So after all, is the patient alive or dead? What will happen next with General Electric: prospects before and after the report.

Dear friends, I LOVE Mondays – because, finally, after two whole days without stock trading, I am again in the MARKET! With what I also congratulate you.

This week is especially interesting, because the period of reports of the corporate segment of the US stock market is just beginning.

For what I like the analysis of the stock market, and in general trading on it, is for the feeling that you are touching the real destinies of companies and their employees, this indescribable feeling can only be obtained here.

The company that we will disscus today is the pride of the American industrial segment and one of the historical giants that once created the US industry:

General Electric Company (GE: NYSE)

The company was founded in 1878 by the inventor Thomas Edison and was originally called “Edison Electric Light”, after the unification in 1892 with the company “Thomson-Houston Electrician” received its modern name.

At the moment the company includes 6 divisions:

- GE Energy includes GE Power & Water, GE Energy Management, GE Oil & Gas. GE Energy produces equipment for water treatment, equipment for power generation, safe and reliable distribution of electricity, oil and gas equipment, including turbines.

- GE Healthcare produces medical equipment.

- GE Transportation manufactures freight and passenger locomotives, railway signaling equipment, diesel engines for rail and sea transport, as well as drives for quarry dump trucks and drilling rigs.

- GE Aviation produces jet engines, gas turbine units for use in shipbuilding, and also serves aviation equipment.

- GE Capital includes GE Money Bank and GE Commercial Aviation Services.

- Home & Business Solutions includes GE Lighting, Intelligent Platforms manufactures lighting equipment and uninterruptible power supplies.

(WIKIPEDIA)

The history of this mastodon is the intricacies of intrigues and many stories about military orders, participation in the development and production of nuclear weapons, strategic contracts of the Military Industrial Complex, in one word, is very interesting).

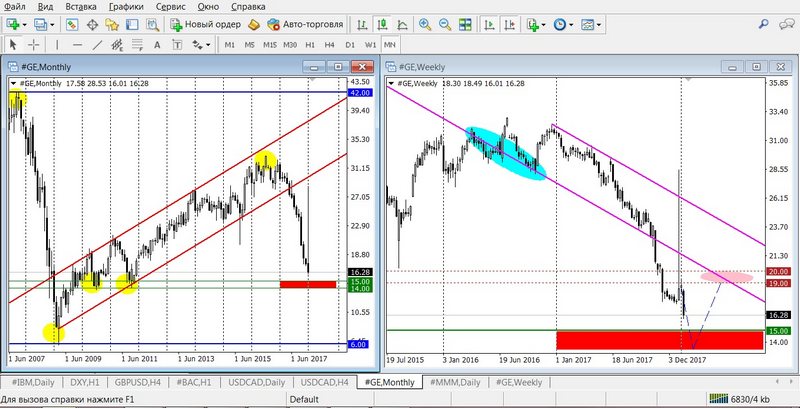

But the topic of this article is already from our time, and, perhaps, it is worth looking at the graph of life and movement of the company’s shares for the period since 2005. (Figure # 1)

As we see, the crisis of 2008 “touched” our hero of the article. The simple word “fall” does not describe the dynamics that we see on the graph – here the option of the stall is more appropriate, and even more accurate is the actual precipice, from which a magnificent view of the sea opens, but there is not the slightest desire to take a step forward or even simply stand on the edge. Dynamics from 40 USD per share and up to 6 USD – this, probably, was like the Apocalypse for shareholders.

But the second wind came and support in the form of a number of state orders and the company, almost like a phoenix, “rises from the ashes” and slowly, but steadily gaining momentum. And in 2016, against the background of the start of the curtailment of the quantitative easing program and the minimum oil prices, it forms a stable maximum in the region of 34-35 USD per share.

And then the public favorite, a man from the people and for the people, the master of conflict and scandal creation – the future president of the United States – Donald Trump comes to the arena. After decades of rule of the democrats and their disposal of state orders, there is a “specter” of republican changes. And after a series of attempts to go just in step with the market, we are witnessing dramatic changes and practically a repetition of the very precipice, which is still in the process at this stage.

Let’s move on to figures

A number of analysts allow a further decline to the level of $ 15 per share, which in fact echoes with my benchmarks in the 2010 and 2011 minimums. 14-15 USD, where there is a possible bridgehead for at least a short-term correction for growth, but as a maximum of the mid-term turn. The potential of this reversal is the levels of strong psychological resistance of 19-20 USD per share.

It would be super, if the price in the market depended only on technical analysis, but in the stock market, even more than on others, the dynamics takes into account also the fundamental external factors. And then, of course, we need to take into account the strong and long debate about the possible division of the company, and the future policy and direction that will be followed by the new leadership of the company, headed by John Flannery, who replaced Jeff Immelt in October-November 2017

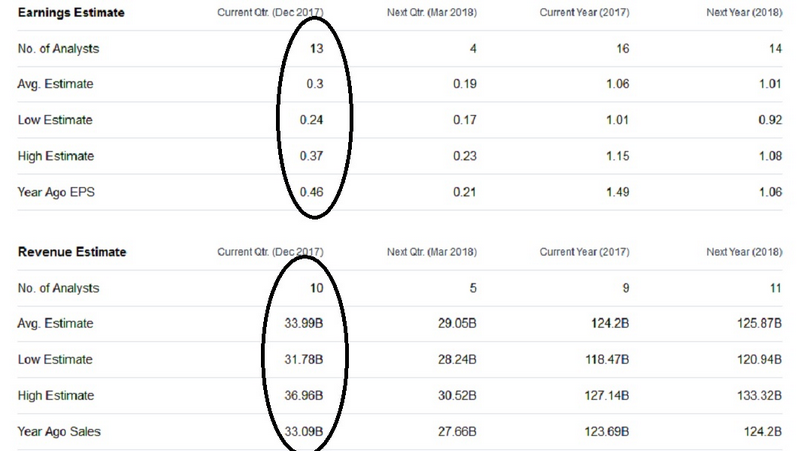

The other day, namely on January 24, we expect the report for the 4th quarter of 2017. What are the forecasts (Figure # 2):

After a surprise on the results of three quarters of 2017 (expectations is EPS 0.49 USD and the fact is 0.29 USD), of course, I want to believe in a positive alignment), but as for me, even the output below the forecast will not give enough momentum for the breakdown of the support range . What can cause further decline is only a real restructuring of the units.

But let’s be more specific …

Trade recommendation: BUY on completion of correction, with a step-by-step fixation of profit.

Examples of transactions:

- conservative option:

BUY limit 15.00, SL 13.90, TP 17.50

- aggressive option:

BUY (from the opening of the market on 22.01.18), SL 13.50, TP 25.00

(with the growing dynamics from the opening, and the rise in prices above 19.00, the transfer of SL to the lossless zone)

For those who met in the text a lot of unfamiliar terms, do not fall into despair, and go to individual training courses, more specific information about them can be fround on the Ester website, and if there are questions email me support@esterholdings.com with a note for Andrew Green.

Stable earnings are good, but it is the opportunities of big profits that created the exchange trade. So appreciate what you have, but strive for the heights!

Andrew Green