Opinion on the GBP/USD pair: Brexit continues to exert pressure

The GBP/USD pair positively started a new week, recovering about 60 points of lost positions last week, which is mainly due to partial profit-taking by investors. The significant decrease in the pound was facilitated by the results of the November meeting of the Bank of England, during which the discount rate was raised from 0.25% to 0.50%. But, the Central Bank gave a disappointing outlook for further economic development and tightening of monetary policy . Read more …

Negotiations on Brexit still did not give concrete results on the issue of the transition period and whether London will be able to maintain trade relations with the EU. European and British enterprises are already preparing for the worst outcome of the negotiations and are looking for ways out of the possible negative development of further trade relations between the EU and the UK. Read more …

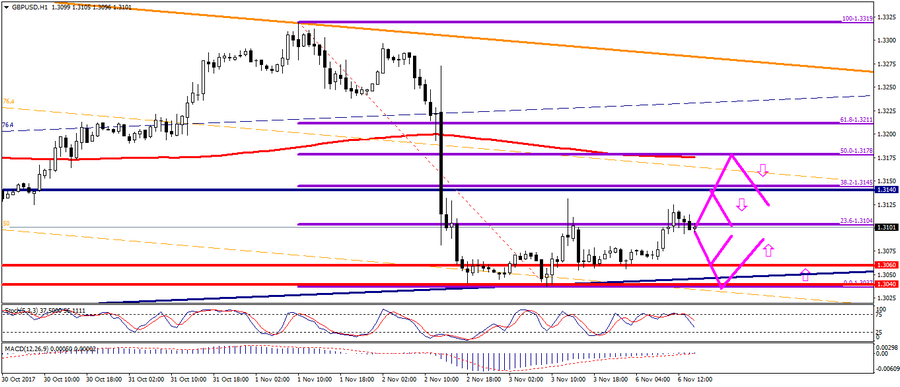

Technical analysis: During the European session, the EUR/USD pair demonstrates a moderate dynamics because of the lack of a significant driver in the market. Resistance levels for sale entries are at marks 1.3140 and 1.3180. Support levels for buy entries at 1.3060; 1.3040.

Fig. Chart EUR/USD current price – 1.3101

Alexander Sivtsov