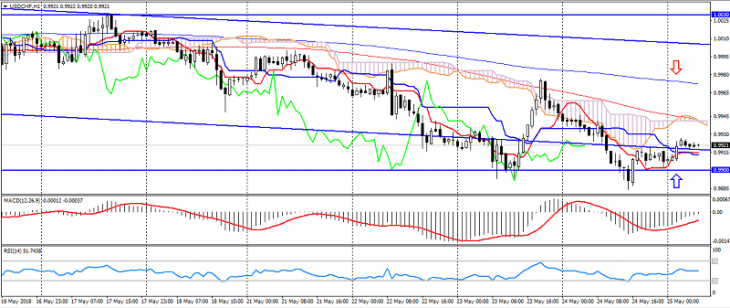

USD CHF (current price: 0.9920)

- Support levels: 0.9750, 0.9600, 0.9450.

- Resistance levels:, 0.9900, 1.0030, 1.0150.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.9950, 0.9970, 1.0000.

- Alternative recommendation: buy entry is from 0.9900, 0.9880, 0.9860.

The Swiss franc is traded in a downtrend, limited by risk reduction.

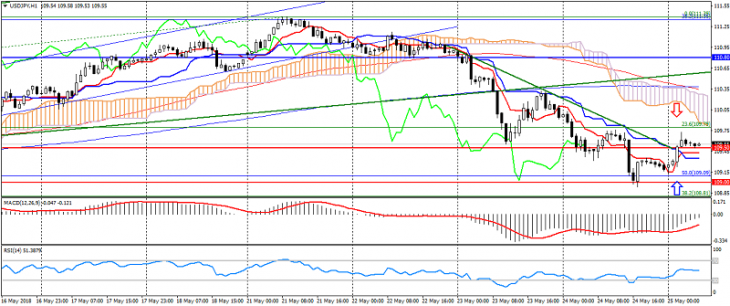

USD JPY (current price: 109.60)

- Support levels: 109.50, 109.00, 108.50.

- Resistance levels: 110.80, 112.00, 113.70.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is above the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 109.80, 110.30, 110.60.

- Alternative recommendation: buyn entry is from 109.30, 109.00, 108.80.

The USD/JPY pair was under pressure of correction due to the reduction of risks.

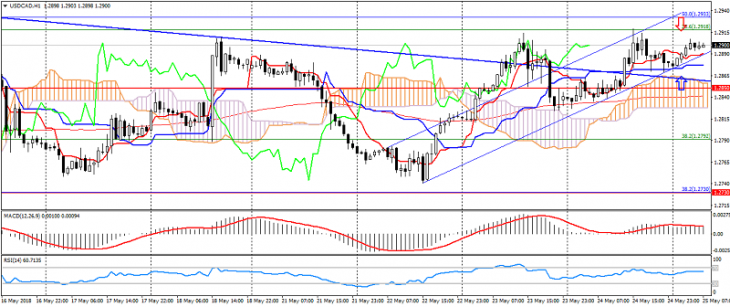

USD CAD (current price: 1.2900)

- Support levels: 1.2950, 1.2730, 1.2600.

- Resistance levels: 1.3030, 1.3150, 1.3280.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 1.2920, 1.2940, 1.2960.

- Alternative recommendation: buy entry is from 1.2870, 1.2850, 1.2830.

The pair accelerated growth, breaking the common downward channel at a lower oil price.

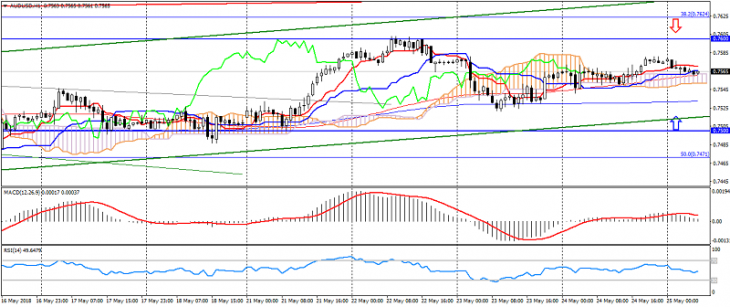

AUD USD (current price: 0.7560)

- Support levels: 0.7320, 0.7250, 0.7150.

- Resistance levels: 0.7500, 0.7600, 0.7770.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – flat): the Tenkan-sen line is near the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 0.7580, 0.7600, 0.7630.

- Alternative recommendation: buy entry is from 0.7520, 0.7500, 0.7480.

The Australian is traded in a contained uptrend, limited to the uncertainty of the market.

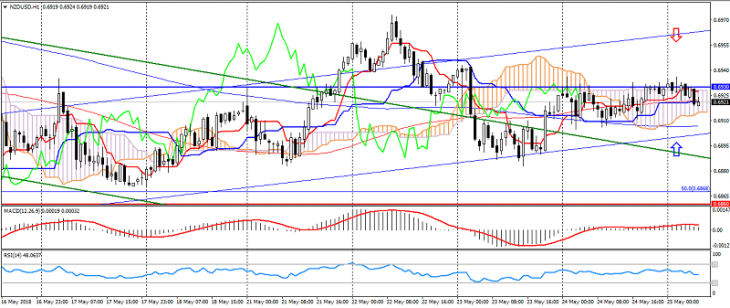

NZD USD (current price: 0.6920)

- Support levels: 0.6860, 0.6920, 0.6780.

- Resistance levels: 0.6930, 0.7000, 0.7050.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal-flat): the Tenkan-sen line is below the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 0.6950, 0.6970, 0.6700.

- Alternative recommendation: buy entry is from 0.6900, 0.6880, 0.6860.

The New Zealand dollar is also traded in uncertainty, waiting the clarification of the situation with North Korea.

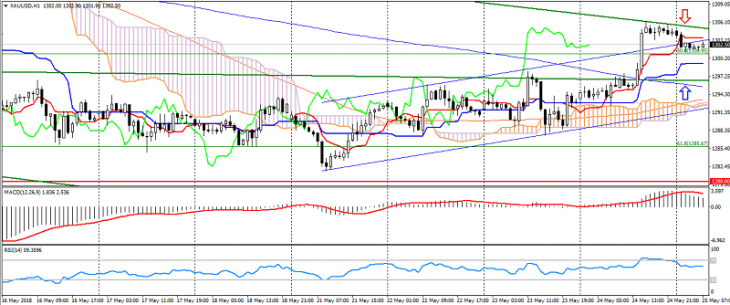

XAU USD (current price: 1301.00)

- Support levels: 1280.00, 1265.00, 1250.00.

- Resistance levels: 1315.00, 1335.00, 1355.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 1305.00, 1308.00, 1315.00.

- Alternative recommendation: buy entry is from 1298.00, 1295.00, 1290.00.

Gold has risen markedly on risks, but may fall under the pressure of correction.