U.S. Preliminary Employment Data

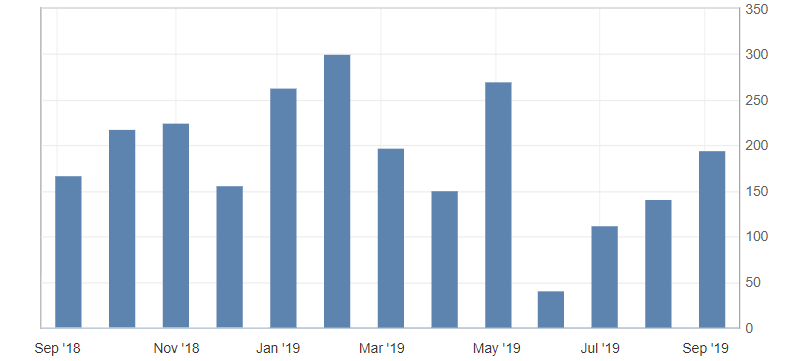

- ADP nonfarm employment change (Aug), fact 195K, forecast 148K.

- Initial jobless claims, fact 217K, forecast 215K.

- Non-agricultural sector productivity level (q/q) (Q2), fact 2.3%, forecast 2.2%.

- Labor costs (q/q) (Q2), fact 2.6%, forecast 2.5%.

Data for the United States to a greater extent showed growth in the labor market. Of particular note is the change in the number of people employed in the non-agricultural sector by ADP, which has unexpectedly increased. Also worth noting is the increase in productivity and labor costs. A negative note in the report was the increase in the number of initial applications for unemployment benefits, which remains near average values.

Fig. 1. ADP nonfarm employment change chart in the USA

This report significantly increased optimism on Friday’s US employment report, which also indicated support for the US dollar, which remains oversold across the market. The US dollar index slowed down near 98.20. On expectations of positive employment data in the United States, short positions in the US and a restrained correction may be reduced. Support levels: 98.00 and 97.80, resistance: 98.50-40.

Fig. 2. The US dollar index chart. Current price – 98.20 (10-year US government bonds yield – blue line)

Read also: “Escalation of the US-China Trade War

and what it means for the market?”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Currency is a weapon in a trade war!

- How far the prospects for USD/JPY may be downward

- What does the US Fed Chairman Powell statement mean for the US dollar

Current Investment ideas: