Industrial production in the US is declining

- According to published data, the volume of industrial production in the US declined in January by -0.1%, against the growth in the previous period at the level of 0.4%.

- At the same time, the capacity utilization ratio in January was 77.5%, slightly lower than the December figure at 77.7.

- In anticipation of the opening of the US stock session, the US currency remains under pressure and continues to trade near the low of today’s trading against the basket of currencies.

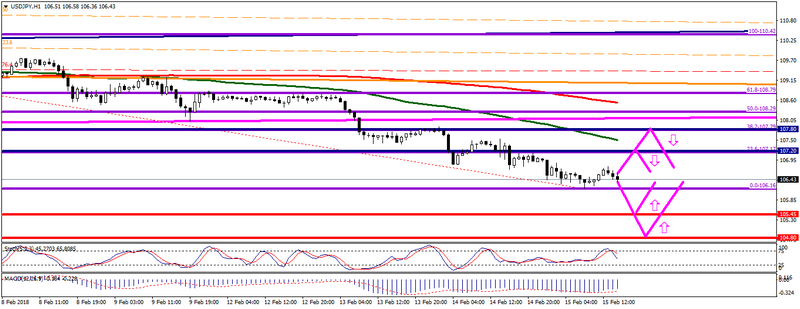

Technical analysis: Against the backdrop of the weak position of the US dollar, the pair USD/JPY keeps the downward movement from the beginning of February 2018.

- Significant levels of support are 105.45, 104.80.

- The nearest levels of resistance are considered at 107.20, 107.80, which correspond to the levels of 23.6 and 38.2 Fibonacci.

Computer analysis: On the charts H1 and D1, the forex indicator MACD formed the “Bullish Divergence”, against which one can expect an upward correction of the pair USD/JPY.

The main recommendations: To date, the main recommendation will be the sale of the pair from the marks 107.20, 107.80. Purchases should be considered from the marks 105.45, 104.80, provided that the formation of the “Bull Divergence” continues.

Fig. USD/JPY. The current price is $ 106.43.

Alexander Sivtsov