Technical analysis of cross-rates. (Anton Hanzenko)

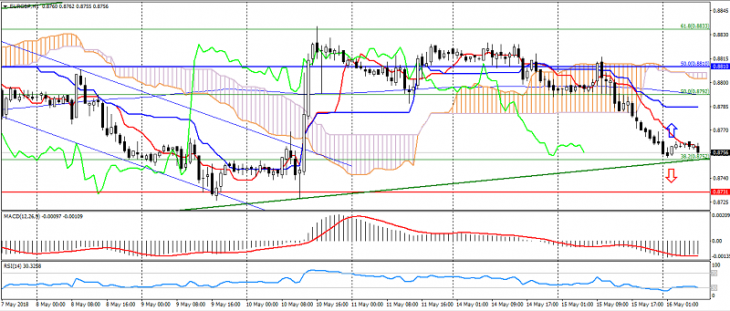

EUR GBP (current price: 0.8760)

- Support levels: 0.8730 (minimum of the last months), 0.8650, 0.8530.

- Resistance levels: 0.8810, 0.8900, 0.9050 (November 2016 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 0.8770, 0.8790, 0.8810.

- Alternative recommendation: buy entry is started from 0.8750, 0.8720, 0.8700.

The pair is trading near the level of the opening of the day, limited to a general uptrend.

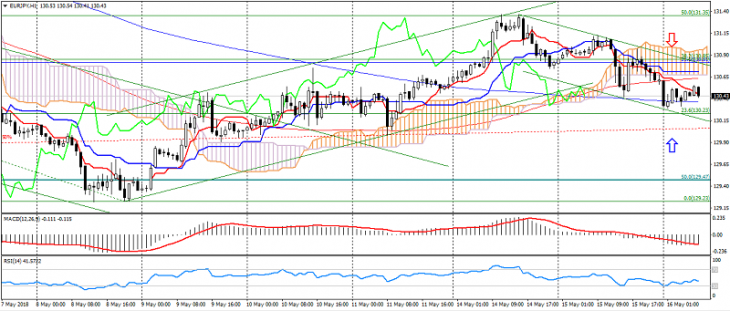

EUR JPY (current price: 130.40)

- Support levels: 130.20, 128.50, 126.80.

- Resistance levels: 133.00, 134.50, 136.80.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 130.70, 130.90, 131.20.

- Alternative recommendation: buy entry is started from 130.20, 130.00, 129.80.

The pair is trading in a downtrend, thereby resuming the downward momentum of the beginning of the month.

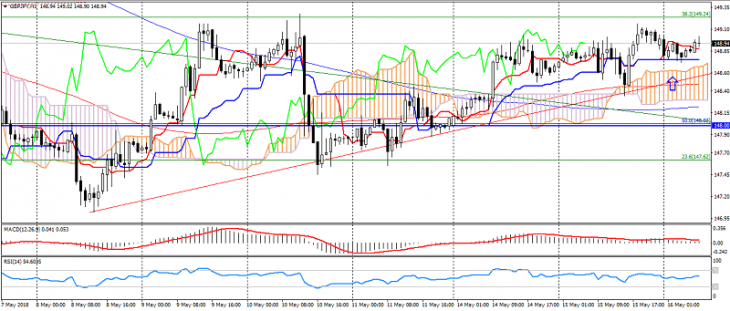

GBP JPY (current price: 148.90)

- Support levels: 146.00, 144.50, 143.50.

- Resistance levels: 148.00, 150.00, 151.50.

Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud. - The main recommendation: sale entry is started from 149.30, 149.50, 149.80.

- Alternative recommendation: buy entry is from 148.80, 148.50, 148.00.

The pair is trading with a strengthening on the formation of a “double bottom” on H4.

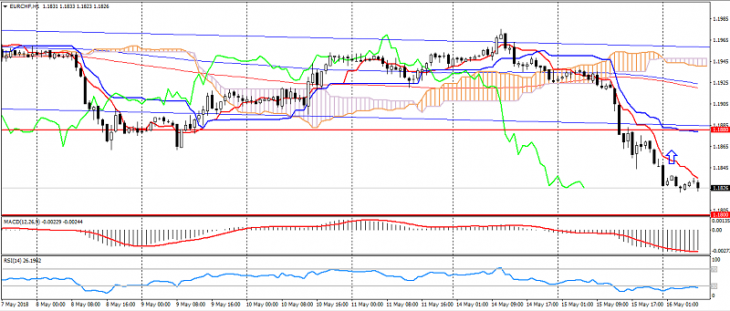

EUR CHF (current price: 1.1820)

- Support levels: 1.1880, 1.1800, 1.1700.

- Resistance levels: 1.2030, 1.2100, 1.2150.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1.1850, 1.1880, 1.1900.

- Alternative recommendation: buy entry is started from 1.1800, 1.1780, 1.1760.

The pair continues to trade with a decrease at the exit from the channel.