Opinion on the pair GBP/USD. The decline in the pound may continue

The British pound has fallen against the US dollar by more than 300 points since February 2. The catalyst for this decline was the widespread strengthening of the US currency, as well as the beginning of the correction of the pound’s position on the eve of the meeting of the Bank of England, where the increase in the interest rate is not expected. Also, the additional pressure on the pound is exerted by yesterday’s message from S & P Global about a possible decline in the credit rating of the UK, which is connected with the risks around Brexit.

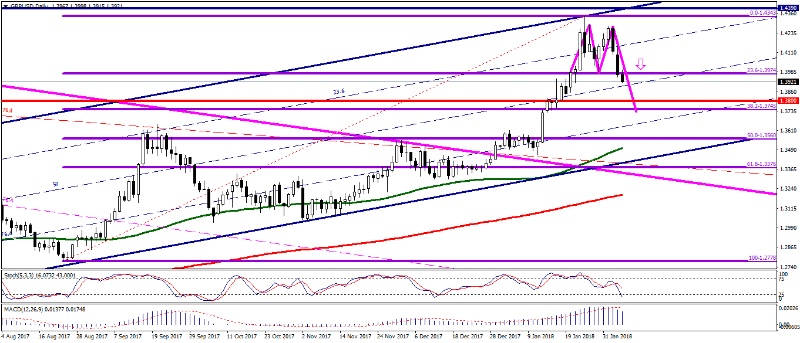

Technical analysis: As a result of the decline in the British currency, the GBP/USD pair on the D1 chart formed the double top pattern, which will lead to a further decline in the British currency. Also today, the instrument price breaks the level of 23.6 Fibonacci lines on D1, which is a signal of further price reduction to the level of 38.2 Fibonacci lines.

Key recommendations: The main recommendation will be the sale of the GBP/USD pair from the level of 23.6 Fibonacci on D1, which corresponds to the mark 1.3974 with the potential to decline to 1.3800, 1.3750. For those who prefer aggressive trading, you can go on sale from the current positions, but the stop-loss will be around 100 points.

Fig. GBP/USD. The current price is $ 1.3921.

Alexander Sivtsov