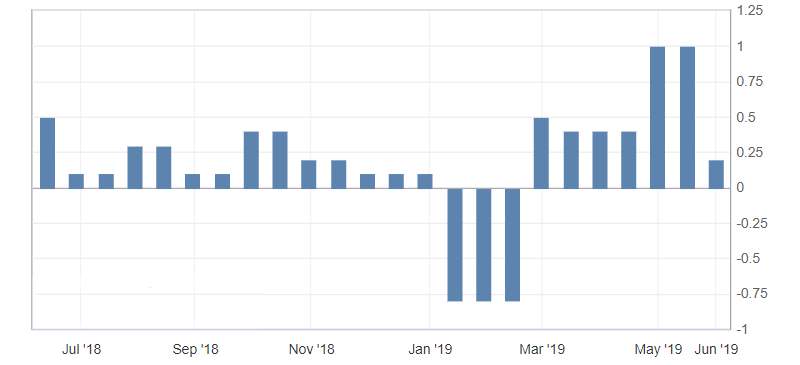

Preliminary inflation data in Germany

- German Consumer Price Index (CPI) (m/m) (May), fact 0.2%, forecast 0.3%.

Preliminary data on the consumer price index (CPI) of Germany slowed down more significantly than expected, thereby reinforcing concerns about the data on inflation in the eurozone, which will be released next week.

Fig. 1. Graph of consumer price index (CPI) of Germany

The dynamics of the euro, despite the weak data for the euro area, remained restrained ascending, due to general market sentiment and the weakness of the US dollar. Despite the noticeable increase in risks and the sale of the American dollar, the EUR/USD pair continues to trade in a weekly downward channel, limited to resistance levels of 1.1160-70. Repulsing levels will indicate a resumption of a downtrend. Support levels: 1.1130 and 1.1110.

Fig. 2. EUR/USD chart. Current price – 1.1150

Read also: “Do not let yourself win or the main enemies of the trader”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Should we expect the currency intervention from the Bank of Japan?

- Political risks in the UK increase the chances of Brexit without a deal

- Cryptocurrencies as new safe haven assets

Current Investment ideas: