Тechnical analysis of currency pairs (Anton Hanzenko)

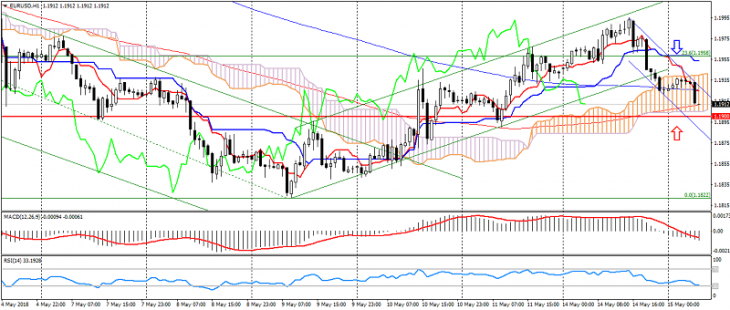

EUR USD (current price: 1.1910)

- Support levels: 1.2100 (September-September maximum), 1.1900, 1.1700.

- Resistance levels: 1.2600, 1.2750 (March 2013 minimum), 1.2270 (November 2014 minimum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is

- in the body of the histogram. RSI (14) is in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1.1930, 1.1960, 1.1990.

- Alternative recommendation: buy entry is started from 1.1900, 1.1870, 1.1850.

The euro dollar pair broke the uptrend on the resumption of the American growth, thereby opening the way to psychological support 1.1900.

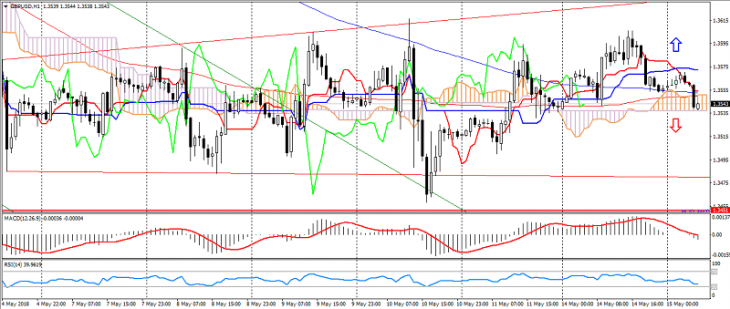

GBP USD (current price: 1.3540)

- Support levels: 1.3820, 1.3650 (September 2017 maximum), 1.3450.

- Resistance levels: 1.4050, 1.4350, 1.4500.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is started from 1.3560, 1.3690, 1.3650.

- Alternative recommendation: buy entry is started from 1.3530, 1.3500, 1.3470.

The British pound continues to maintain lateral dynamics, limiting itself to an expanding formation and shifting to a decline.

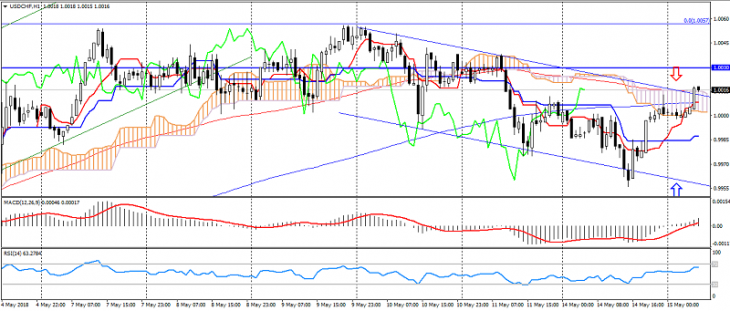

USD CHF (current price: 1.0020)

- Support levels: 0.9750, 0.9600, 0.9450.

- Resistance levels:, 0.9900, 1.0030, 1.0150.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1.0030, 1.0050, 1.0070.

- Alternative recommendation: buy entry is started from 1.0000, 0.9980, 0.9950.

The Swiss franc is trading near the upper limit of the descending channel on the recovery of the American, but does not hurry to leave the channel.

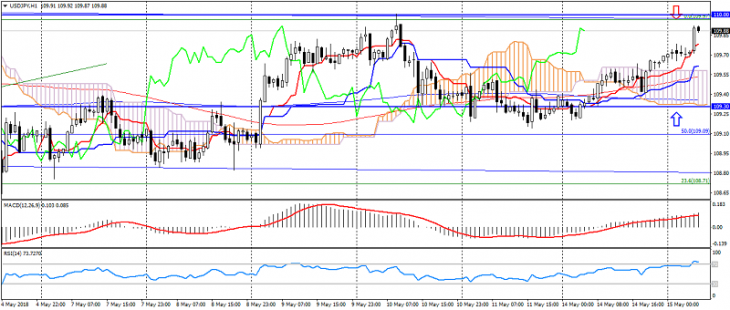

USD JPY (current price: 109.90)

- Support levels: 108.50, 107.50, 106.70.

- Levels of resistance: 109.30, 110.00, 110.50.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 110.00, 110.30, 110.50.

- Alternative recommendation: buy entry is started from 109.70, 109.50, 109.30.

The pair accelerated growth on the strengthening of the American, but is still limited by the 110.00 resistance level and the lateral trend.

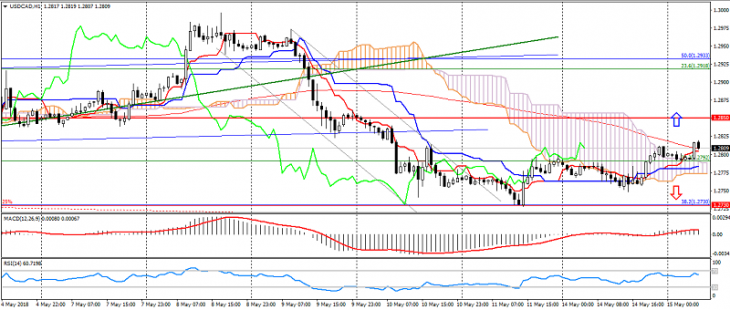

USD CAD (current price: 1.2810)

- Support levels: 1.2950, 1.2730, 1.2600.

- Resistance levels: 1.3030, 1.3150, 1.3280.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1.2850, 1.2880, 1.2900.

- Alternative recommendation: buy entry is started from 1.2800, 1.2770, 1.2750.

The pair is trading with a strengthening on the growth of the American and the mixed dynamics of raw materials, thereby forming a reversal.

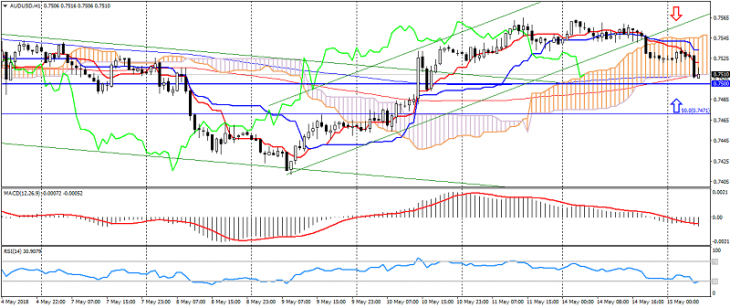

AUD USD (current price: 0.7510)

- Support levels: 0.7320, 0.7250, 0.7150.

- Resistance levels: 0.7500, 0.7600, 0.7770.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is started from 0.7550, 0.7570, 0.7590.

- Alternative recommendation: buy entry is started from 0.7500, 0.7480, 0.7450.

The Australian was under pressure of correction, but is limited by the general upward dynamics.

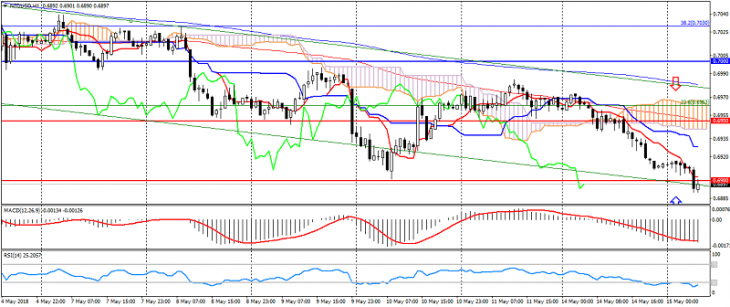

NZD USD (current price: 0.6890)

- Support levels: 0.6950, 0.6900, 0.6860.

- Resistance levels: 0.7000, 0.7080, 0.7150.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 0.6920, 0.6950, 0.6970.

- Alternative recommendation: buy entry is started from 0.6880, 0.6850, 0.6830.

The New Zealand dollar remains in the oversold zone, which may cause correction.

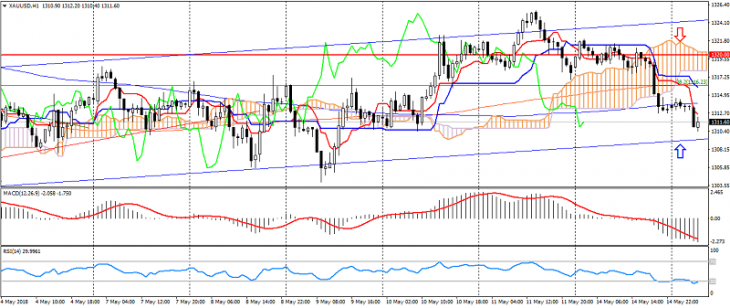

XAU USD (current price: 1311.00)

- Support levels: 1320.00, 1303.00, 1280.00.

- Resistance levels: 1355.00 (May May 2016 maximum), 1374.00, 1290.00 (March 2016 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1315.00, 1317.00, 1320.00.

- Alternative recommendation: buy entry is started from 1310.00, 1308.00, 1305.00.

Gold developed the figure “head and shoulders” and is limited to an ascending channel.