Price Levels – A Technical Analysis Tool. Alexander Sivtsov.

Price in the market may move in different ways during the trades, depending on various factors, but at the same time it forms local minima and maxima, as well as clusters of the same minima or maxima. Price levels on the market are of two main types: technical and psychological. Now let’s take a closer look at each of them.

Technical price levels

Technical price levels are formed in the process of price movement in the market and show areas where the price stopped for a while and continued to move or turned in the other direction. Often it happens so that the price does not stay in a certain area, but immediately rebound and moves in the opposite direction. It can happen in the market because such price areas are profitable to large market-maker players.

Technical price levels can be built on any timeframe as support or resistance levels. Do not forget that the longer the timeframe, the more accurate information it carries. The price levels on a longer timeframe will be more effective.

Fig. 1. Cluster of maximums for the EUR/USD pair.

Psychological price levels

Psychological price levels are much easier to find than technical ones, since they are already known in advance. Psychological levels are those for which the price is eneded by at least two zeros. They are called psychological because it is psychologically easier for a person to work with round numbers and more attention is paid to it. For example, when you see in the store a pricetag of 575 hryvnias, you don’t think about this number, but that it is almost 600 hryvnias

A person may think differently when sees round prices in the market, perhaps it is the ceiling price and it is worth selling, or if the price has grown to this value, then it may continue moving, and it is better to buy it. Despite the fact that psychological price levels are easy to use, it can be rather risky, because the range of price movement can be about 100 points, in other words, to the next psychological level.

Fig. 2 Examples of psychological levels for the AUD/USD pair

Trade with price levels

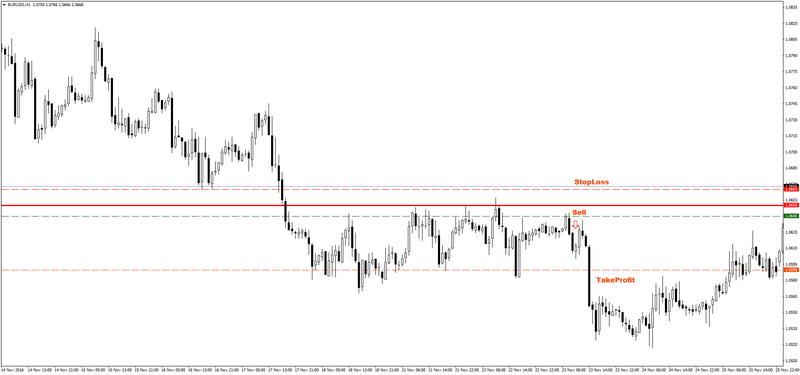

Trading using price levels is easy, they are used as support or resistance levels, from which the price often turns around and goes in a different direction. A buy or sell transaction it is better to place not at the price level itself, but 5-10 points before it for a greater probability of orders execution. You should not forget about the rules of money- management and setting a Stop Loss. Stop Loss it is better to set beyond the price level, at a distance of about 20 points, or even more, depending on your money-management terms.

Fig. 3 Example of placing orders based on the price level.

In drawing conclusions from this article, we can say that price levels are pretty simple and effective tools for trading in global financial markets. Trend channels and moving averages can be used together with price levels in order to more accurately estimation of potential price movements.

Follow the Trader Blog – knowledge is available to everyone!

Alexander Sivtsov

If you have suggestions on topics in Trader’s Blog – write to info@esterholdings.com