Opinion on the USD/CAD pair

The Canadian dollar strengthened its position against the US dollar based on weak statistics data on the real estate sector in the United States and positive data on sales in the manufacturing sector of Canada. Read more …

Also, the Canadian is supported by the positive dynamics of oil prices in anticipation of government data on crude oil reserves in the US. For more information, see the Technical Analysis of Oil https://esterholdings.com/en/2017/10/18/tehnicheskij-analiz-nefti-aleksandr-sivtsov-240/#more-50033

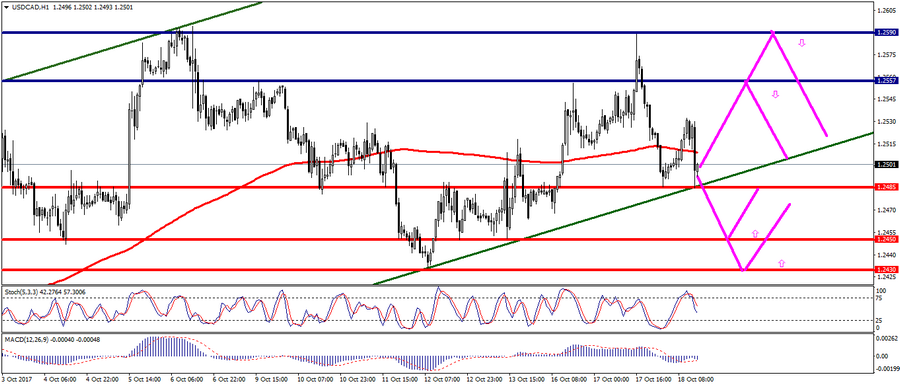

Technical analysis: Despite the fall in the pair USD/CAD at the beginning of the American session, the instrument continues to maintain an upward trend in the medium term. In сase, the instrument continues to decline and consolidates below 1.2485, one should expect a price decrease in the area of 1.2450-1.2430. The main resistance levels considered at the levels 1,2557; 1.2590.

The main recommendations: Buying of the pair should be considered from the levels 1,2450; 1.2430. The main levels for sales should be considered from 1,2557; 1.2590. In this case, the decision on trade should be taken after the publication of data on crude oil reserves in the United States.

Fig. Current price USD/CAD – 1.2501

Alexander Sivtsov