Stochastic Oscillator (Stochastic) is another useful indicator

Earlier we discussed several standard indicators and no less legendary, such as the RSI and Bolinger Lines. Today I would like to talk about the lack of the popular and widespread oscillator Stochastic Oscillator (Stochastic).

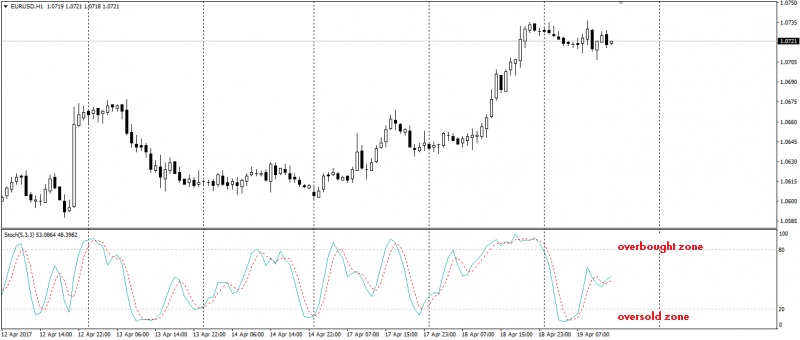

Stochastic Oscillator is an indicator that indicates the ratio of the current closing price to highs or lows for a certain period. Simply put, stochastic indicates the rate of change or momentum of the price. The indicator itself is presented in the form of an oscillator and is located under the main price chart. Stochastic consists of two lines: % K – main and% D – auxiliary, which move on a scale from 0 to 100. The scale is divided into zones: from 0 to 20 – oversold zone, 80 to 100 – overbought zone. Stochastic has flexible settings suitable for any trading instruments.

The movement of the stochastic lines near the level of 50, which we add in the settings, indicates that the market has reached a balance between sellers and buyers.

The Stochastic Oscillator indicator is versatile and can give other equally important signals in addition to the main signals of overbought and oversold.

Let’s consider the signals of the Stochastic Oscillator:

- Overbought and oversold.

Overbought and oversold are the main signal of the stochastic, which are indicated by lines while in a particular zone (0 – 20 – oversold zone, 80 – 100 – overbought zone). - Divergence.

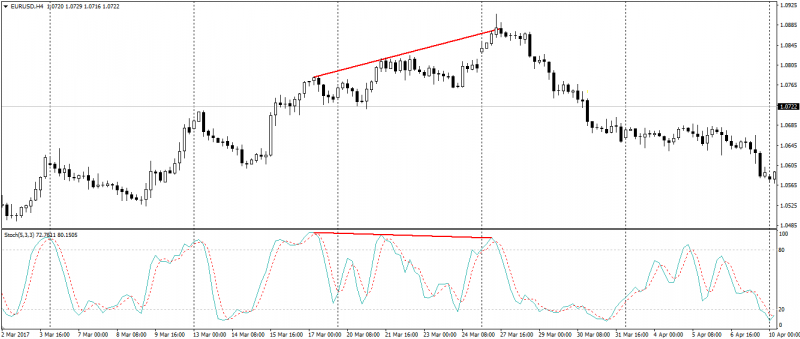

One of the best signals of the indicator is divergence, the difference between the indicator lines and the price.

The figure shows an example when the price forms new highs, each subsequent one is higher than the previous one, and the indicator highs are vice versa, each subsequent one is lower than the previous one. As a result, we get a bearish divergence, which worked perfectly. Bullish divergence is formed in a similar way. - Crossing of the indicator’s lines.

The Stochastic Oscillator indicator has two lines: % K – main and% D – auxiliary. Buy signal: % K crosses % D from the bottom up; for sale: % K crosses % D from top to bottom. This signal is generated often and requires an additional confirmation.

Like most other oscillators, Stochastic Oscillator has one significant drawback – the instability of the work during the formation of strong deviations in the market. As a result, the stochastic can give false signals and distort the picture of the situation. You can short disadvantage by manipulating settings that are tailored to any trading instrument.

Despite the shortcomings of the Stochastic Oscillator, it is widely used by a large number of successful traders and is an excellent addition to any trading strategy.

Anton Hanzenko