Тechnical analysis of currency pairs (Anton Hanzenko)

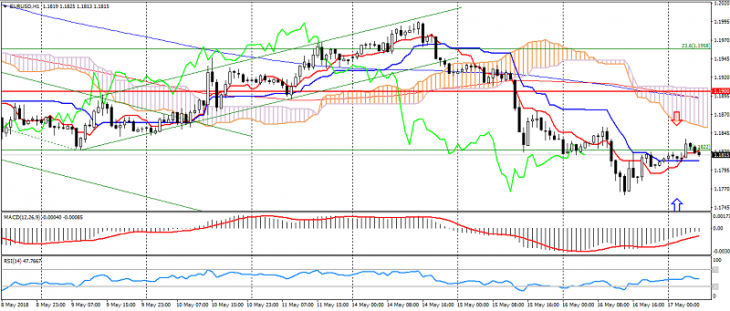

EUR USD (current price: 1.1810)

- Support levels: 1.2100 (September 2017 maximum), 1.1900, 1.1700.

- Resistance levels: 1.2600, 1.2750 (March 2013 minimum), 1.2270 (November 2014 minimum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is above the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1.1850, 1.1880, 1.1900.

- Alternative recommendation: buy entry is started from 1.1800, 1.1780, 1.1750.

The pair is traded with a strengthening on the correction of the American, but at the same time it is limited by the general downward dynamics.

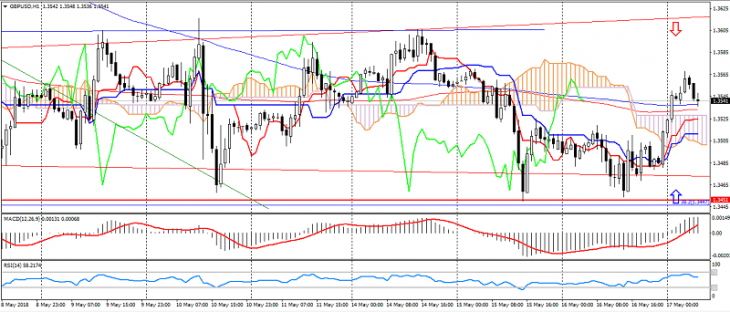

GBP USD (current price: 1.3540)

- Support levels: 1.3820, 1.3650 (September 2017 maximum), 1.3450.

- Resistance levels: 1.4050, 1.4350, 1.4500.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1.3570, 1.3600, 1.3620.

- Alternative recommendation: buy entry is started from 1.3500, 1.3480, 1.3450.

The British pound continues to maintain lateral dynamics, expecting correction after growth.

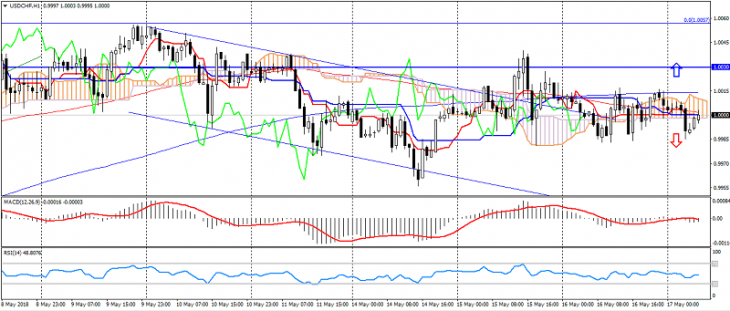

USD CHF (current price: 1.0000)

- Support levels: 0.9750, 0.9600, 0.9450.

- Resistance levels:, 0.9900, 1.0030, 1.0150.

- Computer analysis: MACD (12, 26, 9) (signal-flat): the indicator is near 0. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal-flat): the Tenkan-sen line is near the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is started from 1.0020, 1.0040, 1.0060.

- Alternative recommendation: buy entry is started from 0.9980, 0.9950, 0.9930.

The Swiss franc is traded in flat, waiting for drivers to move.

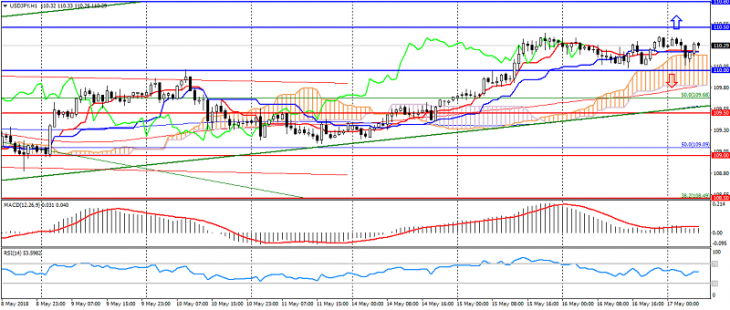

USD JPY (current price: 110.30)

- Support levels: 109.50, 109.00, 108.50.

- Resistance levels: 110.80, 110.50, 110.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 110.50, 110.80, 111.00.

- Alternative recommendation: buy entry is started from 110.00, 109.70, 109.50.

The pair also moves in a sideways trend to uncertainty about safe assets.

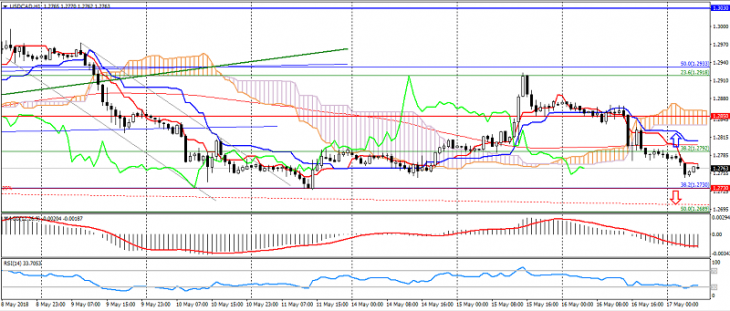

USD CAD (current price: 1.2770)

- Support levels: 1.2950, 1.2730, 1.2600.

- Resistance levels: 1.3030, 1.3150, 1.3280.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal- upward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1.2820, 1.2850, 1.2880.

- Alternative recommendation: buy entry is started from 1.2730, 1.2700, 1.2670.

The pair remains under pressure, limiting itself to oversold resumption of negotiations on the NAFTA agreement.

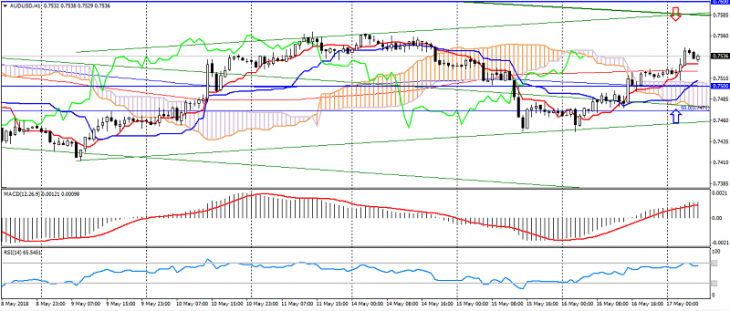

AUD USD (current price: 0.7540)

- Support levels: 0.7320, 0.7250, 0.7150.

- Resistance levels: 0.7500, 0.7600, 0.7770.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, signal line is in the body of the histogram. RSI (14) is in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 0.7550, 0.7580, 0.7600.

- Alternative recommendation: buy entry is started from 0.7500, 0.7580, 0.7560.

The Australian is traded with a strengthening on the publication of very positive data on employment in Australia.

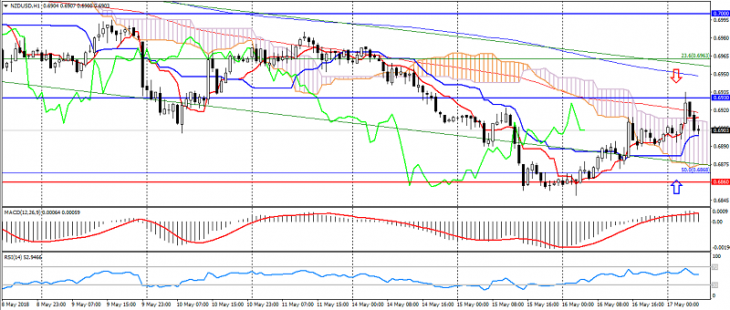

NZD USD (current price: 0.6900)

- Support levels: 0.6860, 0.6920, 0.6780.

- Resistance levels: 0.6930, 0.7000, 0.7050.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – flat): the Tenkan-sen line is above the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is started from 0.6920, 0.6940, 0.6960.

- Alternative recommendation: buy entry is started from 0.6890, 0.6860, 0.6840.

The New Zealand dollar remains in a downtrend, thereby confirming the potential for a decline.

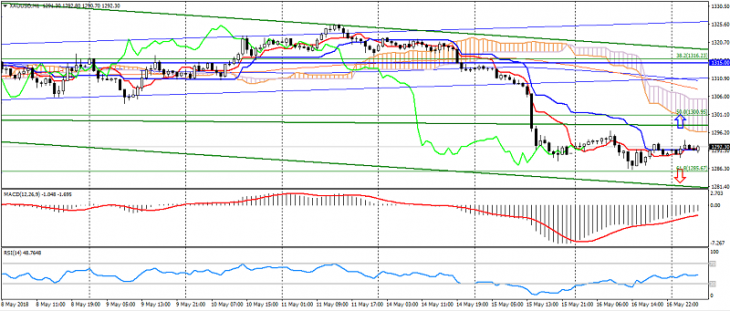

XAU USD (current price: 1292.00)

- Support levels: 1280.00, 1265.00, 1250.00.

- Resistance levels: 1315.00, 1335.00, 1355.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1295.00, 1300.00, 1309.00.

- Alternative recommendation: buy entry is started from 1287.00, 1285.00, 1280.00.

Gold remains in flat, waiting for drivers to move.