Opinion on the USD/CAD pair

The pair USD/CAD is trading in a narrow range after yesterday’s growth, amid a persisting interest rate of the Bank of Canada at 1.00% and disappointing inflation forecasts in Canada. Therefore further tightening of monetary policy may be put on hold . For more information, see https://esterholdings.com/en/2017/10/25/kanadets-teryaet-pozitsii-3/. At the moment, the dynamics of the pair is associated with a restrained movement of oil prices, which has a direct impact on the Canadian currency.

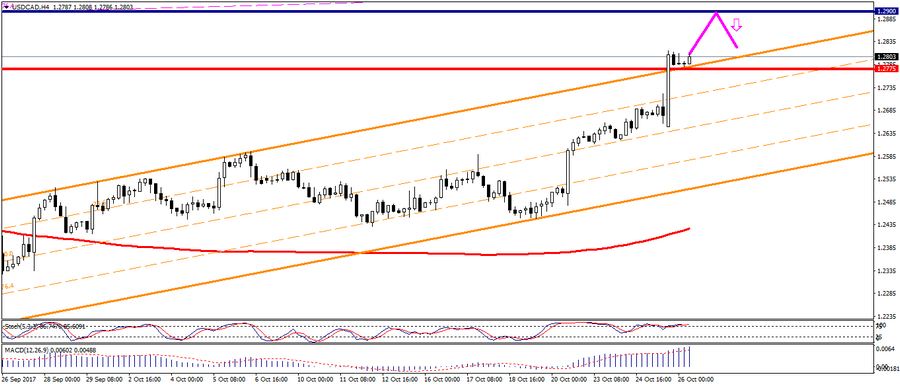

Technical analysis. Based on the yesterday’s growth of the pair, the figure “Flag” is formed on the chart H4 In the case it works off, it is possible to increase the price of the instrument to the level of 1.2900.

Computer analysis: The H4 chart indicates overbought of the instrument. Thia indicates a possible decline in the price of the USD/CAD pair.

The main recommendations: The main recommendation is the sale of the pair from the level of 1.2900, in the case the figure “Flag” on the chart of H4 works off.

Fig. Current price USD/CAD – 1.2803

Alexander Sivtsov