The beginning of the end, or what does the future prepare for us? Review of main events for the week on the USD index.

Good afternoon, dear friends and co-workers on a difficult field of exchange trade.

With you a big income lover and a professional surfer

on the waves of stock trading Andrew Green.

Analyzing with what to begin a series of reviews of the coming week, in general, special options for the coming years are not expected. The most influential instrument of the financial market is the US dollar – USD. To analyze its dynamics, we use a ticket for futures on the USD-DXH index. But before we start the graphic and technical analysis of this derivative, let’s pay attention to the fundamental factors and drivers of the market today.

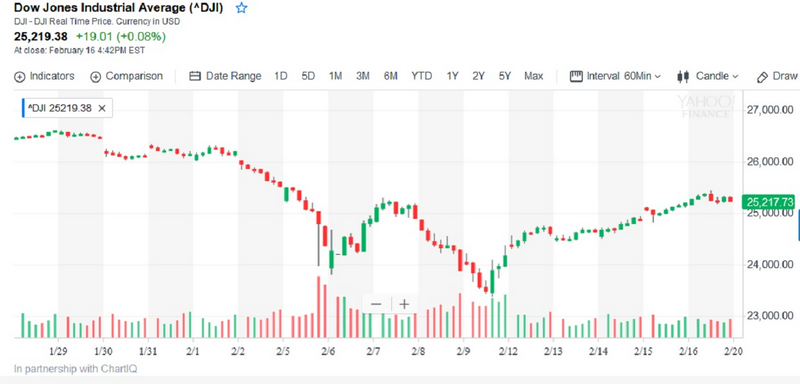

First of all: aggressive sentiment among investors in the stock market, whose fears subsided a bit last week after a significant drop in stock indices two weeks later. Here one should take a closer look at Figure # 1, where you can carefully study the dynamics of recent weeks for the composite index DJIA.

As you can see, after the double re-test of support in the region of 24000, the index is steadily gaining momentum, in fact, firmly entrenched by the results of the week above the level of 25000. But how quickly and dramatically the downward momentum developed, for many market participants gives grounds to conclude about the high overbought of securities of the corporate segment of the United States.

Another indicator of the overall dynamics and volatility of the US financial market – VIX, one can see in Figure # 2.

It is interesting that there is a complete mirror image to the DJIA index, which can be seen with the naked eye. This confirms the current caution to the risks of American investors. In general, these two indicators reflect a not very bright prospect for the US dollar, on the one hand, the market’s propensity to acquire non-risk assets, on the other hand, the corporate segment is now viewed as a less risky option than the US dollar itself.

Determining factors for decoupling this situation in the market will be the nearest decisions of the Fed on monetary policy (21.02.2018, 19:00 UTC, FOMC Meeting Minutes – the minutes of the previous FOMC meeting), as well as speeches and press conferences of a number of representatives of the committee in the next Friday February 23, during the US stock session, among which the opinion and position of William Dudley, the current head of the Federal Reserve Bank of New York, and Loretta Mester, head of the Federal Reserve Bank of Cleveland, should be highlighted.

The position of the former is more neutral and links further actions of the Fed at the discount rate with the dynamics of inflation and economic growth. Whereas Loretta Mester belongs to a group of American “hawks”, experts who are prone to rapid tightening of US monetary policy and strengthening of the USD in the international financial arena.

An interesting fact is that William Dudley this year hands over his position as Vice-President of the Federal Reserve, and the closest possible candidate for this position is Loretta Mester.

So this week promises to be saturated with external stimuli for the overall dynamics of the US dollar.

In turn, if we take a look at Figure 3 – the dynamics of DXH, the US dollar index, here we have re-test of the support zone in the region of 88.00-88.40.

This also gives grounds for assuming a possible pullback and strengthening of the dollar. How serious this will be, to a greater extent, depends on the clarity of the timing of the next further increase in the discount rate for US federal bills. Well, we are waiting…

Trading recommendations:

- DJIA – SELL 27000 and higher …

- DXH – BUY 88.00 and below …

In a word, we bet on the USD reversal, but after continuing the current dynamics to the key resistance/support lines.

The principle when you are not sure about your positions on the market – buy USD, is now very relevant, especially after a strong enough and long-term dynamics against the “green” American.

If you have any questions about the review and need advice, write to the support email of the partner Ester Holdings support@esterholdings.com with a note “for Andrew Green”. Also, if there is a desire to learn new and you notice a lack of theoretical and practical training in trading, study the possibilities of individual training from the company on the Ester website.

Advice from the expert – “do not be a hostage of self-confidence” …

Trade with stop-loss.

Andrew Green