Тechnical analysis of currency pairs (Anton Hanzenko)

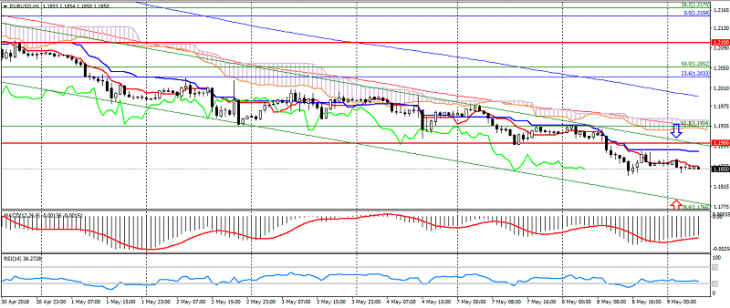

EUR USD (current price: 1.1850)

- Support levels: 1.2100 (September 2017 maximum), 1.1900, 1.1700.

- Resistance levels: 1.2600, 1.2750 (March 2013 minimum), 1.2270 (November 2014 minimum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1.1880, 1.1900, 1.1940.

- Alternative recommendation: buy entry is started from 1.1820, 1.1800, 1.1780.

The pair continues to trade in a downtrend, limiting itself to a restrained correction.

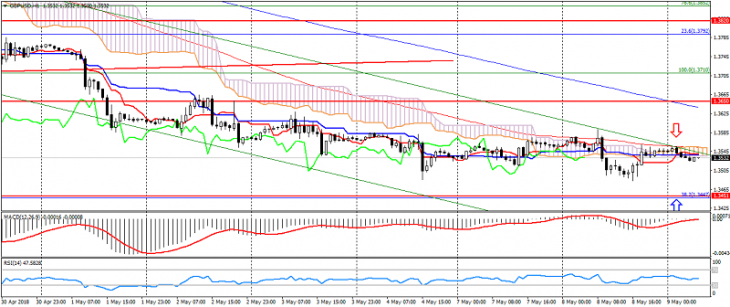

GBP USD (current price: 1.3530)

- Support levels: 1.3820, 1.3650 (September 2017 maximum), 1.3450.

- Resistance levels: 1.4050, 1.4350, 1.4500.

- Computer analysis: MACD (12, 26, 9) (signal-flat): the indicator is near 0. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal-flat): the Tenkan-sen line is near the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is started from 1.3580, 1.3600, 1.3630.

- Alternative recommendation: buy entry is started from 1.3500, 1.3450, 1.3420.

The British pound remains in a sideways trend, while maintaining a downward trend.

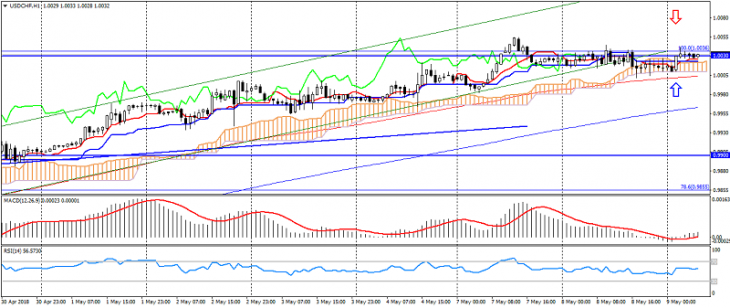

USD CHF (current price: 1.0030)

- Support levels: 0.9750, 0.9600, 0.9450.

- Resistance levels:, 0.9900, 1.0030, 1.0150.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1.0050, 1.0080, 1.0100.

- Alternative recommendation: buy entry is started from 1.0000, 0.9980, 0.9950.

The Swiss franc is limited to the highs of October last year 1.0030, thereby indicating a slowdown in the uptrend in the pair.

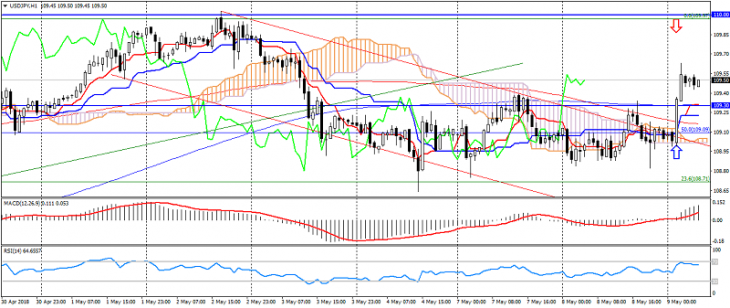

USD JPY (current price: 109.50)

- Support levels: 108.50, 107.50, 106.70.

- Levels of resistance: 109.30, 110.00, 110.50.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 109.70, 110.00, 110.20.

- Alternative recommendation: buy entry is started from 109.30, 109.00, 108.80.

The pair has emerged from a downtrend due to the risk reduction, but is limited by the uncertainty of the market.

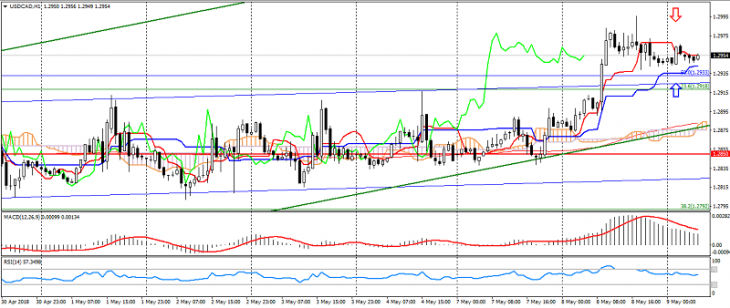

USD CAD (current price: 1.2950)

- Support levels: 1.2950, 1.2730, 1.2600.

- Resistance levels: 1.3030, 1.3150, 1.3280.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1.2980, 1.3000, 1.3030.

- Alternative recommendation: buy entry is started from 1.2930, 1.2900, 1.2880.

The pair has accelerated growth, but is limited to correction.

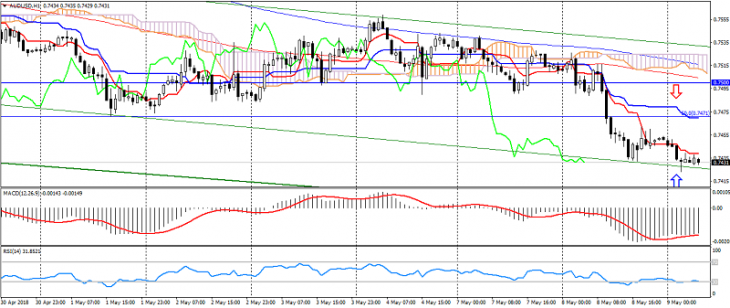

AUD USD (current price: 0.7430)

- Support levels: 0.7320, 0.7250, 0.7150.

- Resistance levels: 0.7500, 0.7600, 0.7770.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 0.7450, 0.7470, 0.7500.

- Alternative recommendation: buy entry is started from 0.7400, 0.7380, 0.7350.

The Australian accelerated the decline early in the day, thereby increasing oversold.

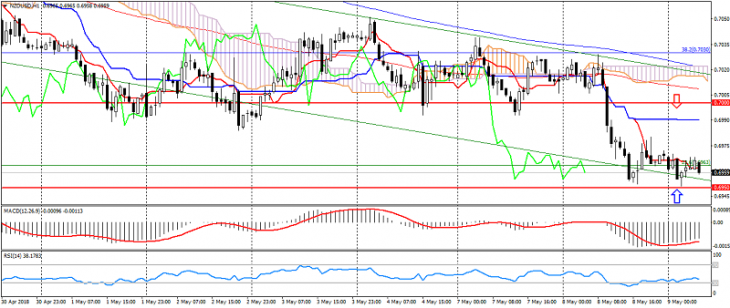

NZD USD (current price: 0.6960)

- Support levels: 0.7000, 0.6950, 0.6900.

- Resistance levels: 0.7080, 0.7150, 0.7250.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 0.6980, 0.7000, 0.7020.

- Alternative recommendation: buy entry is started from 0.6950, 0.6920, 0.6900.

The New Zealand dollar remains in flat and is limited to oversold after a decline.

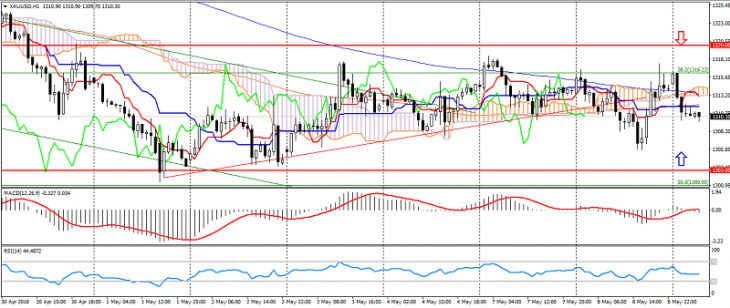

XAU USD (current price: 1310.00)

- Support levels: 1320.00, 1303.00, 1280.00.

- Resistance levels: 1355.00 (May May 2016 maximum), 1374.00, 1290.00 (March 2016 maximum).

- Computer analysis: MACD (12, 26, 9) (signal-flat): the indicator is near 0. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1313.00, 1316.00, 1320.00.

- Alternative recommendation: buy entry is started from 1308.00, 1305.00, 1303.00.

Gold maintains a sideways trend, despite the risk reduction.