Passion for the British. What to expect from GBP/USD this week?

Good afternoon, amateurs and professionals of exchange trade.

With you your partner in crime and associate in financial confrontations

at the International Currency Market Andrew Green.

What interesting happened last week and what to expect on this one?

- The meeting of the Bank of England and the decision will leave everything unchanged. The first meeting of the central bank of Great Britain this year did not bring serious changes to the overall monetary and credit policy. Leaving the discount rate and quantitative easing volumes unchanged, the Bank of England noted the continuation of the current policy, emphasizing that inflation indicators remain fairly stable and the growth rates of the economy are restrained. Also, the incomplete procedure for withdrawing from the European Union, as well as the lack of a clear agreement on the procedure for the withdrawal itself and the conditions for further cooperation with the EU after the withdrawal, also remains the basis for maintaining a “soft” policy.

- In the next three weeks Teresa Mey’s speech is expected on the issue of further progress in negotiations with the EU on withdrawal.

- Multidirectional economic indicators in the UK economy (indices of business activity, industrial production, trade balance) did not clarify the situation in the context of fundamental analysis.

The next week is not particularly rich in news, we are waiting for a group of reports on inflation indices and retail sales. The probability that they will cause serious dynamics is not high. So the main focus is on the overall dynamics of the US dollar.

To analyze the trading situation, it is worth paying more attention, in this case, to technical analysis of current trends.

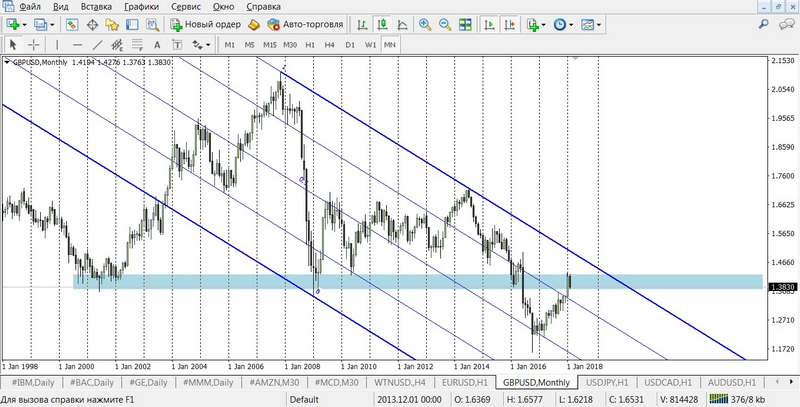

Let’s start, perhaps, with a long-term analysis and a monthly timeframe (Figure # 1).

The pair is in a very sharp, down for a month period, downtrend. At the moment, the pair is testing a zone very close to the resistance, above the named channel. The figure is marked blue. As you can see, from the analysis of past periods (2000-2002, 2008-2009, 2016), the zone 1.3700-1.4500, before the breakdown of the range after the Brexit referendum in 2016, was a strong support zone, from which later formed a very strong upward movement.

Now the current market price is just inside this range and, globally, the situation is not certain. According to one of the laws of graphic analysis, the support zone, after a breakdown, forms a strong resistance zone. Now the situation, it is quite possible, can confirm this law in practice. The key steps will be a breakdown of 1.3700 level down – a return to the downtrend, or a breakdown with a fixation of 1.4500 and an open road to the levels of 1.55-1.60. I am inclined to the first option of the development of events, although I certainly do not exclude the variant of breakdown).

Let’s return to the medium-term analysis, in the case of this tool, the most suitable period is a week (Figure #2).

Here we see a strong (red) uptrend.

- The purchasing area with averaging is 1.3300-1.3700, the averaging range is 50 points. Clipping or stop loss at 1.3100.

- The sales area with averaging is 1.4500-1.5000, the averaging range is 50 points. Clipping or stop loss at 1.5100.

I see more attractive option of sales, but more likely to be in the near future – purchases. In the market it happens.

And now the most interesting for the most part of traders, recommendations for trading during the day, or as they are also called Intraday. If you are a beginner trader and want to explore the benefits of trading at different periods, then I recommend that you take an individual training course from the partner company Ester. The content of the course and more detailed information can be obtained from the link.

Watch the timeframe and Figure #3. After the last week’s flat movements and the support level rhetoric in the 1.3780-1.3800 zone, the pair formed a clear signal for a reversal in a downtrend.

As a result, we have two options for trading:

Examples of transactions:

- Recommended (trading in a trend):

SELL limit 1.3940, SL 1.4030, TP 1.3850; - Aggressive (trade on correction):

BUY limit 1.3730, SL 1.2660, TP 1.3810.

Despite the lack of news, the week promises to be interesting (corporate reports), be ready to trade!

Be vigilant and do not lose the opportunity! And remember: the end is when the hammers knock on the lid of the coffin, and everything else is a unique opportunity to start over again …)

Andrew Green